US Treasury 10-yr CDS hits record high

By Emelia Sithole-Matarise

Dec 1, 2008 6:19am EST

LONDON (Reuters) - The spread or risk premium on 10-year U.S. Treasury credit default swaps hit a record high on Monday, extending a recent trend as market participants continued to fret about the scale of the government's financial rescue programmes.

Ten-year U.S. Treasury CDS widened to 68.4 basis points from Friday's close of 60 basis points, according to credit data company CMA DataVision.

Five-year Treasury CDS widened to 52.5 basis points from 46 basis points at Friday's close, it said.

01 December 2008

Armageddon Trade: Credit Default Risk Premiums on 10 Year Treasuries Hit Record

Looks like the Paint is Peeling

Chicago PMI Worst Since 1982

This week is a return to reality as we digest more ugly economic statistics showing without a doubt that the US is heading into a deep recession.

If only predicting the course of the markets was simple, reducible to glib one-liners and simple courses of action and perpetually safe investments.

There is plenty of hot money drifting around, and at some point a terrible inflation is going to appear. But when? We simply cannot know this in advance.

Trading in a monster bear for the short term, with leverage is a fool's game unless one is a seasoned professional. And a fool and his money are soon parted.

If you look at the previous blog entry the best store of value for your wealth is quite obvious, if you have patience and do not succumb to leverage, and keep in mind the principles of diversification and portfolio management. But, even that is no certainty, for there are none in this world except death, change and the unexpected.

For the punters, its most likely we will muck around and set some sort of a bottom, in fear and trembling ahead of the Jobs Report which has expectations set extremely low.

At some point we will get a monster retracement rally, but that will be difficult to predict in advance, and its extent may be dependent on the trigger and how low we go first. Lots of variables. Afraid you'll have to stay tuned for updates.

30 November 2008

Citigroup Memo Points to Gold as a Safe Haven

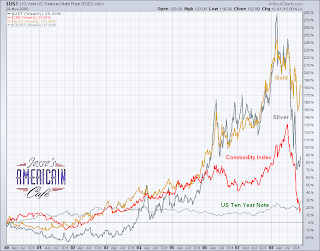

"Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses."

This is perhaps the gem in this article, the reminder that gold has proven to be one of the best stores of value through the turmoil of the turn of the century. People tend to lose sight of this, being preoccupied with the short term up and down of markets.

And it is most probable that it will continue to be an excellent store of value, a safe haven for wealth, over the next twenty or more years, as it has been over the past twenty or more centuries.

Why is this? Because although governments may seek to control it, prohibit it, monopolize it, disdain or disfavor it, they cannot create it, or prevent it from being valued by independent minds throughout recorded history as genuine wealth.

UK Telegraph

Citigroup says gold could rise above $2,000 next year as world unravels

By Ambrose Evans-Pritchard

7:29AM GMT 27 Nov 2008

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold. (A resurgence of inflation is hardly an extreme outcome, being more like the norm for the past 90 years. And we have had civil disorder and wars throughout the period of fiat inflation. - Jesse)

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

"This will lead to political instability. We are already seeing countries on the periphery of Europe under severe stress. Some leaders are now at record levels of unpopularity. There is a risk of domestic unrest, starting with strikes because people are feeling disenfranchised." (President Bush set record lows for popularity, and he did not require deflation to do it. Deflation is being held up as a boogeyman in this note. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)

"What happens if there is a meltdown in a country like Pakistan, which is a nuclear power. People react when they have their backs to the wall. We're already seeing doubts emerge about the sovereign debts of developed AAA-rated countries, which is not something you can ignore," he said. (We have not read the original note, but the questions of sovereign debt are related to default and inflation, not deflation. This is an awfully muddled set of ideas. - Jesse)Gold traders are playing close attention to reports from Beijing that the China is thinking of boosting its gold reserves from 600 tonnes to nearer 4,000 tonnes to diversify away from paper currencies. "If true, this is a very material change," he said. (True and it would be an extremely intelligent move if they were to do so. - Jesse)

Mr Fitzpatrick said Britain had made a mistake selling off half its gold at the bottom of the market between 1999 to 2002. "People have started to question the value of government debt," he said. (Government debt has always been devalued and defaulted upon throughout history without exception. - Jesse)

Citigroup said the blast-off was likely to occur within two years, and possibly as soon as 2009. Gold was trading yesterday at $812 an ounce. It is well off its all-time peak of $1,030 in February but has held up much better than other commodities over the last few months – reverting to is historical role as a safe-haven store of value and a de facto currency. (This is not much of a prediction to be frank. Gold was bouncing along the 1000 level on the last leg up, and is now consolidating. A target of 2000 over the next two years seems a bit tame. - Jesse)

Gold has tripled in value over the last seven years, vastly outperforming Wall Street and European bourses.

28 November 2008

Money Supply, Paul Krugman, and the Great Depression

We like Paul Krugman and enjoy reading his columns. But every so often he writes a column that is so off his normal standards that it makes us wonder if he is on vacation and the task of producing the column has been delegated to a graduate assistant.

Here is one such example.

NY Times

Was the Great Depression a monetary phenomenon?

By Paul Krugman

November 28, 2008, 1:47 pm

Has anyone else noticed that the current crisis sheds light on one of the great controversies of economic history?

A central theme of Keynes’s General Theory was the impotence of monetary policy in depression-type conditions. But Milton Friedman and Anna Schwartz, in their magisterial monetary history of the United States, claimed that the Fed could have prevented the Great Depression — a claim that in later, popular writings, including those of Friedman himself, was transmuted into the claim that the Fed caused the Depression.

Now, what the Fed really controlled was the monetary base — currency plus bank reserves. As the figure shows, the base actually rose during the great slump, which is why it’s hard to make the case that the Fed caused the Depression. But arguably the Depression could have been prevented if the Fed had done more — if it had expanded the monetary base faster and done more to rescue banks in trouble.

So here we are, facing a new crisis reminiscent of the 1930s. And this time the Fed has been spectacularly aggressive about expanding the monetary base:

And guess what — it doesn’t seem to be working.

I think the thesis of the Monetary History has just taken a hit.

We have mixed emotions on this one since we think the monetarist approach is a too one-dimensional to explain what happened then and now, and agree with Keynes that monetary policy alone is incapable of dealing with a complex economic event such as we are now facing. We also do not believe that the Fed 'caused' the Great Depression.

However, to try and make the case that the Fed can "only" control reserves and the currency base, the monetary base, is an old canard trotted out by the likes of Greenspan and his ilk when they wish to make the case that things are happening, like enormous bubbles, that are beyond the Fed's control. This is a Clintonian use of the word 'control' and is always and everywhere rubbish.

The Fed's power, its influence, is profound, and ever moreso in this era of aggressive financial engineering. Krugman uses the narrow argument of literal control to point to the Adjusted Monetary Base as his sole metric and say, "See the monetary base went up in the Depression in his Chart 1, just as it is today in Chart 2. Therefore there was no error from the Fed at that time because it was all that they could do."

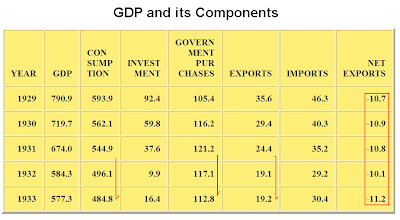

Here are two other charts that help to provide a better view of what really happened.

Please note in the above chart that after the British abandoned the gold standard, the Federal Reserve RAISED the discount rate for US banks in the spring of 1931 from 1.5 to 3.5 percent, or 200 basis points.

To emphasize the policy error look at this estimate of real interest rates leading into the bottom of the Great Depression in 1933. Nine out of ten economists might notice that, relative to the price deflation which was obviously occurring, that the increase in Discount Rate was motivated by other than monetary and domestic considerations.

Finally, let's take a look at a broader money supply for the period, M1, against the change in GDP.

Please notice the decline in M1 tracking the changes in GDP.

So, what might the Fed had done differently?

It is obvious that devaluing the dollar was the right thing to do. To that end, the Fed might have cut the discount rate to less than one percent, instead of raising it, which was likely in response to the movement of the British pound and the Bank of England's abandonment of the gold standard. They also might have lent in size to any bank requiring deposits, so that there would be no more bank failures for banks that were in otherwise reasonably good shape, that is, because of depositor runs.

And this is where we do part company with Mr. Friedman and Ms. Schwarz and join Lord Keynes in his observation that it requires fiscal and legislative actions to repair an economic shock such as the country was experiencing in the early 1930's.

Notice that Government Purchase drop, and rather sharply, into the trough of 1933, along with aggregate demand. This would have been the point where Keynes would have likely observed that supply money was not enough, but was only a first step in stabilizing the system. The 'real cure' was to get people working again, to provide wages and gainful employment, to encourage consumption and economic activity.

As an aside, notice that net exports were negative and remained so throughout the period of 1929 through 1933. Much has been made of the Smoot-Hawley tariff, and indeed exports did nominally decrease. But the proportion of decline to imports makes it clear that protectionism was rampant throughout the rest of the world, and had not been caused by anything the United States was doing per se.

We don't have the chart at hand, and will continue to look for it, but the United States was one of the last of the developed nations to emerge from the Depression with positive GDP growth. We think that this was caused by exactly the phenomenon that Keynes observed, which was a lack of government fiscal and legislative activity to promote economic activity, as well as a relatively open market for imports and a "business first" bias, to the disadvantage of the unemployed working people.

In conclusion we would say that contrary to what Mr. Krugman asserts it is apparent that the Fed made a significant policy error in raising the discount rate in early 1931. It is less clear what latitude they might have had to do more to stem the tide of bank failures because of depositor fears, but they clearly could have done more to react to the contracting money supply. We have heard that they only were able to think in termed of the monetary base and had no statistics beyond that with which to guide their efforts.

We think that this is a weak rationale at best for their failure as bankers to respond to the obviously dire situation of the economy which evident in and of itself. We would not accuse them of lacking imagination, inventiveness, determination, and a spirit of pragmatic activism. In fact, they strike us as 'clubbable men' acting for their club.

We shall see this time perhaps if monetary activism alone is sufficient, especially if the Republicans and corporate banking interests have their way. But it does not appear to be the case since making money available to lend does not solve the problem of helping to create an economic environment in which profits might be made.

Indeed, we can imagine an outcome in which misbegotten monetary policy results in an oligopoly of corporate interests and an economy that is permanently frozen in a series of de facto monopolies based on central planning, not all that dissimilar to the experience of the Soviet Union prior to its dissolution and some countries in which a hundred or so powerful families control the government and its economy in a state of permanent corruption and malaise.