Considering the AMB and the narrow money figures went parabolic, with the greatest increase in Fed history, these are somewhat unusual words from a Fed official.

Considering the AMB and the narrow money figures went parabolic, with the greatest increase in Fed history, these are somewhat unusual words from a Fed official.

Best to take him at his word. He is only saying the truth about what the Fed is already doing. This sounds like a classic misdirection.

Let's guess. In order to save us he Fed should give more money to the big money center banks through Fed programs? The Fed should buy bad assets at par from unconventional parties like every large corporation with bad debts? The Fed should more aggressively debase the currency and to transfers the wealth of savers of to those who caused this crisis?

This ought to be fun to watch.

Bloomberg

Fed Should Expand Supply of Money, Bullard Says

By Scott Lanman and Anthony Massucci

Feb. 17 (Bloomberg) - Federal Reserve Bank of St. Louis President James Bullard said the U.S. faces a risk of “sustained deflation” and called on the central bank to avert a decline in prices by expanding the money supply.

The prospect of deflation is a “significant downside risk” and may increase home foreclosures, Bullard said in a speech today in New York. Adopting a target “rapid” growth rate for the monetary base, which includes money in circulation and banks’ reserve deposits with the Fed, should “head off any incipient deflationary threat,” he said.

Bullard is one of a few Fed officials to advocate a new policy tool after the Federal Open Market Committee in December cut its main interest rate almost to zero. The central bank is using money-creation authority to put assets such as home loans on its balance sheet, aiming to unfreeze credit and end the longest recession since 1982.

“By expanding the monetary base at an appropriate rate, the FOMC can signal that it intends to avoid the risk of further deflation and the possibility of a deflation trap,” Bullard said in prepared remarks to the New York Association for Business Economics.

He didn’t propose a specific figure for the target.

The FOMC said in its Jan. 28 statement that there’s “some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.”

Growth Target

The FOMC at its December meeting discussed setting a target for growth in measures of money, such as the monetary base. While a “few” policy makers favored a numerical goal for money growth, most preferred a more open-ended “close cooperation and consultation” with the Fed board on how to expand assets and liabilities, according to minutes of the session.

Bullard’s warning about deflation is stronger than comments by other central bank officials. Chicago Fed President Charles Evans said Feb. 11 that he’s “not tremendously concerned about deflation.”

Bullard told reporters after the speech he supports the adoption of an inflation target to prevent expectations for prices from falling too far. A target for inflation “would be helpful at this time,” he said.

“You have to consult with all players, including Congress,” he said. “If they don’t want to do it, then we don’t do it.”

17 February 2009

St. Louis Fed Chief Says Fed Must Inflate Money Supply More Aggressively

Culture Shock - CNBC

For some reason Bloomberg Television lost its signal for an extended period today, and in a moment of desperation CNBC looked like an alternative. CNBC doesn't get watched much here.

For some reason Bloomberg Television lost its signal for an extended period today, and in a moment of desperation CNBC looked like an alternative. CNBC doesn't get watched much here.

CNBC is a 'news channel' in name only. Its like the McLaughlin Group with financial overtones.

Its overseas branch operations are not as bad, with the UK show often being reasonably good.

But this Fort Lee operation is abysmal, an extended infomercial, a puppet show for corporate perspectives without fact based reasoning.

Bloomberg has been reaching new lows in reporting standards, but next to CNBC it looks like pure reason, a Pulitzer Prize operation.

Long Term Dow Chart and Forecasts

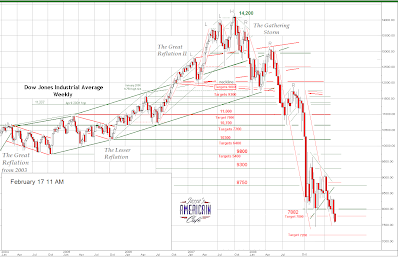

For some time we have had a downside target of 7200 on the Dow based on classic charting measuring objectives.

Here is an update of that chart showing we have broken down out of the symmetrical triangle and appear to be moving lower towards that objective.

Here is a very long term chart of the Dow showing the obvious importance of the 7200 level to the bulls. If that breaks the next support level on this chart will be around 6400. It will confirm the tentative neckline at 10,300 on the chart above.

When charts done from various perspectives and techniques agree, technically it can be a powerful confirmation of their validity.

These lower forecast numbers could be thrown off IF the government manages to start reflating the money supply and stock prices. They will at some point, its just a matter of timing, but it will obviously impact the nominal stock index numbers.

The Dow gold ratio will likely reach at least 2 and possibly less. This implies that at the bottom gold will be $2700. Gold will likely hit significant resistance around 1250-1300 in the short term and correct and consolidate its gains from there depending on how quickly we arrive at that target and the steepness of the slope of the price increase leading up to it.

If the reflation kicks in then all bets for a gold top are off. Silver is a little harder to forecast because of its industrial component. But we think $100/oz. is a slam dunk in the longer term, but anything can happen.

There is no forecast for the DX US Dollar Index because it will become increasingly irrelevant and detached from reality.

This is a longer term view, probably out to 2011, so the number of things that could impact it are many and significant.

Russia and China Sign Oil Deal for the Next Twenty Years

Look for more deals like this to start happening between non-western nations, that do not involve anglo-american companies and exchanges.

The Economic Times

Russia, China sign $25 billion energy deal

17 Feb 2009, 1721 hrs IST, AGENCIES

MOSCOW: Russia and China signed a $25 billion energy deal in Beijing on Tuesday that will see China secure oil supplies from Russia for the next 20 years in return for loans, Russia's state pipeline monopoly Transneft said.

As part of the broad energy supply deal, China will lend $15 billion to Rosneft, Russia's state-owned oil major, and $10 billion to Transneft, a vital boost for energy companies as they struggle to raise capital amid straitened lending conditions and plunging oil prices.

In return, Russia promised to guarantee annual oil supply of 15 million tons (300,000 barrels per day) for 20 years to its energy-hungry neighbor.

Igor Dyomin, Transneft's press spokesman, confirmed the outline of the deal.

The signing ceremony marks an end to months of talks between the neighbors after negotiations broke down amid disagreements over interest rates and state guarantees.

Russian crude will be supplied through a long-delayed pipeline project agreed to late last year. The pipeline, which extends from western Siberia to the Pacific coast, is to be linked to China from the Siberian city of Skovorodino, 70 kilometers (44 miles) north of the Sino-Russian border.