For some reason Bloomberg Television lost its signal for an extended period today, and in a moment of desperation CNBC looked like an alternative. CNBC doesn't get watched much here.

For some reason Bloomberg Television lost its signal for an extended period today, and in a moment of desperation CNBC looked like an alternative. CNBC doesn't get watched much here.

CNBC is a 'news channel' in name only. Its like the McLaughlin Group with financial overtones.

Its overseas branch operations are not as bad, with the UK show often being reasonably good.

But this Fort Lee operation is abysmal, an extended infomercial, a puppet show for corporate perspectives without fact based reasoning.

Bloomberg has been reaching new lows in reporting standards, but next to CNBC it looks like pure reason, a Pulitzer Prize operation.

17 February 2009

Culture Shock - CNBC

Long Term Dow Chart and Forecasts

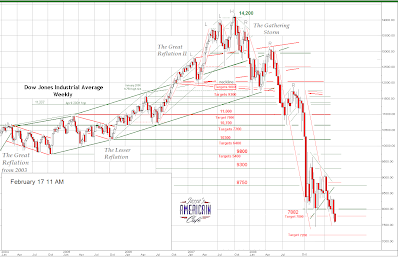

For some time we have had a downside target of 7200 on the Dow based on classic charting measuring objectives.

Here is an update of that chart showing we have broken down out of the symmetrical triangle and appear to be moving lower towards that objective.

Here is a very long term chart of the Dow showing the obvious importance of the 7200 level to the bulls. If that breaks the next support level on this chart will be around 6400. It will confirm the tentative neckline at 10,300 on the chart above.

When charts done from various perspectives and techniques agree, technically it can be a powerful confirmation of their validity.

These lower forecast numbers could be thrown off IF the government manages to start reflating the money supply and stock prices. They will at some point, its just a matter of timing, but it will obviously impact the nominal stock index numbers.

The Dow gold ratio will likely reach at least 2 and possibly less. This implies that at the bottom gold will be $2700. Gold will likely hit significant resistance around 1250-1300 in the short term and correct and consolidate its gains from there depending on how quickly we arrive at that target and the steepness of the slope of the price increase leading up to it.

If the reflation kicks in then all bets for a gold top are off. Silver is a little harder to forecast because of its industrial component. But we think $100/oz. is a slam dunk in the longer term, but anything can happen.

There is no forecast for the DX US Dollar Index because it will become increasingly irrelevant and detached from reality.

This is a longer term view, probably out to 2011, so the number of things that could impact it are many and significant.

Russia and China Sign Oil Deal for the Next Twenty Years

Look for more deals like this to start happening between non-western nations, that do not involve anglo-american companies and exchanges.

The Economic Times

Russia, China sign $25 billion energy deal

17 Feb 2009, 1721 hrs IST, AGENCIES

MOSCOW: Russia and China signed a $25 billion energy deal in Beijing on Tuesday that will see China secure oil supplies from Russia for the next 20 years in return for loans, Russia's state pipeline monopoly Transneft said.

As part of the broad energy supply deal, China will lend $15 billion to Rosneft, Russia's state-owned oil major, and $10 billion to Transneft, a vital boost for energy companies as they struggle to raise capital amid straitened lending conditions and plunging oil prices.

In return, Russia promised to guarantee annual oil supply of 15 million tons (300,000 barrels per day) for 20 years to its energy-hungry neighbor.

Igor Dyomin, Transneft's press spokesman, confirmed the outline of the deal.

The signing ceremony marks an end to months of talks between the neighbors after negotiations broke down amid disagreements over interest rates and state guarantees.

Russian crude will be supplied through a long-delayed pipeline project agreed to late last year. The pipeline, which extends from western Siberia to the Pacific coast, is to be linked to China from the Siberian city of Skovorodino, 70 kilometers (44 miles) north of the Sino-Russian border.

16 February 2009

Wall Street Execs Knew Madoff Was a Fraud Years Ago But Kept Silent

There is no way that the top execs on Wall Street did not know Bernie Madoff was running a scam. No way.

Why? Because once they heard he was pulling down those kinds of returns in all types of markets they would have had their own whiz kids climbing up his company's investment portfolio looking to see how he did it. They would want to do it too. It took Markopolos how many minutes to figure out it wasn't legitimate?

But now you know why so few Wall Street firms lost any money with Madoff despite his 'superior returns.'

Why did they keep quiet? Professional courtesy amongst scumbags is not likely, because there isn't any. More likely Bernie knew about some of their frauds, and that made him untouchable.

If they dig deeply enough they might find the real truth behind the Madoff scam, and it won't be pretty. This is no lone trader operation.

We may never hear the details behind this scam. It might shake our confidence in the system.

NY Post

Madoff Wall of Silence

By James Doran

February 16, 2009

Senior executives at some of Wall Street's biggest firms were convinced Bernard Madoff was a fraud as early as 2005 - yet none alerted authorities, documents filed with the Securities and Exchange Commission reveal.

Leon Gross, the former managing director in charge of worldwide equity derivatives research for Citigroup, told friends and colleagues on Wall Street in 2005 that he thought Madoff was being less than honest about the returns he could make for investors but did nothing to prevent the fraud.

Likewise, Joanne Hill, Goldman Sachs' global head of equity derivatives research, believed there was something wrong with Madoff's investment scheme because the returns he boasted in marketing materials seemed too good to be true.

Like Gross, Hill did not alert her superiors or regulatory authorities. She did, however, tell friends and colleagues about her suspicions.

Bud Haslett, of Write Capital Management, an investment firm, also suspected something fishy. But he told no one of his concerns.

The actions - or inaction - of the bankers is unveiled in a 700-plus-page dossier of e-mails, letters and analysis filed with the SEC by Harry Markopolos, the fraud investigator who tried to blow the whistle on Madoff for eight years.

The silence by the executives is disturbing to some, who claim a second alarm bell could have forced the SEC's hand and brought Madoff's alleged scam to an end sooner.

Markopolos told the SEC, according to the documents in the file, that he had been in contact with Gross, Hill and Haslett and that they would give evidence to the SEC so long as they were never required to speak in an official capacity.

Citigroup confirmed that Gross had been an employee but had left the bank some months ago. The company declined to comment about his views on Madoff.

A source close to Citi said Gross should not be singled out, as his views about Madoff were commonplace on Wall Street, adding that Gross did not spend much time analyzing Madoff's investment strategies.

Goldman Sachs did not return calls seeking comment. Write Capital Management, meanwhile, has not filed records with the SEC since 2006.