Although it is slightly less visible to those who only look at US equity markets, there is a liquidation sell off in the world markets especially Europe. This is helping to steepen the correction in the metals markets.

Notice from this chart that the gold/silver ratio is back over 50 again. And so I have become interested in silver again today for my short term interests.

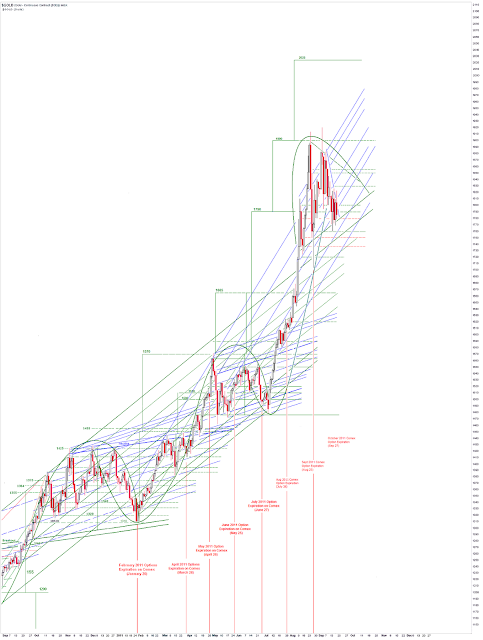

It is important to keep this retracement in context, as alarming as it might be even for those who hold positions for the long term but watch their portfolios in the short term.

Comex expiration is next week. This is always an occasion for mischief, and I think the metals were hit particularly hard because of the delivery situation shaping up on Comex.

But the key driver is the European selloff and the search for liquidity amongst traders and funds. So if you wish an indicator of the future watch how that situation develops.

Once the short term players have raised their cash, the selling will abate and reverse, even if the situation does not remarkably improve. That is how markets work in their different time frames. Treasuries are getting bought to insanity as investors seek to flee European related risk.

And this is why I have two sets of portfolios: short term and long term. And I use two very different sets of strategies and tactics in them. And truth be told, despite some amazing ups and downs in the short term, I make most of my lasting gains in the long term portfolio where I sit and wait on the fundamental trends.

So I have to ask, 'is the gold bull market over?' And so I have added the second chart which shows the market in a longer term context. So far we have had a fairly typical Fibonacci retracement, and the longer term trend lines are intact.

If Europe 'collapses' then we might see a greater selloff similar to that of the Lehman moment in the US. Will Europe collapse in a liquidity panic even deeper than we have seen thus far? I cannot forecast the unknowable, except to say that it is possible, but not probable unless the currency war intensifies and both North America and Asia begin to beat the Europeans while they are down. And if Europe falters, then the UK is next, and then Asia. The financiers have no loyalties, but they need the US dollar at least for now.

Talk is cheap. Europe has to find itself, and decide to DO something. This is one of the darkest hours in their ongoing identity crisis. And the financial wolf packs are taking advantage of their indecision.