"Perfection, of a kind, was what he was after,And the poetry he invented was easy to understand;He knew human folly like the back of his hand,And was greatly interested in armies and fleets;When he laughed, respectable senators burst with laughter,And when he cried, the little children died in the streets."W. H. Auden, Epitaph To a Tyrant

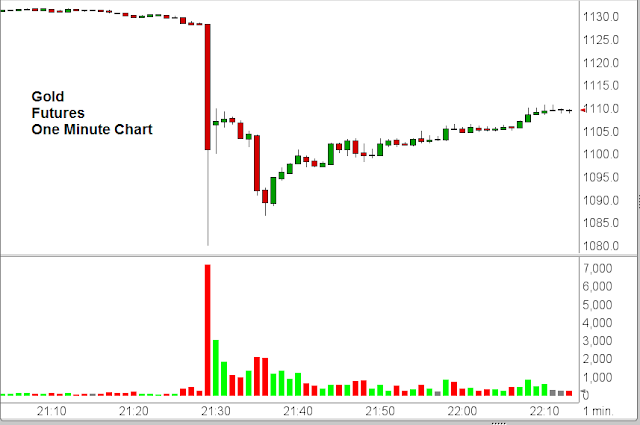

The hit on the metals last night was obvious and heavy handed.

There were some additional antics during the day.

Silver was more robust against this, most likely because it is in an active month at The Bucket Shop.

I think the stock market has reached at least a short term apogee, and risk is grossly mispriced.

This is how it goes sometimes.

The commentary about the precious metals this afternoon on Bloomberg TV was laughable for the most part.

Have a pleasant evening.