skip to main |

skip to sidebar

Futures were very weak overnight, and for the 10,001st time the bulls came in and bought the market back up on light volumes. I took my short profits in the first ten minutes and let the metals run into the last hour and took the miners off as well.

I just *hate* this market action.

Consequently I took almost everything short term off the table today and booked my trading profits. I want to see what comes next. I don't think the market will decline severely yet, but like most traders I have one eye on June and the nominal end of QEII.

After the bell the Freescale IPO priced at the bottom of the range, at $18.

The US has a three day holiday weekend (Memorial Day) coming up.

"Manipulating cash prices for a larger derivative payout is a regular feature in all markets. And $50 million is chump change compared to the billions being made manipulating the markets on almost a daily basis."

Bill King, The King Report

At least according to this update from 24hourgold it is crisis averted for Blythe and her Merry Pranksters, just in time for the May - June deliveries, as 37 million ounces of silver have been added to the dealer inventory at the Comex.

I believe that an addition of this size in one fell swoop, if true, might be called 'unprecedented,' at least since the benefice of Buffett supplied the silver for the newly forming SLV.

Such a huge addition, if true, is certainly worth some examination in what is known to be a tight market for physical supply. This inventory system does seem to move improbably large amounts of 'bullion' around like Tinker to Evers to Chance.

These are the saddest of possible words:

"Tinker to Evers to Chance."

Trio of bear cubs, and fleeter than birds,

Tinker and Evers and Chance.

Ruthlessly pricking our gonfalon bubble,

Making a Giant hit into a double –

Words that are heavy with nothing but trouble:

"Tinker to Evers to Chance."

It might even be just a 'data glitch' at 24hourgold since the public Comex sources do not yet confirm any such addition. (I have highlighted this caveat to prevent the 'I told you so' crowd from embarrassing themselves more than necessary.)

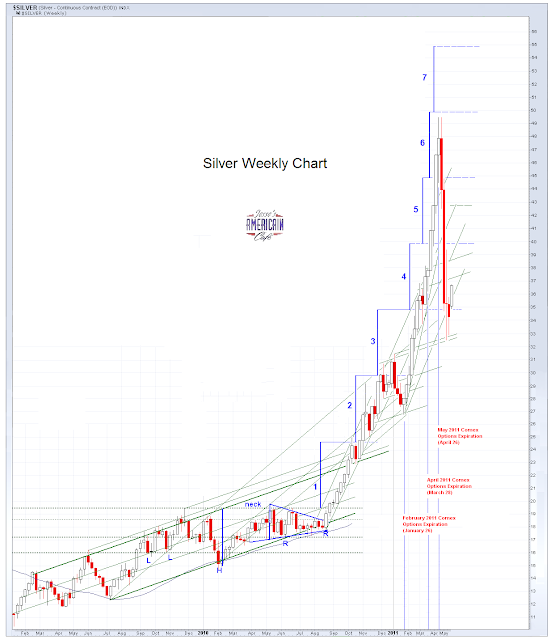

You just have to love these option expiration days in the metals.

I will have to take a look later tonight to see where it may have come from, and if it is even true. Or better yet, I will wait for either Danny Norcini or Harvey Organ to show their findings. Never makes sense to duplicate effort.

Wishful thinking from the bullion bears or real supply, we'll have to wait and see. But no matter how you wish to view it, Blythe, you're called. Let's see what you've got.

"He who sells what isn't his'n,

Must buy it back, or go to prison."

(or obtain a presidential pardon

for services rendered.)

Daniel Drew

Once again the dollar was weak, and metals rallied, while stocks wallowed.

I am once again long metals, short stocks. Options Expiration on the Comex tomorrow. If they cannot bring prices down watch for a secondary bear raid into the weekend. This is how they played the last one.

Of course it is possible that the paper bears will be broken in their attempts to take on the bullion demand, and will be forced to retreat and attempt to defend a higher price level. This has also happened around an expiration.

The US is heading towards a crisis that very few understand, whether out of ignorance or arrogance. I have been a little surprised by this, but it is only to be expected, and is the hallmark of the really 'big events' in which God let's us have our way, if only to teach us that our ways are not His, and bear the taint of death.

"In this world there's room for everyone, and the good earth is rich and can provide for everyone. The way of life can be free and beautiful, but we have lost the way. Greed has poisoned men's souls, has barricaded the world with hate, has goosestepped us into misery and bloodshed."

Charlie Chaplin

They'll never learn, it seems, except the hard way.

This is about the area where the bulls need to obtain traction and take this market higher, or risk losing control of the trend.

I added index shorts on strength today to bring my short term portfolio to a neutral stance, long metals and short stocks.