Orwellian manipulation of government economic statistics, par excellence.

The moving average of the Non-farm Payrolls marked the downturn in the economic expansion with amazing clarity by a steep drop in late 2007. It will also mark the bottom and a sustained upturn when it arrives.

03 April 2009

Non-Farm Payrolls: Revisio ad Absurdum

Pictures From a Monetary Bubble

Credit bubbles are very much like pyramid, or Ponzi, schemes.

The middle class is particularly hard hit as they exchange their remaining real assets in an increasingly corrupted financial system. They are dulled by falling from crisis to crisis. We seem to be at the stage where the wealth transfer from the many to the few has it last parabolic gasp before the collapse.

All turns to ashes, one way or the other, when we abandon our commitment to justice and the truth, with things as they really are.

SP Futures Hourly Chart at 2:30 PM

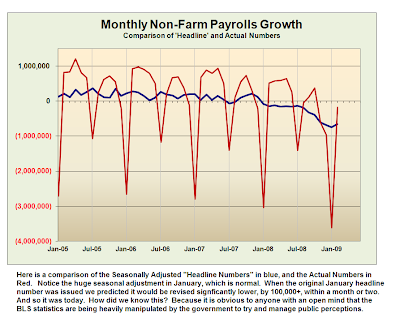

The Jobs Number today was a horror show, not so much for the 'headline number' which is routinely manipulated, but rather in the utterly cynical, almost Orwellian, of the January number down to a breath-taking low.

The Obama Administration did this as part of an effort to spin 'a bottom.'

Is there a V bottom in the making? Is this a legitimate rally in equities?

We don't think it is, at least in terms of the economy. The indicators continue to deteriorate badly.

But we need to be aware of the possibility of an attempt to reflate the asset bubble, and this will show up in equities first, with a possible deflation in the Treasury bubble as hot money moves from relative safety to risk.

Everything about this market, and our economy, is directed by expediency rather than principle, and is therefore short term in its goals and outlook.

Having said all this, the market is overbought and the rally overextended. It may get more overbought and overextended, as we saw in the market 'recovery' of 2004-6 in which the US equity indices were managed up to new highs, even while the rot in the real economy spread, crumbling the foundations of wealth.

It is hard to comment on this market, because the Obama Administration is a profound disappointment, to the extent now that our short term optimism and confidence has dissipated.

If Democrats were trying to create a new Weimar Republic it would be hard to imagine a more sincere and effective effort. The problem is that the shadow of what comes next looms over the world like a dark cloud of misery brought about by the madness of men.

02 April 2009

US Dollar (DX Index) Hourly Chart

Trichet disappointed today by not cutting the Euro interest rates more sharply to match the monetization of the US dollar by the Federal Reserve.

The US dollar hegemon is based on relativism. The monetization of a fiat currency does not matter so much if the most reasonable alternatives are also in decline. It will show up as an inflation in the price of real goods, but these can be managed in a financial services regime in the short term.

Do not confuse what the Fed and the Obama Administration are doing now with any sort of long term plan. Their bias is the same as corporate management: getting through the short term and looking as good as is possible in doing it.

Obama would like to shift to a longer term strategy, but this is difficult given the huge momentum of malinvestment that grips our national economy.