"J. P. Morgan and Andrew Mellon made their billions through inter locking directorates and outright ownership of hundreds of nationally prominent enterprises. Glass-Steagall is one crucial piece of a litany of legislation designed to place checks and balances on the concentration of financial resources. To repeal it would be tantamount to bringing back the days of the robber barons. The unbridled activities of those gifted financiers crumbled under the dynamic forces of the capital marketplace. If you take away the checks, the market forces will eventually knock the system off balance."

Mark D. Samber, End Bank Law and Robber Barons Ride Again, NY Times, March 5, 1995

"In 1999, on signing Gramm-Leach-Bliley into law, Clinton said, 'This is a day we can celebrate as an American day' and that 'the Glass-Steagall law is no longer appropriate for the economy in which we live' and 'today what we are doing is modernizing the financial services industry, tearing down these antiquated laws and granting banks significant new authority' and 'This is a very good day for the United States.'"

Columbia Journalism Review, Bill Clinton on Deregulation

"There is no reason to believe either equity swaps or credit derivatives can influence the price of the underlying assets any more than conventional securities trading does."

Alan Greenspan, July 24, 1998, Testimony on the Regulation of OTC Derivatives

"But bad economics was only a symptom of the real problem: secrecy. Smart people are more likely to do stupid things when they close themselves off from outside criticism and advice."

Joseph Stiglitz, What I Learned at the World Economic Crisis, April 17, 2000

"It is no exaggeration to say that since the 1980s, much of the global financial sector has become criminalised, creating an industry culture that tolerates or even encourages systematic fraud. The behaviour that caused the mortgage bubble and financial crisis of 2008 was a natural outcome and continuation of this pattern, rather than some kind of economic accident."

Charles H. Ferguson

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

"We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices."

Goodbody and Company, The New York Times, October 25, 1929

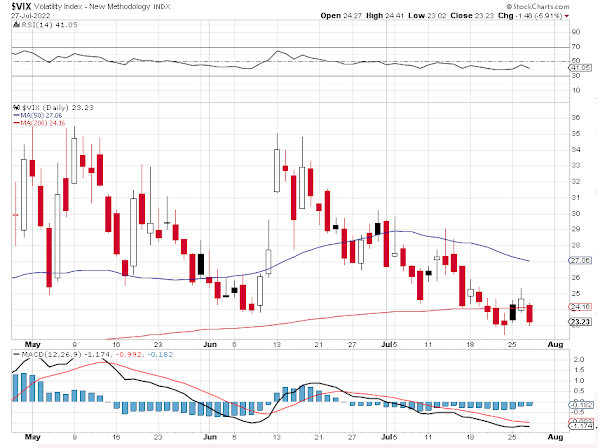

The market read between the lines of the FOMC decision and in particular Chairman Powell's remarks and assumed that the Fed is in a pivot to a less hawkish stance on interest rates.

And so gold and particularly silver rallied.

Stocks went stratospheric.

The Dollar dumped back to the 106 handle.

Whether this interpretation of the Fed's intentions is valid or not remains to be seen.

Certainly eyes will be on the data,

After hours the corporate earnings reports were a very mixed bag.

Tomorrow we will be getting an advance look at 2Q GDP.

Regardless of this backward look, history suggests that we are heading into a recession.

Unless this time is different.

Have a pleasant evening.