skip to main |

skip to sidebar

Great drama in Washington. Does anyone recall that there was a budget surplus in Washington not ten years ago? What transpired to change that is unfunded wars on two fronts, and tax cuts for the wealthy to promote growth in support of a trickle down economic theory that is a hoax. And of course the financial crisis from the banking bubble and the decline in employment and associated tax revenues.

The markets are signalling that they do not think the US will default. But as the week progresses, and if nothing changes, look for a possible flash crash to signal to Washington that their apparent nonchalance is misplaced.

They could accidentally stumble over the cliff, and there are some large financial firms and powerful people that would welcome this.

Speaking of tumbling over a cliff, Netflix is getting hammered after the bell on a brief glimpse of reality in their quarterly financial report. I spent years as a product manager, doing all the planning, operations and pricing. When I saw their new pricing proposal I assumed that they were planning on exiting the DVD business for some cost based strategic reason. If this is not the case, someone should lose their job.

If I were ever to give any advice to a leader in troubled times it is this:

"I am a firm believer in the people. If given the truth, they can be depended upon to meet any national crisis. The great point is to bring them the real facts."

Abraham Lincoln

For all his eloquence and presence, Obama is one of the more timid and abstract communicators I have seen. And this makes people suspicious of him. It makes it appear that he has something to hide. Does he even know how to use a visual aid like a chart? He needs to stop being overwhelmed by the spin in his message, and start using it to convey real information and thereby make his case. There are a few intelligent people out there, but he is losing them quickly.

I think this is an interesting discussion and worth a listen.

I agree with quite a bit of it. I could be wrong, but I do not think that the Obama Administration has willfully passed up a few convenient ways to circumvent this debt ceiling impasse, two of which were relatively doable, and the last being a 'little more radical.' I looked into each one and they all appeared to be risky and improbable of success.

Invoking the 14th Amendment to nullify the debt ceiling would undoubtedly provoke a Constitutional challenge by the Republicans. It would go to the Supreme Court and would likely be overruled there after generating considerable uncertainty, given the current makeup of the court. The debt ceiling has been in place for a long time, since 1917 as I recall, and it would not be easily dispensed. I do think it is a bad law, and should be nullified, but by legislation, not by the judiciary and not in a crisis of this sort.

Selectively defaulting on Treasury debt being held by the Fed is also probably a non-starter because the ratings agencies have said that this would be considered a default, and would trigger a CDS event. Selectively defaulting even if the Fed agreed would be a far-reaching event. I did consider some action by the Fed to write off the debt on its own accord, but I don't see that happening as it would appear to be overtly partisan. This is more an artificial political fight than a genuine financial crisis. If you don't understand this, you are not understanding the ebb and flow of the drama.

As for the third alternative, slightly more complex, it involves the Mint creating a falsely valued asset, like a trillion dollar platinum coin, and selling it to the Fed at face value. The Constitutionality of this would also be challenged, as it would be a form of fraud and pure money printing. I think it is much more awkward than having the Fed just buy more Treasury debt in the open market and send the interest back to Washington, ex expenses, which they already do. But that does not help with the debt ceiling.

There is a possibility that Obama could resort to Executive Order after the deficit ceiling deadline passes, but that would be a very clumsy political maneuver. It will be interesting to see if the CDS are triggered, in which case the government may have to nationalise some of the banks. Hardly a desirable outcome.

So I don't see a viable solution in any of these three suggestions, and view them as being clever, without being practical. Just as political people rarely understand the finer points of economics, so the economists rarely understand the finer points of Washington politics.

I hasten to add at this point that Yves is far more knowledgeable in the financial area than I am, and I have the utmost respect for her. She has knowledge and integrity, which are rare commodities to find in combination these days. I do not want this to be viewed as a criticism in general, but it is an important point since some do believe in these alternatives, and they did seem to play into some of her later thinking. Yves has probably forgotten more about finance than I know, and her book is an absolute gem and a must read.

I struggle with the question of Obama's motives, that he always wanted to cut entitlements. I don't agree with this based on what I have seen, although it is difficult to assess someone's motives. I think this theory is weakened because there really is not any 'easy way out' yet shown, and the House Republicans are hardly allies of Obama. In fact, they have shown a determination to make this a political event, and to stretch it out if possible into the 2012 elections.

I cannot imagine that he wants this, and if anything has been bending over backwards to try and avoid it. He is a compromiser, non-confrontational, and although one would like to think that there is a method to his madness, and there may well be, in fact we just don't know what his motives are. I suspected he was positioning the Republicans to take the blame, but the excesses and extortion are their own. Like Clinton, he is trying to force them to eat the consequences of their actions. Hence the exaggerated gestures of compromise to look reasonable. He could be sincere, but since politicians rarely are I would not count on it.

The Republican right and the financiers are indeed looking like extortionists, as they mention in this video, and setting up opportunities to threaten the operational integrity of the country in order to get their way, in support of ideas not accepted by the majority of the people. They can obstruct, they can use the threat of damage, but they cannot win by normal means because they are a minority. But since they are an ideological minority they are willing to use methods not usually considered appropriate, and that are dangerous and potentially destructive.

This debt ceiling 'crisis' is not an aberration but a recognizable modus operandi from the new Right's playbook, cutting taxes for the wealthy, and then declaring a financial crisis, and seeking to gut social and popular policies and laws and organizations which the monied interests oppose. It is using crisis to circumvent the political process. This is being done at the state level in Wisconsin and New Jersey, for example.

I was involved with politics on the periphery, and did some work in Washington years ago. I don't have any inside knowledge or insights anymore, but I like to think I am seasoned enough to figure out what is going on. And I don't think it is honorable or in the best interests of the country.

The apparent lack of a viable debt deal sent stocks dropping and gold soaring in Sunday evening NY trade.

Gold needs to break out from here, or risk a correction back down to support. The reverse is the story for broad equities.

Notice how the SP futures dropped right down to key support at 1322, to mark it firmly. While stocks remain above the 1320 level, Wall Street does not seriously believe that a budget impasse will prevail.

If stocks break down below 1300 we could be in for a Nantucket sleigh ride on the world market. And below 1290 it might be time to head for the exits.

I thought all along that the teenage drama queens in Washington would take this into last minute sturm and drang to impress their constituents that they are major players with serious concerns and must be appreciated.

The financiers like to create crises when they wish to get their way. It is always a mistake to give in, since it just encourages them for the future.

As a reminder it is Comex option expiry this week.

It is said that during the Roman Triumph, in which a great hero was recognized by a procession through the city, generally for a military victory, a slave was positioned behind them, whispering in their ear:

"Memento mori," roughly speaking 'Remember that thou art a man.'

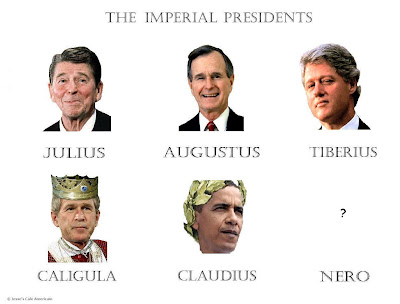

As you may recall, Rome had become a Republic, after the overthrow of its monarchy, and enjoyed a period of Hellenistic influence, both in science and philosophy.

In its decline into the reign of the imperial, god-like emperors and their increasingly idiot and sociopathic successors and sons, the elite became utterly distinct from the people by self-decree. 'They would become as gods' is a hallmark of an empire on the road to decline and decay, repeatedly endlessly through history. It is the logical end of the will to power, in which none will be served but oneself, with power as an obsessive distortion of self-preservation and ego.

Death is the great leveler, and the balancer of the scales of fortune.

Perhaps a member of the middle class can whisper this to the financiers and the politicians, those newly made masters of the universe, as they bask in their moments of power and triumph, and forget their commonality with the people.

Better to have someone whisper in your ear, than succumb to the excess of self-delusion and have the crowd cut it off with your head. But madness has no discourse with logic.

Roman Art: Memento mori, a philosophical theme the Hellenistic period, an allegory of death that has rebalanced and weighs the same as all people regardless of their wealth and social status, with symbols of Life and Death.

Mosaic from Pompeii. 2nd style. Sun 47×41 cm Museo Archeologico Nazionale, Naples