skip to main |

skip to sidebar

The propaganda coming out of the mainstream media is reaching a crescendo. And the carnies on the financial networks are getting so obvious and clumsy it is almost funny, like watching a bad magic show.

Next week will be lightly traded in the States because of the Thursday national holiday.

If the specs start piling on in the metals they will likely get another 'gut check' or two in the off hours because that is often how these things go in dysfunctional markets as are common in New York and London these days.

The physical markets opening in Asia and Russia are going to turn NY and London into the carnival sideshows that they deserve to be.

I would like to see gold take out its 50 Day Moving Average. That is a technical signal that could spark a rather robust reversal.

Someone may be getting set up to take a beating a little later this year. But let's not get ahead of ourselves. The lack of transparency in the markets makes good forecasting difficult. The use of offshore entities, trading gimmicks, and shell companies by some of the big financials is a serious problem.

And the second quarter is finally over.

Stocks extended their rally in a choppy trade for much of the day but then slumped into the close as traders took profits and squared up ahead of a holiday shortened week.

As a reminder there will be no trading in the US on Thursday, 4 July, and the volume on Wednesday and Friday is likely to be rather light. So I think we will see a lot of 'technical trading' unless something happens.

I do think these markets have been so corrupted by gimmicks that they have become virtually dysfunctional to the real economy.

Have a pleasant weekend.

Premiums are still quite weak, but the snapback in silver is a classic.

The Gold/Silver ratio is still high but nowhere near the 66 it was hitting.

This has been a market operation brought to you by your financial sector.

And there will be repercussions and consequences in the real world for what they have done.

There is no free lunch, even in control frauds.

Are you truly a den of vipers and thieves? Give the gold you have taken back to the German people to whom it rightfully belongs.

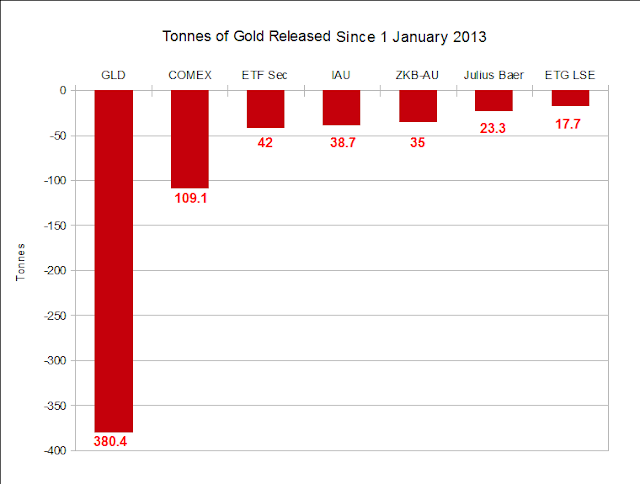

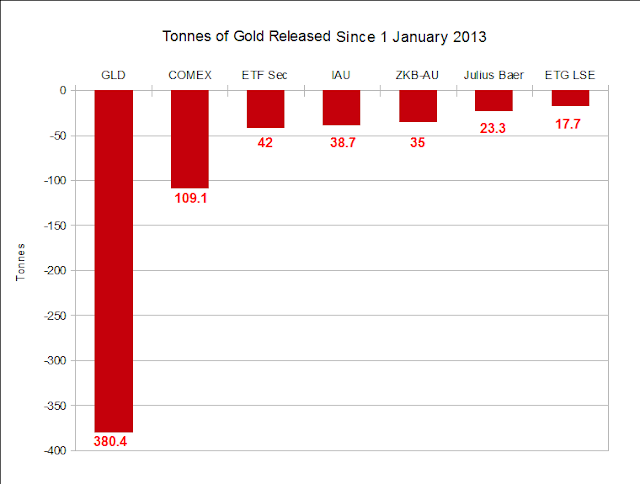

Considering the theory that the purpose of this market operation was designed to take the price of gold lower since the first of the year, and to free up bullion to relieve certain stresses in delivery, I was wondering if we could quantify the results of it in any way.

With the help of Nick at Sharelynx.com, the keeper of records and master of charts, I was able to calculate the approximate number of tonnes of inventory that were released into the market, or some private storage area perhaps, from the top funds and exchanges in the western world. The time period is from the beginning of this year through 26 June.

If this is correct, and the hypothesis is correct, then it is 'mission accomplished.'

There should be no excuses for not delivering Germany's gold. And plenty of other bullion has been made available to solve those other pesky failures to deliver that seemed to be cropping up.

So one may presume that the bullion is in the mail to its rightful owners, in care of the Herr Weidmann at the Deutsche Bundesbank. The NY Fed sends its special regards. Ich liebe dich.

Unless of course it has been rehypothecated to those barbarian buyers in Asia and the Mideast, yet again.

C'est la guerre des monnaies. Quelle dommage!

I have also included Nick's personal wave count for gold and silver, although I am not an adherent to the waves theory per se. And his long term confidence range for the gold bull market.

The stars seem to be aligning, with perhaps a few more antics and end of quarter shenanigans. But boys will be boys, and they can't keep their hands off their toys. So who can say what will happen next. How about another round of bailouts?