Note: About 30 minutes after I put this up, gold and silver were hit with concentrated selling designed to break the short term price trend in a very obvious bear raid.

You should be used to this by now. It will not change until the financial system is reformed. So do not hold your breath, or get angy or excited, at least as a trader. That is counterproductive. Instead use these pullbacks while the trend is intact.

28 June 2010

Net Asset Value of Certain Precious Metal Funds and Trusts

25 June 2010

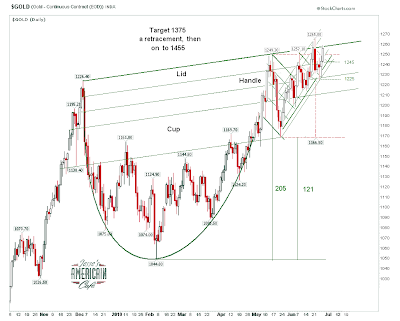

Gold Daily Chart: The Cup and Handle Is Now Fully Formed; Longer Term Projections

As the 'handle' of the cup and handle chart formation formed, it slowly yielded enough points to finally place 'the lid' on the cup and hand, and firmly label the rims.

This allows us to set the minimum measuring objectives. There will probably be a run higher to about 1375, with the usual back and forth noise, after the breakout is achieved with a firm close above 1260 that sticks for a week.

Then we will experience the first major pullback, most likely back down to the 1330 level. And then the market will continue to rally up to the 1455 level.

I cannot furnish time frames for these moves at this time. But I suspect the move to 1375 will be fairly expeditious once the breakout is clearly accomplished.

All forecasts are estimates assuming some 'steady state background conditions. If the fundamental conditions of markets change, then the forecast must change to accommodate that.

As an aside, I can see where some chartists might try to feature the handle of this cup as a bearish rising or ascending wedge. This is a weaker interpretation given the greater substance of the cup and handle. It should also be remembered that bearish wedges only resolve lower about 50-60% of the time, and really are not safe to play until there is a clear breakdown. I have paid dearly to learn that lesson when trading stocks from the bear side.

Gold Weekly Chart

I think we can safely assume that the next 24 months will be extremely interesting.

Here is a very long term gold chart showing the entire inception at the end of the twenty year bear market.

The next leg which we are now entering projects to about 2180 - 2200 before we would expect to see a major protracted pullback.

I do not think that this bull market will be limited to only 'four legs,' which is just a bit of anthropomorphism, but I do strongly suspect that it will continue until about 2020. So we seem to have almost ten more years of upside ahead of us, and could be considered to be at the halfway point.

Gold has been gaining, on average about 70% every three years. So what is the end point?

Just for grins, I would expect gold to hit $6,300 near the end of this steady bull run, but will the bull market will end in a parabolic intra-month spike towards $10,000. This is likely to occur around 2018-2020.

Long term forecasts are fun, but there are so many exogenous variables that it is very hard to say what will happen even a few years out. Let's see how this breakout goes, and where we are at then end of this year first. The charts will inform us of any major trend changes. Charts provide perspective more than prediction.

Why Are the Miners Underperforming The Metal?

Occasionally a reader asks, "Why are the miners lagging the performance of gold?"

My standard reply is that the mining stocks are both stocks and a store and source of the underlying bullion which is the basis of their business.

Past regression analysis which I had done a few years ago indicated that it was about a 50 - 50 split. Over time, an 'average' mining company will correlate roughly 50% to the SP 500 and 50% to the metal which is its predominant business. The lags due to anticipation and expectations are taken care of in the size your sample.

Just to do a quick check, since these things do sometimes change over time, I ran a quick comparison of the GDX Mining Index, GLD as a proxy for gold, and the SP 500.

I think the results since mid 2008 shown below seem to indicate that the miners, on average, are still a rough split between a stock and a store of wealth, with bullion exerting a bit more pull than in the past. This is probably an effect of the underperformance of the financials, and their heavy influence in the SP index. I would caution against using this in place of a genuine regression analysis. But its close enough to make the point that the mining stocks are, to some significant degree, a stock.

Note: Please read what I have said before snapping off a quick comment objecting to it on the basis of the stellar performance of your favorite junior or senior mining company.

I have done very excruciatingly details multivariate regression analysis of the price of bullion itself. and have published the results in the past on my 'old site' the Crossroads Cafe. That correlation does change. Perhaps I will find the time to take out the big spreadsheets and run them again.

Not So Much Deflation as the Decay of Value: SP 500 Futures and Gold Daily Charts Updated at Market Close

Wash and rinse. Best way to get that stubborn money out of the public through fees, commissions, and of course front running for those perfect trading profits at the faux banks.

Chart Updated at Market Close

Now that option expiration is over gold is back to where it was a week ago, trying to break out of its large cup and handle formation. Silver is on the cusp of activating a massive and bullish multi-year chart formation of its own. It is an open question whether gold or silver will lead the way.

But I have to say that the CFTC is a disgrace. Eventually they will clean up their markets, but the foot dragging and dissembling is a mark against them. Chairman Gary Gensler knows better, but he is a Goldman alumnus, so what else would we expect? There are always many frustrated people in every organization trying to do a good job, so we should not paint them all with the same brush. The boss sets the tone, and Gensler's tone seems to be the status quo and crony capitalism. But that is the overall flavor of the Obama economic team.

Chart Updated at Market Close

Most people have a profound misunderstanding about the function that gold, and to a somewhat lesser extent silver, perform in the currency markets and wealth preservation trade.

The meme is that gold is a hedge against inflation. Over the past 100 years or so in particular, the greatest threat to the US dollar, and indeed to most currencies, has been inflation, which is the debasement of the value of a currency through printing or expanding supply faster than real growth in productive economic activity.

But was it really inflation that drove the gold hedge, or something more properly called 'currency risk.' Inflation through expansion of supply is just one facet of currency risk.

The risk today is not a gradual inflation through an overexpansion of the broad money supply, but something insidiously different, not seen since the last Great Depression. It is the risk of the default and devaluation, and the erosion of the assets backing the currency itself, which is not yet showing up in the conventional inflation figures.

What backs the US currency? Often referred to simply as 'the full faith and credit of the government,' it is the ability to collect taxes and service the debt with real returns, and of course and importantly the Fed's and the Treasury's balance sheets. I should have to say no more about this to anyone who has been following recent developments. The erosion of the ability of the government to produce revenue by taxing real income, and the rapidly declining quality of the assets held by the Fed, are obvious. Yes the US dollar may look good when compared some of the other wretched alternatives, but that appearance is like the portrait of Dorian Gray, not capturing the rapid decline in its own worth and well being.

So perhaps this will prove to be some help to those who are expecting debt deterioration and monetary deflation to deliver to them a stronger dollar and stable wealth. They fail to notice that this did NOT happen in the 1930's, and in fact quite the opposite occurred. I am now *hoping* for stagflation as an outcome because it seems better than the alternatives where the US and Europe now appear to be heading.

Yes, it can do so in the short term, particularly if you own the world's reserve currency, and that largely an illusion. But the decay is there for any who care to see it, and the rush to gold by the smarter money is also there to see, for those who will not willfully blind themselves to it.

There is nothing more disheartening than to watch otherwise good people fighting the last war, or perhaps most properly the wrong war, painfully unaware that their tactics and assumptions are misconstrued and self-defeating, and that they are committed to following 'leaders' who are articulate, persuasive, often very loud, and wrong.