skip to main |

skip to sidebar

Intra-day commentary was given here regarding the Jobs Report and the Credibility Trap that impedes a genuine recovery. Well, in addition to the rampant fraud that still infects the US financial system.

The long gold-short stocks trade worked again today, and the switch from the financial sector to a short on the broad equity index worked well.

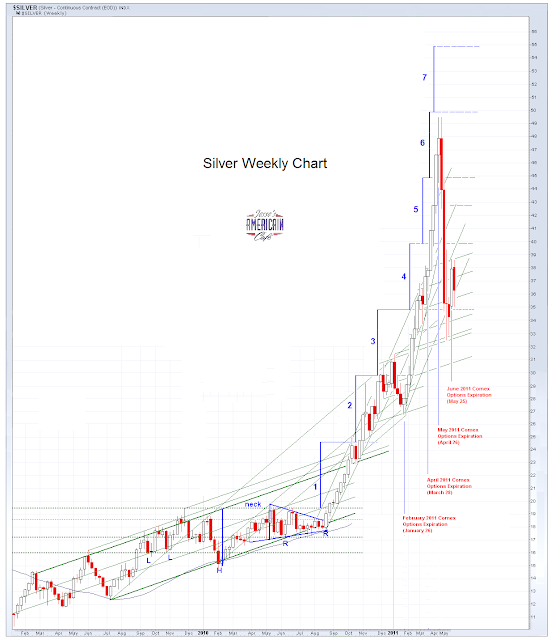

Silver is showing some weakness here based on its industrial component. That at some point will not matter if the Comex really does default on its silver contracts based on a shortage of real bullion.

I thought the dollar weakness today was remarkable especially considering the bid that the bonds caught.

Big things are happening. This sometimes seems like watching a tsunami approaching in slow motion, while most of the people are still playing on the beach, without a clue as to what is coming for them.

"Just as it was in the days of Noah, so also will it be in the days of the Son of Man. People were eating, drinking, marrying and being given in marriage up to the day Noah entered the ark. Then the flood came and destroyed them, sweeping them all away." Luke 17:26-28

A dismal Jobs Report, despite some attempts to paint a happy face on the numbers, brought US equities to another weekly decline and new lows for this short term trend.

This is the target area I had set for a low on the SP 500 futures if this is just a correction and not the start of a new bear trend. So we will see what happens next week.

There were some 'screaming headines' at some blogs this morning about the BLS Birth Death Model, aka the 'imaginary jobs report, reaching some new heights, or lows if you will, of perfidy in misstating jobs growth with a reading of 206,000 imaginary jobs added.

In fact the number was in line if not historically a bit low for a May adjustment. It showed the type of seasonal hiring one might expect for the beginning of summer.

The seasonality factor was also very much in line.

I give the government very little credit on its statistical reporting, and have been a strong critic for many years, and take a back seat on debunking Washingon to no one. But there was nothing particularly unusual in this month's report from a statistical reporting standpoint.

It was bad enough on its own. The recovery has never really gained any organic traction and for reasons that I have cited repeatedly.

I have deseasonalized and backed out the imaginary jobs for each month, and posted what the monthly jobs number would look like without them as shown below. It's a choppy picture even with the seasonality factor to provide some smoothing.

This is why it is advisable to watch a moving nine month average. And I also greatly prefer to watch the changes in median wage, which is probably as much or more important than the actual jobs added. The recovery will not become organic and sustainable until people receive a living wage, able to buy a lifestyle consistent with a democratic republic based on their labor without onerous rents from debt.

This is not economic theory; this is simple common sense. If you want to have a consumer based economy, you cannot debilitate the consumers until they become serfs, because they one has obtained a different form of governance. Unless of course one can persuade the many to love their servitude and think hell a heaven.

The public policy argument revolves around the relationship between the distribution of power, and therefore the accumulation of economic power, as it always does throughout history. That is another matter. I am treating the economic argument and prognosis.

As for employment growth, the longer term 'trend' has not yet turned lower, and seems consistent with a stagflationary outlook. It is obviously in danger of rolling over, but it has not done so just yet.

America had been adding jobs for over twenty years with stagnant wage growth. And this was a result of the partnership between corporate America and the wealthy few with the government policy makers, especially including the Greenspan Federal Reserve. Warren Buffett called it a class war and there is no need to guess which class controls the discussion through the concentration of ownership in the mainstream media. The public cannot even mount a serious reform effort without it being quickly co-opted and used against their interests by a well-heeled propaganda machine.

As Simon Johnson famously observed, there was an economic coup d'etat in the States and it is still having its way with the public and much of the world at large. The financiers have breached the walls, and are sacking and looting the city. Neo-liberalism is little more than a resurgence of the corporatism of the earlier twentieth century, with the jackboots more selectively deployed overseas, at least for now.

And the global reaction against the Anglo-American banking cartel, and their infamous economic hitmen, is the substance of the ongoing currency war, the long standing struggle against colonialism. It is remarkable how with all the change, nothing of substance really changes, at least in regards to human behaviour.

A structural reform of the system is what is required, not short term stimulus or austerity at least for now. And in particular not austerity or more tax cuts for the wealthy which is the hallmark of an intellectually bankrupt theory.

The US economy is severely distorted after years of managerial abuse with an outsized financial sector and a bias towards domestic jobs destruction through an abandonment of long term public policy decisions and investments in favor of short term corporate profits and the public be damned.

And there is no reform because the political administration of the system and those who observe and report on it has been generally captured and corrupted, and is stuck in a credibility trap.

Intraday commentary here: Shenanigans as Moody's Warns on US Rating.

I thought it was rather cute when Adam Johnson of Bloomberg pointed to the weaker price of gold this afternoon as proof that the Moody's warning on US credit rating is no big deal. Perception management at its finest, and most obvious.

At the same time the dollar was rolling over hard, but no one seemed to notice.

Goldman Sachs received a subpoena from the Manhattan DA, and the financial sector was pulling down stocks after yesterday's big sell off.

The equity market is looking for a reason to rally from support here. Groupon has an IPO ready to launch and the Street likes to welcome them in steady markets. Let's see if the Non-Farm Payrolls report gives them anything to cheer tomorrow.

I did take off the Financial Sector short today and yesterday from my own portfolio, and added unleveraged gold and silver holdings on the intraday smackdown today.

I do have an open mind about a meltdown in the US financial markets, but the timing seems a bit early for now, unless there is an exogenous shock.

Let's see what happens.