skip to main |

skip to sidebar

Big Sell Off today in US markets as cash was being raised over renewed fears of a Euro-meltdown and a US recession.

The long gold - short stocks trade provided balance into this correction, but as of today the stock shorts are gone.

Let's see if the short term trends have bottomed. Unless this is the big one Elizabeth, I think they just might be.

If you are not in it, wait for it. But it is coming, like a freight train.

A selloff. Oh my what a surprise! Yo Blythe, these moves in the metals in front of options expiration are getting way too obvious, and even a bit old.

You will top Kweku Adoboli's $2 billion loss at this rate.

Big drop in the US stock market on European jitters and recession fears.

Markets are starting to look for support here, with biggest tell in the NDX. Let see how that develops.

Potential 'island top' in the Vix.

Then again, things could continue to deteriorate. But the probability is that unless we are going to hell in a handbasket, the wiseguys are already starting to buy back in.

The Fed did what was expected, announcing Operation Twist which will buy Treasuries in the 6 to 30 year range to pull down rates. They will also continue to roll over their balance sheet assets.

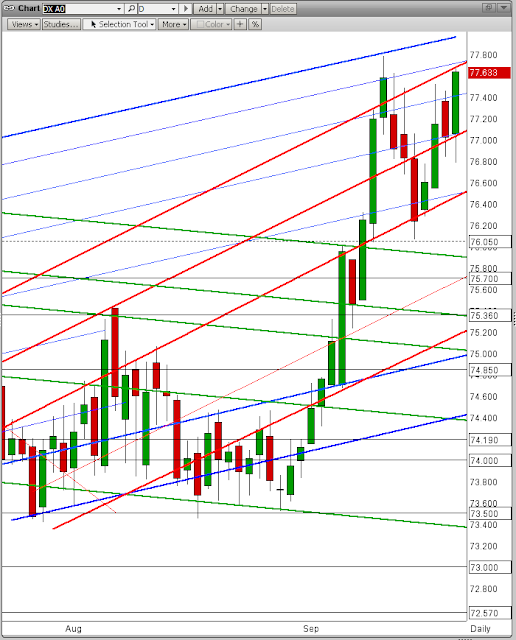

The unexpected perhaps was the strong language in describing the economy in terms of 'significant downside risk.' This language, coupled with the bank downgrades in Italy and the US, had trading flying to buy Treasuries and sell stocks.

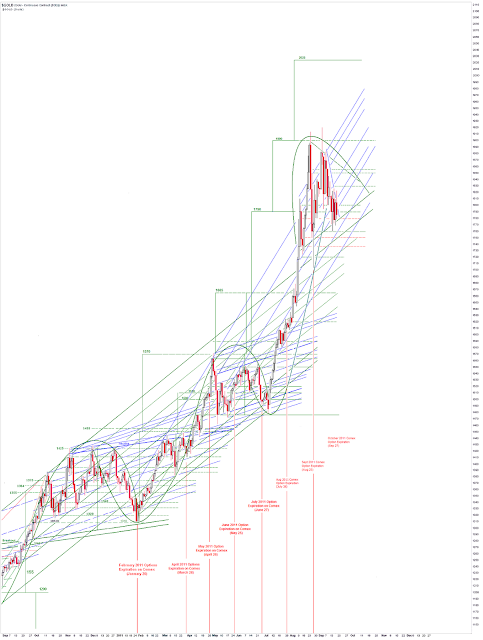

Gold and silver retreated off their highs and closed lower for the day, perhaps on the stronger dollar which rallied as additional capital fled Europe and emerging markets. So we had no resolution of this chart pattern, how disappointing was that!

Typically the day after the Fed takes a policy action, if the stock market sells off it rallies the next day. Let's see if that pattern holds.

I think the support gold has here is important, and many have cited the strong physical buying support that gold is finding in the 1700's.

Option expiration next week, and so no peace for the metals bulls perhaps.

JPM stages major bear raid, encounters determined resistance. Bravo Masters, shall we dance?

Stocks sold off sharply and went out on their lows as the Fed did exactly was was expected, no more no less, but went on to cite 'significant downside risks.'

Given the downgrades of US and Italian banks this was too much for trader's to take, and there was a flight into the dollar and Treasuries, the latter at least in part as a reaction to Operation Twist which will be buying in the 6 to 30 year Treasuries.

It will not surprise me to see a rally tomorrow, grinding higher perhaps after a weak open, and gaining momentum after the European close. Or perhaps I am just being too cynical. So let's see what happens.