On the surface this report shows solid economic growth for the US economy during the second quarter of 2015. Unfortunately, all of the usual caveats merit restatement:

-- A significant portion of the "solid growth" in this headline number could be the result of understated BEA inflation data. Using deflators from the BLS results in a more modest 2.33% growth rate. And using deflators from the Billion Prices Project puts the growth rate even lower, at 1.28%.

-- Per capita real GDP (the number we generally use to evaluate other economies) comes in at about 1.6% using BLS deflators and about 0.6% using the BPP deflators. Keep in mind that population growth alone (not brilliant central bank maneuvers) contributes a 0.72% positive bias to the headline number.

-- Once again we wonder how much we should trust numbers that bounce all over the place from revision to revision. One might expect better from a huge (and expensive) bureaucracy operating in the 21st century.

Among major economies, only the Chinese numbers are more suspect.

All that said, we have -- on the official record -- solid economic growth and 5.3% unemployment.

What more could Ms. Yellen want?

Consumer Metrics Institute, BEA Revises 2nd Quarter 2015 GDP Growth Upward to 3.70%

Thanks to Wall Street On Parade for pointing the way to this commentary above.

The campaign to smother the true state of the US economy with paper, both in terms of paper money and manufactured statistics, is an outgrowth of the credibility trap.

Having crippled the real economy with incompetent and corrupt policy decisions, the status quo of pampered privilege is going full out to try and save the day– for themselves.

Meanwhile, underneath the public relations campaign to persuade people that all is calm, the pressures of a decade or so of malinvestment and crony capitalism continue to build. The persuasion of the official numbers is becoming more and more ineffective, as people hear one thing but see another in their daily lives.

Yes, there are more jobs. And they are of an inferior quality with low pay and often little or no benefits such as basic healthcare, which despite assurances otherwise is becoming increasingly expensive, and as in the clear case of Big Pharma, unnecessarily so but supported by government policies.

And the urge is to spread this malicious monopolistic drug policy globally through secret trade deals such as the TPP and TTIP.

The public is rejecting the 'establishment' in increasing numbers, such that such voices of the privileged are now recognizing them, but dismissing them as a sociological phenomenon, expressive individualism.

The political and economic establishment has failed, again and again and consciously so, because it was to their short term benefit to do it. It is the failure of an oath, of personal morality, and of office.

But now that the consequences of their actions are becoming apparent, they cannot possibly admit to them because, after all, it was they who are responsible. And there is still plenty of money left on the table.

And so they must deny the problems, cover them and distract attention away from them, and continue to press on with what has been working all along, for them and their friends. The oligarchy has indeed become audacious. both in its lust for looting the system, and its bravura in the attempts to cover up the consequences of their decisions.

"Some appear to believe that 'confidence in the banks' can be rebuilt by a new round of good economic news, by rising stock prices, by the reassurances of high officials – and by not looking too closely at the underlying evidence of fraud, abuse, deception and deceit."

James K. Galbraith, Testimony to Congress, May 2010

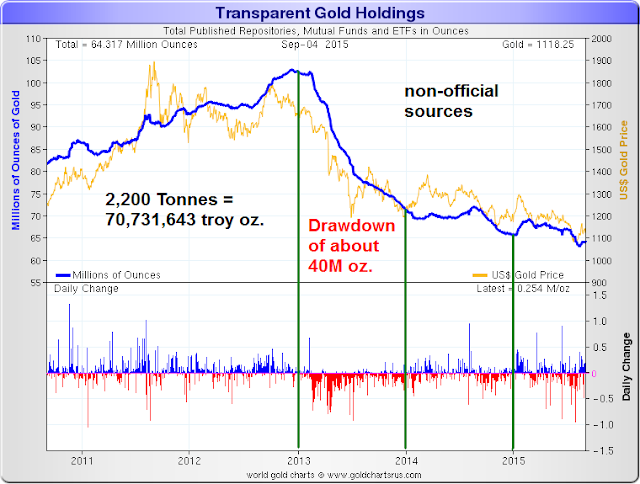

Related: LBMA Apparently Restated Its 2013 Gold Refining Number 2,200 Tonnes Lower