The heart of our financial crisis is reckless speculation with "too big to fail" funds by a relatively small group of US based money center banks.

There is sufficient circumstantial evidence from their concerted lobbying efforts to undo and resist regulation to show planning and forethought in what is an almost amazingly straightforward case of fiduciary and financial fraud. Many a blind eye was turned to the decline of the nation as it occurred, as the media and politicians and financial regulators were caught up in a seductive web of corruption.

The perpetrators are still in place, relatively unrestrained, and certainly not facing anything that might be called 'justice.'

Before there is any recovery, the banks must be once again restrained and balance restored to the economy and the financial system. The efforts of the Obama Administration are hopelessly ineffective, conflicted, and supportive of continuing losses.

The Prime Suspects

The Killing Field

The Wagers on Failure

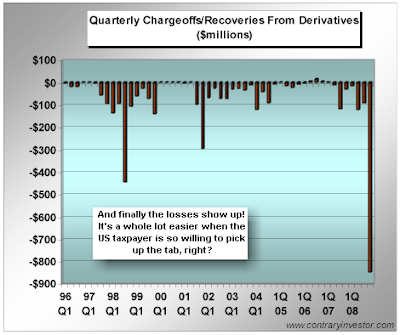

The Wages of Speculation