I would imagine if JPM is the owner then one would find some indication of this ownership on their 'books' and that one could look at their physical position in relation to their large derivative positions.

01 May 2015

Silver in the Individual Comex Warehouses

I would imagine if JPM is the owner then one would find some indication of this ownership on their 'books' and that one could look at their physical position in relation to their large derivative positions.

19 April 2011

Riding the Silver Bull: Worry If It Gets to Triple Digits This Year

I had quite a few questions on this topic of when to sell silver this evening, based on a comment I made with the normal gold and silver charts. I indicated we could see a pullback and consolidation, and it might be 'impressive.' I was thinking of support around 40, maybe 38.

Unless there is a liquidation panic as we saw in 2008 then I do not believe it will be much more profound than that.

Someone brought this interview on this very topic to my attention, and I include it here for your knowledge.

I have a lot of respect for Jimmy Rogers. He is an intelligent man and a real gentleman. I think there is wisdom and experience in what he says.

I own gold and silver in various forms, but have no plans to sell any bullion for the foreseeable future. I may hedge a little for short term trading corrections, but not actually sell it until the fundamentals change, because there is too much 'friction' is buying and selling bullion.

And even with non-bullion holdings, there is the bigger problem that once you have sold and lost your position in a bull market, it is often very hard psychologically to buy back in. It is natural to wish your decision to sell to have been 'right,' and sometimes so badly that your emotions will tend to distort your perception of the market, causing you to make mistakes.

Too often we see people who have sold their positions early making all sorts of foolish comments and dire predictions, trying to get other people to join them and sell, because misery loves company. I will listen to anyone's reasoned opinion, but too often these fellows just talk nonsense and are nothing more than a distraction.

There might be quite a bit more upside in silver, and that $100 is a respectable longer term target if the dollar does not 'turn into confetti' as Jimmy Rogers says.

Gold and silver are heavily tied to the fate of the dollar in some ways, and I do not yet see a clear path for the US to reform its financial house yet. The dollar denominated debt is the last of the great credit bubbles, and that means the bonds and the currency itself.

And yet the dollar is not the be all and the end all, and this is the sea change that so many are missing. Even without inflation the price of gold and silver would likely increase because of the growing demand in the developing world, which demands its own stores of value.

No, the US will not default per se. But they can sure engineer a de facto default through monetary inflation, which is what they are doing now. And they will never admit it, and take all sorts of pains to disguise it, because that is the whole point of it, to gracefully extinguish the debt without a formal devaluation or crashing the system.

I also think that gold and silver are making up for lost time, for the twenty year bear market during which their price was beaten down, held artificially low through central bank shenanigans.

Most institutions and individual investor are underweight precious metals, at a time when they are probably needed the most as insurance against currency and financial default risks.

I began trading stocks, bonds, and options in the stagflation of the latter 1970's in the aftermath of the great bear market, and vividly remember what it was like, and how people viewed inflation hedges like gold and silver, collectibles, coins, income averaging your tax returns for inflation effects. And this is not it, not even close yet.

When the inflation concerns catch some wind in their sails, there is nothing like it. The bulk of the people and unsophisticated investors are convinced that deflation is either here or imminent. So Bernanke has smooth sailing for some time yet.

Here is what Jimmy Rogers has to say.

- Eventually everybody's going to own gold, and then we'll have to sell our gold, but that's a long way from now.

- If triple digit silver happens this year then we'll have a parabolic move and we'll have to sell, and all parabolic moves end badly. I hope it doesn't happen, because I own silver and want to buy more.

- My hope for silver and gold and all commodities will go up for ten years in an orderly manner.

22 June 2010

Silver Leaving the Comex As Investors Want to Get Physical

Dave from Denver reports that:

"On Friday 516,522 ounces of silver were withdrawn from the Comex from Brinks.

Yesterday another 1.6 million ounces were withdrawn from Brink's and HSBC. It all came from the "eligible" category, which is the investor silver being kept at the Comex. This means it wasn't the banks and SLV playing a "shell game" with their "fractional" silver holdings. This was real stuff leaving and going into real hands off-Comex.

This is a lot of silver leaving the Comex and at least the silver leaving HSBC is motivated investors taking physical delivery.

In the context of gold/silver holding up as well as it has so far this week (silver contract roll, options expiry Thurs, 2-day FOMC meeting), it would seem that the demand for actual physical delivery of gold/silver maybe starting to overwhelm the cartel."

06 May 2010

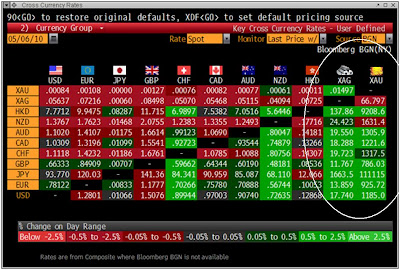

Bullion Denominated in Euros, Pounds and Swiss Francs At New Record Highs as the IMF Prepares for a Currency Crisis

What many traders are starting to realize is that the precious metals plunged with stocks in the recent market dislocation in 2008 because it was a 'liquidity crisis' among private institutions triggered by the credit unworthiness of individuals that provoked a general selling of assets.

What we are experiencing now is a sovereign debt (credit worthiness) crisis, which is really a currency crisis. A fiat currency is backed by nothing except the 'full faith and credit' of the issuer. It is not that it would have to be 'different this time' as some would think. It's not even the same thing, a different type of a crisis entirely.

The markets are assessing the risks of various currencies and countries with regard to default. Gold, and to some lesser extent silver bullion, are wealth that is sufficient to itself, requiring no backing from any particular country. Quite the opposite, there are large short positions and highly leveraged paper commitments, that present significant counterparty risk to the upside, because it is unlikely to be deliverable at anything near current prices.

Regulators have long turned a blind eye to what some contend are officially sanctioned shenanigans and secretive leasing and selling. This is becoming increasingly difficult for the central banks to manage, and we may approach a breaking point unless the financial engineers and politicians can head it off once again. They have a strong vested interest in hiding their past dealings, as we saw in the case of Mr. Gordon Brown in the UK.

If there is a new panic selloff, all assets will again be liquidated in the short term, including the metals. But their rebound may be quite sharp and potentially rewarding if the sovereign debt crisis continues, since the search for safe havens will be even more aggressive, as the seats in the shelters are quickly taken.

This is why the IMF is meeting in Zurich on May 11, ahead of the formal discussions scheduled later this year to discuss the reweighting of the SDR. There is a currency crisis on the horizon, and it may involve not only the PIIGS, but the larger developing countries including the US and the UK. And they are preparing contingency plans, and seeking to head it off.

I do not necessarily view this as gold and silver positive, because when central bankers get together to work their schemes on the markets, valuations may not be based on any fundamentals. The financial engineering of the central banks has been largely deleterious to individual wealth among the public, and there may be some shocking disclosures of market manipulation yet to be heard. The central bankers may be as compromised and hypocritical as their corporate cousins.

But if 'the fix is in' and the wealthy have indeed been buying bullion ahead of the public, then we might see something happen later this, and it could be quite impressive. The amount of 'book talking' being done on behalf of large institutions by paid analysts approaches the level of the appalling, even for such a recently tarnished profession.

By the way, the 'tease' today is that Jimmy Rogers is said to have turned rather bearish on stocks, and says he is getting quite short on one of the big western financial institutions which everyone believes is solid and well founded. He thinks it may soon become involved in the financial crisis. He would not reveal the name. We have a poll running until 9 PM Eastern US time for you to take your best guesses. No I did not include the US Treasury in the list.

As for the theory that currencies gain in strength if there are debt defaults, this is only if the taxation and production levels remain relatively constant or higher, and the debt destruction is within the debt which is owed by private parties. When sovereign wealth is destroyed this is a de facto default, and potentially corrosive as acid to a currency's value.

"Bullion denominated in euros and Swiss francs surged to new record highs this morning. The euro has again come under severe pressure as contagion risks increase. While all the focus is on Europe right now, similar risks face the UK and US economies and this is leading to significant safe haven demand for gold internationally. Prices have risen close to a new nominal record against the British pound and the highest level in yen since February 1983. Gold is slightly higher in most currencies this morning and significantly stronger in British pounds and euros - trading at $1,185.00, £786.03 and €925.72 per ounce this morning. Markets await the ECB rate decision and UK general election with interest."

Sovereign Debt Demands

"This is why the International Monetary Fund (IMF) and the Swiss National Bank (SNB) are jointly hosting a High-Level Conference on the International Monetary System in Zurich on May 11, 2010. The conference is set to analyse the global financial crisis and will provide an opportunity to exchange ideas on a number of related topics, including sources of instability in the international monetary system, improving the supply of reserve assets, dealing with volatile capital flows, and possible alternatives to countries’ accumulation of reserves as self-insurance against future crises.Metal Commentary by GoldCore

The conference will bring together a group of high-level participants, including central bank governors, other senior policymakers, leading academics, and commentators. The key objective of the conference is to examine weaknesses in the current international monetary system, and identify reforms that might be desirable over the medium to long run to build a more robust and stable world economy. The event will be concluded with a joint press conference by SNB Governor Philipp Hildebrand and IMF Managing Director Dominique Strauss-Kahn.

There is speculation that the conference may have favourable implications for gold with proposals that gold reserves may again have some form of role in bringing stability to the international monetary system."

Jim Rogers: More Turmoil Ahead in Global Financial Markets

Clusterstock: Jim Rogers Is Now Shorting A Major Western Financial Firm That Everyone Thinks Is Sound

As for my kitchen, we are plating financials short and bullion long all this week. But this may not be on the menu into the Friday US nonfarm payrolls, at least not in the same combinations and prices.

15 December 2009

Is the Price of World Silver the Result of Legitimate Market Discovery?

"...one US bank, JPMorgan, now holds 200 million ounces net short in COMEX silver futures, fully 40% of the entire net short position on the COMEX (minus spreads). As I have previously written, JPMorgan accounted for 100% of all new short selling in COMEX silver futures for September and October, some 50 million additional ounces. As extreme as JPMorgan’s position is, there is a total true net short position of 500 million ounces (100,000 contracts) in COMEX silver futures. Try to put that 500 million ounce short position in perspective. It equals 75% of world annual mine production, much higher than seen in any other commodity.

This makes claims that the COMEX short position represents a legitimate hedge of mine production a lie. The total short position represents almost 100% of the total visible and recorded silver bullion in the world, and 50% of the total one billion ounces thought to exist."

One cannot tell what is truth here easily, because of the still much too opaque nature of the US markets. But I do have a bias here, and I must disclose it up front. I have little confidence in the ability of the US regulators to do their jobs competently, and now approach anything that is said by the Obama administration regarding the financial markets with great skepticism.

In a fair market with transparent and symmetric distribution of key price information the identity of any holders of positions of over 5% of the market would be made known, so that people might understand the character of the market.

Further, any justification for these outsized positions and the 'backing' for them should also be made known publicly, and not just to a few insiders or regulators who expect to be trusted when past history shows that US regulators cannot be trusted to manage their markets reliably.

If this information about the silver market is indeed true, if J.P. Morgan is this short the silver market and unable to deliver even under duress, then perhaps the US should close down the Comex, because it has shown itself unable to be the price setter for the rest of the world in a metal with such broad industrial usage.

If it is not true, then the CFTC should publish its findings from its latest study of the silver market, and give the public the assurance that there is no manipulation in the silver market, and most importantly, why.

We have little confidence in the Obama Administration these days, which includes CFTC chairman, Clinton Alumni and ex-Goldman partner Gary Gensler as well, despite tough talk about position limits to quell speculation.

"The time for talk is over" should be a general theme in the Obama presidential term. They talk a good game, but never seem to deliver any meaningful reforms already promised, except those that might favor their own special interests.

This is important. It is important because in free markets producers must commit substantial amounts of capital in exploration and production to insure an adequate supply of any industrial commodity. And purchasers and other buyers and investors must be able to make their decisions with confidence.

Other parts of the world are moving towards establishing their own market clearing mechanisms in oil and key commodities outside of the sphere of the Anglo-American exchanges. If London and New York would prefer to continue to see their importance decline, then failing to regain the trust of the world through transparent reform after the enormous scandals that are still shaking world markets and financial systems would be advised, as they continue to do today.

It is not about pay. It is not about worrying that the traders might leave. It is time to show some concern for your customers, and about honest price discovery in a fair market, and making good after you have engaged in a massive fraud which the US and the Wall Street banks seem loathe to discuss when they worry about 'confidence.'

Is Mr. Butler wrong? Good, then show us why, not by belittling him personally, or picking details out of what he says and twisting them to try to undermine the whole of what he has to say. Public records show that there is an enormous short position in the silver metals market, that looks to be utterly out of bounds with physical reality and deliverability. If this is just a paper game then we need to know who is doing it and why, and why the world should accept this sort of nonsense as a basis for real production and real capital allocation.

And if this extreme speculation in silver is shown to be true, how do we know if this is the case in other US exchange based markets, like oil, and energy, and other metals, and food? Can the world afford to allow the US to set prices given the flaws which have been disclosed in their risk ratings and pricing mechanisms of late, despite the stony silence of their compliant media and the assurance of captive regulators? The pervasive fraud involved in the latest banking scandals has not yet been addressed adequately, and it is part of a pattern of misconduct going back to the 1990's at least. And even now, little or nothing has changed. The Partnership Between Wall Street and the Government Will Continue Until the System Collapses?

Show us the market. Show us who is holding the outsized longs and shorts, and what their motivations might be, whether it is a hedging producer, or as an agent for users and who they might be. And who the speculators are, and what limits on speculative manipulation might exist.

Show us the market. Show us who is holding the outsized longs and shorts, and what their motivations might be, whether it is a hedging producer, or as an agent for users and who they might be. And who the speculators are, and what limits on speculative manipulation might exist.What sort of leverage is JPM employing? Are they hedging proven reserves for legitimate customers, or are they shoving prices around the plate using derivatives, simply because they can. It does not reassure us that in the not too distant past the London group of AIG was a major short side speculator in the silver market.

There is too much trading in insider and asymmetric information in the US markets, which is the cause of their opacity and the recent successes of con men, sometimes despite the repeated attempts by concerned market participants to bring suspected abuses to the attention of the regulators in what were later found to be obvious and outrageous frauds.

And as for reassurances that the regulators have conducted a study, with the details withheld, and have in their considered opinion found nothing amiss, don't make us laugh. After the Madoff Ponzi Scheme, the Enron energy manipulation, and the mortgage CDO scandal, US regulators have amply demonstrated their inability to manage their stewardship honestly and competently. At this stage they should be making amends and regaining confidence, and not dictating terms to a bunch of helpless domestic customers who continue to accept such shoddy and arrogant treatment by self-serving financial institutions, who dare to charge even good customers 26% credit card interest rates and outrageous fees, in the spirit of the Obama financial reform.

If the world were of a mind to it, they could buy those futures contracts, and demand physical delivery, and bring Wall Street to its knees. Except as we know it would not work, because the exchange would dictate terms, a settlement in paper, and Ben would provide it, at the buyer's ultimate expense. This is the degraded nature of the US dollar reserve currency regime as it exists today. It is become, as they say in Chicago, a 'racket.' Time for honesty again. This is the reform for which the American people elected a new government.

But yet even today, there is a lack of self-awareness, a lack of proportion and an ignorance of history, that allows many otherwise educated and responsible people to make statements like this excerpt quoted below, a neo-colonial variation of the white man's burden, and bet their future that this dependency on the Wall Street banking cartel will be sustained in perpetuity, because it is a kind of a natural law. This point of view is not an aberration, and underlies the comments of many Anglo-American financial institutions today.

"The dollar is the backbone of the world central banking system. It is the backbone of the China money system. The white cliffs of Dover are as likely to collapse."I am not saying that Mr. Butler is right. I am saying that I no longer trust your markets and their integrity, and the honesty and competency of your agencies and regulators. And there is a groundswell of people around the world, and a quiet but growing majority in your own country, who feel the same way.

Extreme Speculation

By Ted Butler

...The main reason for my recurring thoughts that silver trading may be terminated on the COMEX someday is because that exchange is at the heart of the silver manipulation. If we are closer than ever to witnessing the end of the long-term silver manipulation, as I believe, it must mean an end the extreme concentration on the short side of COMEX silver futures. But the concentrated short position in COMEX silver futures is so extreme, that it is hard to imagine how it can be resolved in an orderly manner. The most recent data from the CFTC indicate that one US bank, JPMorgan, now holds 200 million ounces net short in COMEX silver futures, fully 40% of the entire net short position on the COMEX (minus spreads). As I have previously written, JPMorgan accounted for 100% of all new short selling in COMEX silver futures for September and October, some 50 million additional ounces. You have not seen anyone refute those findings, nor is it likely that you will.

So extreme is JPMorgan’s silver short position that it cannot be closed out in an orderly fashion. How could such a large position be closed out quickly, or otherwise, without strongly disturbing the market? If it could be closed out, it is reasonable to assume it would have already been closed out or greatly reduced to avoid the allegations of manipulation it raises. It’s not like the banks are presently universally loved and admired. The intent of anti-concentration guidelines and surveillance is to prevent the precise monopoly that JPMorgan has amassed on the short side of COMEX silver. Having erred egregiously in allowing this concentrated short position to develop, the CFTC is stuck with coming up with a solution to disband it. There is no easy solution.

Further, it is not just JPMorgan’s 200 million ounce COMEX silver short position that threatens the continued orderly functioning of COMEX silver trading. As extreme as JPMorgan’s position is, there is a total true net short position of 500 million ounces (100,000 contracts) in COMEX silver futures. Try to put that 500 million ounce short position in perspective. It equals 75% of world annual mine production, much higher than seen in any other commodity.

This makes claims that the COMEX short position represents a legitimate hedge of mine production a lie. The total short position represents almost 100% of the total visible and recorded silver bullion in the world, and 50% of the total one billion ounces thought to exist. These are truly preposterous amounts. By comparison, the net total short position in COMEX gold futures, admittedly no slouch in the short category, represents a little over 2% of the gold bullion that exists (45 million oz total net COMEX short position versus 2 billion oz). When it comes to the amount of real material, or mine production, in the world backing up the COMEX silver short position, the word “inadequate” takes on new meaning.

Because of the extreme mismatch between what is held short on the COMEX and what exists or could be produced to be potentially delivered against the short position, a very dangerous market situation exists. It is this dangerous situation that haunts me and causes me to contemplate a closing of the COMEX silver market. It has to do with what I see developing in the silver physical market and by putting myself in the other guy’s shoes. The other guy, in this case, is Gary Gensler, chairman of the CFTC.

It seems to me that there may be real stress in the wholesale physical silver market. All the factors I look at, including flows into ETFs, the shorting of SLV, the decline in COMEX silver inventories, the strong retail and institutional investment demand in silver, the now growing world industrial demand, etc., suggest tightness and the potential for a silver shortage like never before. This, in essence, is the real silver story. In spite of a large and growing concentrated short position, the price of silver suggests that it is the manipulation that is under stress. At some point, a physical silver shortage will destroy any amount of paper short selling. We may be very close to that point.

When the silver shortage hits, the price will explode. On this, there is no question. Industrial users, at the very first sign of delay in silver shipments, will immediately buy or try to buy more silver than they normally buy, in order to protect against future operation-interrupting delays. This is just human nature. The world has never experienced a true silver shortage ever, so the price impact is clearly unknown. I’ll try not to overstate how high I think the price will go in a true silver shortage and how quickly it will occur, so that I don’t sound too extreme. But the price move will give new meaning to “high” and “fast.”

Please remember, I am only talking of the price impact of the industrial users scrambling to secure silver supplies for their operations. This has always been my “doomsday machine” future silver price event. I am not speaking of new investment demand or short covering. Users, anxious to keep their assembly lines running and their workers employed will care less about price and more about availability and actual delivery. The users will buy with an urgency and reckless abandon rarely witnessed. That the price explosion caused by user buying will destroy the shorts is beyond doubt. So certain and devastating will be this destruction, that you must start asking questions as to what the regulatory reaction is likely to be. This is where you must try to put yourself in the other guy’s shoes. When the industrial silver shortage hits and prices explode, what would you do if you were Chairman Gensler?...

Read the rest of Mr. Butler's essay here.

01 October 2009

The Utility of Gold and Silver Over the Past 200 Years

A bit of an oversimplification as one might expect for a short video, but rather effective in making its several of its points. Some interesting data as well.

Warren Buffett has asked "What utility does gold have?"

Since his views are respected and he is unusually successful, it is important to consider this question.

The utility of gold is that it resists the manipulation of the statists, which is why they hate it. It provides a store of wealth that is difficult for the state to confiscate through debasement. Gold and silver have represented the instruments of freedom and safety, a secure store of wealth, for individuals faced with adversity and uncertainty over thousands of years.

For quite some time the various pieces of evidence with regard to the Central Banks and gold have been becoming public. It seems to this reader, based on a careful search and consideration of the facts, that the attempt to control the price of gold and to a lesser extent silver by some of the Banks, led by the Brits and the Yanks, is almost certain as an adjunct in their efforts at financial engineering.

But the Banks are failing. They are failing in particular since the market break of 2000 when the first of the post Asian financial crisis bubbles collapsed. They are being broken, once again, by the physical buying coming in particular from Asia and Europe, where currency risk is a familiar concept. Most American go through their lives never having handled another currency except the dollar, and their education in finance, and even their own history, is sadly lacking. For them, the US dollar is the monetary alpha and the omega, and its decline is incomprehensible.

We are now in the midst of a new financial bubble in world equity markets, and it too will collapse.

This is not to say the future will be straightforward and simple. It will not.

People sometmes worry about government confiscation. Since gold no longer has any official status in the US except as private property, this is a bit of a red herring. True, government can try to seize any of your private property not just gold. It can try to force you to wear a number, or imbed a chip in your head, to buy and sell, it can even try to pack you on a freight train for resettlement in New Mexico. The question is not what the state can try to do, but rather, what you will let them do and how you will respond to it.

At the moment the US dollar remains the linchpin of the Anglo-American financial oligarchy. That is it failing is probably one of the great issues facing world stability today.

Right now the Dollar is the subject of an aggressive carry trade, with traders selling it short to buy other assets. This obviously sets up the potential for another short term dollar squeeze such as we saw last year when the Eurobanks were devastated by the failure of the toxic dollar assets on their balance sheets which had to be paid in full in dollars to their depositors.

A reversal in the dollar and the collapse of carry trade would shake world equity markets to their core as the gamblers are forced to unwind positions. The vampire squid and associates would probably benefit, but many would suffer. In today's environment, that makes the possibility of this happening even more likely in our book.

But then again, sometimes things do go down into a long spiral, and finally are priced at 30 on a Friday, and open up on Monday at 2, or 'no bids.' It happens. But usually it happens in slow motion at first with national currencies. It is much easier to boil a batch of frogs slowly than to wade in and start chopping heads.

Likelihood is a dollar rally at some point if stocks start unwinding. And then things get interesting, and ugly. Not with a bounce, but a 'splat,' with interest rates running to levels that would make your jaw drop.

For a longer view and a warning likely to fall on deaf ears, the more the oligarchs and elitists take the world's people through these cycles, the greater they need to pay attention to one lesson that ripples throughout history: the trick is not only how to make a great fortune through theft and trickery, but how to hold on to it, and very likely your life, when the tide turns and the people have finally had enough.

Gold and Silver Video

02 September 2009

Martin Hennecke: Protecting Your Wealth in Volatile Markets

"Hennecke stressed that investors should go for physical forms of gold and other

precious metals rather than "paper gold investment scheme where there isn't full

backing, where the metal might be leased out or used for derivatives. That's

crucial because there is 80 times more paper gold in the market than actual

physical metal in existence in the planet."

For the most part alternative currency trades remain 'highly specialized' investments, not often seen in the 401k, IRA, or the average brokerage account.

If gold and silver go mainstream, which they often will do in times of crisis of confidence, the rally may be rather impressive on short covering alone. Expect the exchanges to invoke special rules to allow for settlement of delivery obligation in cash or kind rather than bullion, and at artificially low, albeit significantly higher, prices.

But this may not help those who are holding gold in 'custodial accounts' where the same gold has been lent out to the market and sold, or is loosely mingled with multiples of uncertain ownership.

Can't happen? Who would have thought that one of the largest retail commodity brokerages, Refco, could roll over? Counter party risk is always an issue when you are 'off-exchange.'

“The desire of gold is not for gold. It is for the means of freedom."

Ralph Waldo Emerson

Go for Gold and Silver: Strategist

By CNBC

Wednesday, 2 Sep 2009 2:44 AM ET

China's key stock index recovered its poise on Tuesday, rising nearly 0.5 percent after diving 6.7 percent the day amid liquidity concerns and worries that lending growth may slow in the country. In August alone, the Shanghai Composite lost nearly 22 percent, snapping a seven-month winning streak.

If those stock gyrations are hard to stomach, there are other investment options to help ride out the wild swings in China, according to Martin Hennecke, associate director at Tyche.

For one, Hennecke liked convertible bonds in China, saying he is bullish on the Chinese economy given its fundamental strength, compared to Europe and the U.S. (No thank you for now, its a bubble and a bit less than free market environment, even given its bawdy good time with capitalism over the past ten years. - Jesse)

"Valuation is not as cheap anymore compared to the beginning of the year. Hong Kong-listed China companies are slightly cheaper than (those in) Shanghai," Hennecke said on CNBC Asia's "Protect Your Wealth". " One who plays more cautiously -- convertible bonds in China are an option."

Gold and silver ranked among Hennecke's top recommendations, as China, the world's largest gold buyer this year, is likely to buy more of the yellow metal going forward.

"Whether we see a further crisis or a recovery globally, with inflation coming back up again...gold should do quite well and it hasn't risen much this year yet," said Hennecke.

Hennecke stressed that investors should go for physical forms of gold and other precious metals rather than "paper gold investment scheme where there isn't full backing, where the metal might be leased out or used for derivatives. That's crucial because there is 80 times more paper gold in the market than actual physical metal in existence in the planet."

Hennecke also preferred exposure to direct agricultural commodities, as opposed to investing in commodities through equities, where markets have already rallied sharply.

"Agricultural commodity prices are similar to precious metals. (Prices) across board are mostly dropping, apart from sugar and a few items. So direct commodities are quite undervalued and quite cheap now," he explained. "Agricultural prices are likely to rise quite substantially."

Hennecke expected the investment environment to be volatile, as the U.S. will be saddled with a massive debt load over the next ten years.

"It's tricky to see where stock markets are heading, it depends on how fast inflation feeds through as a result of the debt problems." (Precisely correct, except for those who prefer to see what they have already decided *should* happen. They are often wrong, but rarely uncertain. - Jesse)

17 July 2009

New Silver Fund

Silver Bullion Trust, an all silver fund from the CEF/GTU closed-end fund group, has its roadshow going on now.

Silver Bullion Trust, an all silver fund from the CEF/GTU closed-end fund group, has its roadshow going on now.

Initially it will only be available in Canada. It will trade on the TSX to start, then on the AMEX once it has risen to $75 million of assets which is a similar process used in the introduction of GTU.

It will trade in Canada in both U.S. and Canadian dollars.

The initial offering is reported to be for up to $200 million, so the $75 million threshold could be met immediately depending on the bid size of the deal.

It is expected to price at around US $10 (1 share + 1 $10 warrant) by July 29th.

This could be a interesting alternative to SLV and to CEF for those who wish to invest more heavily in silver.

16 July 2009

Paper, Scissors, Gold

As you may have heard recently, the Comex has asserted their right under their rules to deliver the equivalent paper interest in Exchange Traded Funds such as GLD in lieu of the delivery of physical bullion for those standing for delivery under the rules of the commodity exchange.

Is GLD really the same as physical bullion?

"...it appears that a lot of investors believe and trust that investing in GLD is the same thing as buying physical gold bullion. A close reading and analysis of the GLD Prospectus, however, reveals that investing in GLD is drastically different from owning gold. This analysis will show why GLD is nothing more than another form of a derivative security which is loaded with counter-party default risk."Here is a recent statement from Dennis Gartman who most often derides those he calls 'goldbugs.'

Owning GLD Can Be Hazardous to Your Wealth

"To finish, we do agree that recent decisions to allow for the "delivery" of ETF shares in the stead of actual physical gold against a futures position does cause us some concern. Indeed, it causes us some very real concern, for if we stand for delivery of wheat we expect to receive wheat, not paper. The same holds true for delivery processes on the COMEX, and if GATA and the "Bugs" have a complaint it is this new decision by the COMEX. On this, we’ll grant that the "Bugs" have something to complain about." Dennis Gartman in The Gartman Letter

We have often said that when the real crisis of liquidity comes, and the final flight to safety from the credit bubble collapse begins in earnest, the exchanges will alter the rules to allow for cash and paper settlement of claims for bullion, which they cannot or will not be able to deliver at the agreed upon prices.

This is what makes the current structure of the short positions held by a few banks on the precious metals exchanges a 'racket,' a type of Ponzi scheme where the same thing is sold repeatedly with no means of satisfying the aggregate of the claims and ownership.

We are sure the Comex is "well capitalized," and will continue to be so, even as it is rocked by de facto delivery failures and the substitution of more paper to back up the general failure of paper.

The wheels of justice grind slowly but they grind exceedingly fine.

30 May 2009

Silver Rockets to a Record Gain

There were delivery strains at the Comex this month.

A few more months like this and they will be taking the metal bears out of the pits on stretchers.

Remember, nothing ever goes straight up.

Silver posts biggest monthly gain in 22 years; gold rallies

By Moming Zhou, MarketWatch

May 29, 2009, 2:29 p.m. EST

NEW YORK (MarketWatch) -- Silver futures gained 3% Friday, ending May with their biggest monthly gain in 22 years as inflation worries and hopes for an economic recovery boosted the metal. Gold rose to three-month highs as the dollar slipped.

Silver for July delivery, the most active contract, gained 45 cents to end at $15.61 an ounce on the Comex division of the New York Mercantile Exchange. The front-month June contract closed at $15.60 an ounce.

Meanwhile, gold for June delivery rose $17.30, or 1.8%, to close at $978.80 an ounce, the highest settlement since Feb. 23.

Silver has gained 26.6% this month, the biggest since April 1987. The metal has many industrial uses but is also seen as a hedge against a weaker dollar and inflation. In contrast, gold, which has limited industrial uses, has gained 9.8% in the month, the biggest monthly gain since November.

"What you may now be seeing is people think we are moving toward a recovery, and maybe we should be less pessimistic about the future of the metal, that may be factoring in the prices," said Jeffery Christian, managing director of New York-based precious metals consultancy CPM Group.

Silver, whose biggest single industrial use is in photography, is also used in medical applications and solar-energy devices.

Friday's economic news reinforced economic recovery hopes. The U.S. economy contracted at a revised 5.7% annual rate in the first quarter, a decline that's smaller than the 6.3% drop in the fourth quarter, the Commerce Department reported Friday.

More volatile

CPM's Christian also pointed out that silver had declined sharply in the second half of last year, when the global economy was entering into a sharp downturn. Its prices had fallen more than the price of gold.

"Silver is playing catch-up to some extent," said Christian.

The silver investment market is traditionally more volatile than gold, because the market is smaller than the gold market.

"The gold market is more participated, involved more money, and more liquid, and it tends to see lower volatility," said Christian. "In silver, you have few people with less money. It's a much more illiquid market and prices are always more volatile than gold."

In exchange-traded funds, iShares Silver Trust ETF has gained 38% this year, following its 40% decline in the second half of last year.

SPDR Gold Trust , meanwhile, has risen 11% this year. It fell 6% in the second half of last year.

In other metals Friday, July copper gained 6.05 cents, or 2.8%, to $2.1975 a pound. Copper rose 7% in May.

The June palladium contract rose $4.05, or 1.7%, to $236.05 an ounce, while July platinum rose $46.20, or 4%, to $1,196 an ounce.

Among metals-sector equities, shares of Barrick Gold Corp. rose 2.2% to $37.98 and South Africa's Gold Fields Ltd. was up 2% at $13.34, while Newmont Mining Corp. gained 2.1% to $48.35.

The Amex Gold Bugs Index , which tracks the share prices of major gold companies, rose 2.6% to 395.52.

30 April 2009

Silver First Notice Day

This note just received from a metals trader:

This note just received from a metals trader:

"Today is first notice day for the silver futures contract. The open interest as of the end of yesterday is a good approximation for the number of contracts that will stand for delivery, as brokers typically require any longs not funded for delivery to be sold or rolled forward by the end of trading the day before 1st Notice (some require this up to 3 days before).

Comex May silver Open Interest as of yesterday's close was 4365. I don't think this includes the old CME contract, which is the NYSE Liffe contract, so this number ultimately may be low.

These 4365 contracts equate to 21.8 million ounces, or 33% of the amount of silver on the Comex that is registered for delivery. Not enough to do real damage to the Comex inventory, but probably enough raise some eyebrows around the world. I am absolutely convinced that part of this week's pure paper attack on silver was designed to discourage longs from taking delivery."

The silver market has been manipulated for some time now based on what we have seen. Interestingly enough one of the principle players had been the London crew of AIG, who apparently had to find a new routine when AIG exited that trade a few years ago. What was an insurance company doing as a major trading player in the metals markets? Because they had not yet discovered the benefits of selling increasingly worthless derivatives.

If this is true, if these markets are being used in this way, then we should see increasing shortages of the physical products until the exchange delivery mechanism is broken, and the contracts force settled in cash, with defaults in funds galore.

The investigation into the metals and energy markets by the CFTC and other government agencies makes the SEC appear to have the wisdom and integrity of Solomon.

Let's see how this plays out, and how it is spun if and when it breaks. It's sure to be amusing.

21 March 2009

The Net Asset Value of Certain Gold and Silver Trusts and ETFs

GLD and SLV generally trade at a slight discount to spot because of their management fes. They are also used for arbitrage plays.

The premium on GTU is substantial as a result of the recent rally in gold. Personally I would not buy it at that level of premium preferring other investments.

02 March 2009

17 February 2009

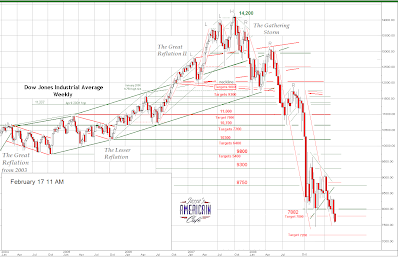

Long Term Dow Chart and Forecasts

For some time we have had a downside target of 7200 on the Dow based on classic charting measuring objectives.

Here is an update of that chart showing we have broken down out of the symmetrical triangle and appear to be moving lower towards that objective.

Here is a very long term chart of the Dow showing the obvious importance of the 7200 level to the bulls. If that breaks the next support level on this chart will be around 6400. It will confirm the tentative neckline at 10,300 on the chart above.

When charts done from various perspectives and techniques agree, technically it can be a powerful confirmation of their validity.

These lower forecast numbers could be thrown off IF the government manages to start reflating the money supply and stock prices. They will at some point, its just a matter of timing, but it will obviously impact the nominal stock index numbers.

The Dow gold ratio will likely reach at least 2 and possibly less. This implies that at the bottom gold will be $2700. Gold will likely hit significant resistance around 1250-1300 in the short term and correct and consolidate its gains from there depending on how quickly we arrive at that target and the steepness of the slope of the price increase leading up to it.

If the reflation kicks in then all bets for a gold top are off. Silver is a little harder to forecast because of its industrial component. But we think $100/oz. is a slam dunk in the longer term, but anything can happen.

There is no forecast for the DX US Dollar Index because it will become increasingly irrelevant and detached from reality.

This is a longer term view, probably out to 2011, so the number of things that could impact it are many and significant.

29 January 2009

When the Incoming Tide Turns to Tsunami

Not a matter of if, but when.

The Times

Gold price could treble if China divests dollars, warns mining boss

Jenny Booth

January 29, 2009

The gold price is likely to hit record highs in dollar terms as fears grow about the stability of the US currency, the chairman of Barrick Gold said today at the World Economic Forum (WEF) in Davos.

The founder of the world’s largest goldmining company said that there was even a possibility that central banks, including China’s, might start to switch from dollar holdings to gold, which could cause the price of the metal to treble.

“Gold is at record levels in every currency except dollars," Peter Munk told Reuters at the WEF meeting.

"Even within dollar terms it is within a few percentage points of an all-time high, at a time when all the other major commodities are falling.”

Mr Munk said: “Whether it’s the currency effect or a reaction to a feeling of uncertainty, gold, in my opinion, is more likely to go up than down.”

The gold price was up today, trading at about $890 at 1500GM. At present the record high is $1,030.80 an ounce, achieved in March last year.

Mr Munk emphasised that he was merely weighing the odds.

“It would be stupid to assume commodities prices can only go one way,” he said, adding that physical demand for gold jewellery was not high during the economic downturn.

Gold has been one of the best-performing assets of recent months, rising in value by nearly 17 per cent since late October even as the price of other commodities, such as oil and copper, has dropped sharply. (This is because gold is more monetary than commodity. Silver is a more even mix but it is still monetary as well as industrial. - Jesse)

Investors have bought heavily into physical bullion in the form of coins and bars, and physically backed assets, such as exchange-traded funds, as a safe store of value at a time of increased volatility in other asset prices.

Mr Munk said that downward pressure on the dollar, partly due to massive US spending and printing money to stimulate the economy, would increase gold’s attractions as an investment even further.

Gold usually moves in the opposite direction to the dollar, as it is often bought as a hedge against weakness in the US currency. (Gold has been moving with the dollar as foreigner flee out of other currencies and begin to treat gold as a safe haven alternative with, not in lieu of, the dollar - Jesse)

“My personal feeling is that with the rescue packages calling for trillions, not billions ... the value of the [US] currency has to go down,” Mr Munk said.

He said that there was a possibility that central banks, including that of China, a major dollar asset holder, might start buying gold. (Rumour is that the physical market is so tight they have been calling quietly around looking to lock in major sources of supply - Jesse)

“If they decide to diversify, we assume into gold, then we start to talk about a trebling or quadrupling of the gold price," he said. "It could be followed by Russia or Kuwait." (They could just be jawboning Tim Geithner back with a credible threat as well - Jesse)

“I don’t think it’s likely, but it’s more likely. I would not have said it two years ago — I’m not a gold bug — but it’s more likely than it was two years ago.”

He added that his company did not now hedge its output — meaning use derivatives to insure against a fall in price — and relied on the price climbing.

In the past its successful hedging allowed it to make key acquisitions.

“It would be dumb to hedge,” Mr Munk said. (Bill Murphy told you that when gold was at $300 per ounce, and he was right - Jesse)

21 December 2007

Investment Performance for 2007

We Trust In God, Everyone Else Shows the Data

We like to check the data. The reason should be obvious, but if not, its because often people deal with the complexities of life by using assumptions, which are a kind of shorthand way of breaking reality down into manageable chunks. Everyone does it. You have to. But every once in a while its useful to check those assumptions you make, and that other people are making, to see if they are still valid, especially if they involve things that are important. Does your wife still love you? Is there a bus coming down the road you are crossing? Do you really still look as hot as you did last year? Are you financially solvent? Those sorts of things.

2007 Returns of Some Major Stock Indices

Let's compare the 2007 year-to-date performance of some of the major stock indices. As always, if you click on the chart you will see a larger, much easier to read version.

Its a little suprising that the Russell 2000 is still not quite positive for the year, not including dividends or subtracting fees and commissions. There was quite a bit more divergence in the gains of the major stock indices. An index after all is just a grouping of things for measurement purposes. The Russell is the broadest, most inclusive of the indexes we normally watch.

Its a little suprising that the Russell 2000 is still not quite positive for the year, not including dividends or subtracting fees and commissions. There was quite a bit more divergence in the gains of the major stock indices. An index after all is just a grouping of things for measurement purposes. The Russell is the broadest, most inclusive of the indexes we normally watch.It looks like tech was the champ of the broad stock sectors this year, if for no other reason that they are NOT financial and NOT housing. The Wall Street storyboard is that tech is invulnerable to the vagaries of housing and financial bubbles, and actually benefits from the weakened US dollar because the we are the champions, the kings of tech, and are selling it to the rest of the world, although very little of it is actually made here anymore, and what we do invent is copied and pirated shamelessly. Its a revenue concept thing perhaps, moreso than real hard cash, like page views and web searches and collateralized debt obligations.

Let's Get Physical

Let's take a look at a different type of investment. How about something that is supposed to be impervious to inflation, a barbarous relic, the bane of central banksters and financial voodoo? Since the generally transitory, subjective, and vaporous nature of financially engineered products is in the headlines it might not be a bad idea to throw in something with a long track record as a hardened test of monetary value into the mix.

Let's take a look at a different type of investment. How about something that is supposed to be impervious to inflation, a barbarous relic, the bane of central banksters and financial voodoo? Since the generally transitory, subjective, and vaporous nature of financially engineered products is in the headlines it might not be a bad idea to throw in something with a long track record as a hardened test of monetary value into the mix.Holy goldaroney, Batman! That is one surprisingly fine performance for gold this year. Even we did not think that it has been this good. The assumption has been, at least lately, that gold's day will come soon, especially when the Central Banks get finished monkeying with it. Well, its been a much better return this year than most would think offhand. We're in that group, and we watch it! See how easy it is to fall prey to your own assumptions, especially when you think you have been watching something for a long time.

The Usual Investment Suspects Let's widen the data net a little more, and see how different things compare. We apologize for the lack of variation in colors on this chart, but we had to tinker with the charting tool a little to get so many items on a single snapshot.

Let's widen the data net a little more, and see how different things compare. We apologize for the lack of variation in colors on this chart, but we had to tinker with the charting tool a little to get so many items on a single snapshot.

Well, there you have it. Some real information about how various investments performed during 2007. We new the US dollar was doing badly. We did not know that gold had done so well, and had outperformed most of the other major alternative so handily (don't forget about those dividends guys. Gold does not pay any, just like a high performing tech stock).

Let's have one more look at a sector that we have admittedly been cool towards for the latter half of this year, because of the general reluctance we have had toward equities.

Data Mining

Well, as someone who has not owned miners for the latter part of the year, we're just a little

disappointed that we overlooked such a hot performing sector. Its been a wild ride, and keep in mind that with high returns comes higher beta (variability of return aka risk, and lately that includes return of capital). Remember this is the HUI gold bugs index, and if you have been playing the junior miners heavily you might have ground your teeth to a fine white powder trying to ride those bucking beta broncos.

disappointed that we overlooked such a hot performing sector. Its been a wild ride, and keep in mind that with high returns comes higher beta (variability of return aka risk, and lately that includes return of capital). Remember this is the HUI gold bugs index, and if you have been playing the junior miners heavily you might have ground your teeth to a fine white powder trying to ride those bucking beta broncos. Our personal preference is to find a few well financed miners that have a shot at paying dividends for a long time if the dollar really tanks and stocks gets smacked down. Bennie and Hank and crew are working overtime to make sure this happens, make no mistake about it. They are just trying to push the date of reckoning into the future. We admit to a bias that says the dollar will inflate significantly further, and then at some point deflate. Its just that we think the deflation will be when they knock a couple zeros off buckaroo. It might not happen that way. We'll stay flexible.

When people put forward ideas that might be important to you, ask for the data. People are often afraid to ask, because they don't want to look foolish. Some people like to put forward their ideas with great ceremony and pomp, and browbeat and belittle anyone who disagrees with them. They often speak with great confidence bordering on arrogance. We'll let you in on a little secret. What we have learned over the years is that if someone can't explain their ideas to you, it just might be that they do not understand the idea themselves. Don't get us wrong. There are some very fundamental beginner questions that people must and should as. Its just that they aren't necessarily best directed to the advanced class. But that doesn't mean you shouldn't ask. Just try to ask the right person in the right places in the right way.

Questions can be annoying. But we find that often they provide the kind of impedance that causes us to revisit them and test our assumptions, to try to explain things over again to ourselves. If you put in an honest effort, it makes our assumptions and ideas stronger, more reliable. Some people might even publish their ideas so that they can be tested in an environment of peer review. Just putting ideas down on paper forces one to really thing them through. You might even decide to put them into charts and a blog, to force your own performance to a higher standard. Interesting concept.