Pimco cancels dividend payments for 6 funds

December 01, 2008: 10:03 AM EST

NEW YORK (Associated Press) - Pacific Investment Management Company Inc. on Monday canceled announced dividend payments for six of its funds, saying the weak market has pushed the value of those funds below legal thresholds.

The dividends declared Nov. 3 that were scheduled for payment Monday will not be paid for Pimco New York Municipal Income Fund, Pimco Municipal Income Fund II, Pimco California Municipal Income Fund II, Pimco Municipal Income Fund III, Pimco California Municipal Income Fund III and Pimco New York Municipal Income Fund III.

"Continued severe market dislocations and recent further erosions in the municipal bond market have caused the values of the Funds' portfolio securities to decline," the company said. As a result, the funds' asset coverage ratios have fallen below 200 percent, it explained, and federal law prohibits a fund from paying or declaring common share dividends below that threshold.

The funds intend to resume paying and declaring dividends as soon as possible, Pimco said. The company said it may consider options including redemption of a portion of its auction rate preferred shares in order to resume dividends in the future.

Pimco is an affiliate of Allianz Global Investors Fund Management LLC, which serves as the funds' investment manager.

01 December 2008

Pimco Cancels Dividends

Armageddon Trade: Credit Default Risk Premiums on 10 Year Treasuries Hit Record

US Treasury 10-yr CDS hits record high

By Emelia Sithole-Matarise

Dec 1, 2008 6:19am EST

LONDON (Reuters) - The spread or risk premium on 10-year U.S. Treasury credit default swaps hit a record high on Monday, extending a recent trend as market participants continued to fret about the scale of the government's financial rescue programmes.

Ten-year U.S. Treasury CDS widened to 68.4 basis points from Friday's close of 60 basis points, according to credit data company CMA DataVision.

Five-year Treasury CDS widened to 52.5 basis points from 46 basis points at Friday's close, it said.

Looks like the Paint is Peeling

Chicago PMI Worst Since 1982

This week is a return to reality as we digest more ugly economic statistics showing without a doubt that the US is heading into a deep recession.

If only predicting the course of the markets was simple, reducible to glib one-liners and simple courses of action and perpetually safe investments.

There is plenty of hot money drifting around, and at some point a terrible inflation is going to appear. But when? We simply cannot know this in advance.

Trading in a monster bear for the short term, with leverage is a fool's game unless one is a seasoned professional. And a fool and his money are soon parted.

If you look at the previous blog entry the best store of value for your wealth is quite obvious, if you have patience and do not succumb to leverage, and keep in mind the principles of diversification and portfolio management. But, even that is no certainty, for there are none in this world except death, change and the unexpected.

For the punters, its most likely we will muck around and set some sort of a bottom, in fear and trembling ahead of the Jobs Report which has expectations set extremely low.

At some point we will get a monster retracement rally, but that will be difficult to predict in advance, and its extent may be dependent on the trigger and how low we go first. Lots of variables. Afraid you'll have to stay tuned for updates.

30 November 2008

Citigroup Memo Points to Gold as a Safe Haven

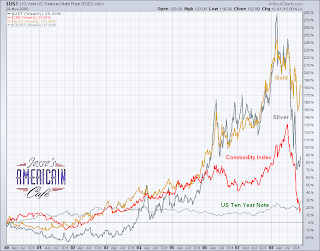

"Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses."

This is perhaps the gem in this article, the reminder that gold has proven to be one of the best stores of value through the turmoil of the turn of the century. People tend to lose sight of this, being preoccupied with the short term up and down of markets.

And it is most probable that it will continue to be an excellent store of value, a safe haven for wealth, over the next twenty or more years, as it has been over the past twenty or more centuries.

Why is this? Because although governments may seek to control it, prohibit it, monopolize it, disdain or disfavor it, they cannot create it, or prevent it from being valued by independent minds throughout recorded history as genuine wealth.

UK Telegraph

Citigroup says gold could rise above $2,000 next year as world unravels

By Ambrose Evans-Pritchard

7:29AM GMT 27 Nov 2008

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold. (A resurgence of inflation is hardly an extreme outcome, being more like the norm for the past 90 years. And we have had civil disorder and wars throughout the period of fiat inflation. - Jesse)

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

"This will lead to political instability. We are already seeing countries on the periphery of Europe under severe stress. Some leaders are now at record levels of unpopularity. There is a risk of domestic unrest, starting with strikes because people are feeling disenfranchised." (President Bush set record lows for popularity, and he did not require deflation to do it. Deflation is being held up as a boogeyman in this note. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)Gold traders are playing close attention to reports from Beijing that the China is thinking of boosting its gold reserves from 600 tonnes to nearer 4,000 tonnes to diversify away from paper currencies. "If true, this is a very material change," he said. (True and it would be an extremely intelligent move if they were to do so. - Jesse)

Mr Fitzpatrick said Britain had made a mistake selling off half its gold at the bottom of the market between 1999 to 2002. "People have started to question the value of government debt," he said. (Government debt has always been devalued and defaulted upon throughout history without exception. - Jesse)

Citigroup said the blast-off was likely to occur within two years, and possibly as soon as 2009. Gold was trading yesterday at $812 an ounce. It is well off its all-time peak of $1,030 in February but has held up much better than other commodities over the last few months – reverting to is historical role as a safe-haven store of value and a de facto currency. (This is not much of a prediction to be frank. Gold was bouncing along the 1000 level on the last leg up, and is now consolidating. A target of 2000 over the next two years seems a bit tame. - Jesse)

Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses.