One of the more significant things that I have seen so far this year is independent confirmation from a credible source that there is price rigging in the silver markets, and that this knowledge is being suppressed by the mainstream media in the US.

You can read about that here.

I think the fact, given all the rigging scandals from Madoff to LIBOR, that there are major mainstream publications which will refuse to run an article showing evidence of rigging in the silver markets from a credible source is probably as profound as the report itself might be. They know what is happening, and they are afraid.

So what does this imply.

It implies that powerful financial interests are engaged in an attempt to manipulate the value of certain precious metals to artificial targets. They frequently do this with certain things we know.

Dollars and bonds are amenable to this sort of financial engineering, because the financiers are able to create enormous amounts of money using their balance sheets, and with it buy bonds and other financial paper. So they can raise and lower interest rates and other benchmarks at will provided that they can do it in secret and with plausible deniability.

They can rig LIBOR, and the ISDAFix, and any number of benchmarks, because these are creatures of their system, without a hard reference or a firm anchor to anything in the real world. LIBOR and the amount of money they have in their vaults can be almost whatever they wish them to be, as long as the people believe.

Their nemesis, however, is when they foolishly tie themselves to something external, something that is beyond their system. Their error is when they overreach, and try to extend the mythology of their price fixing to things that are not completely under their control for any longer period of time.

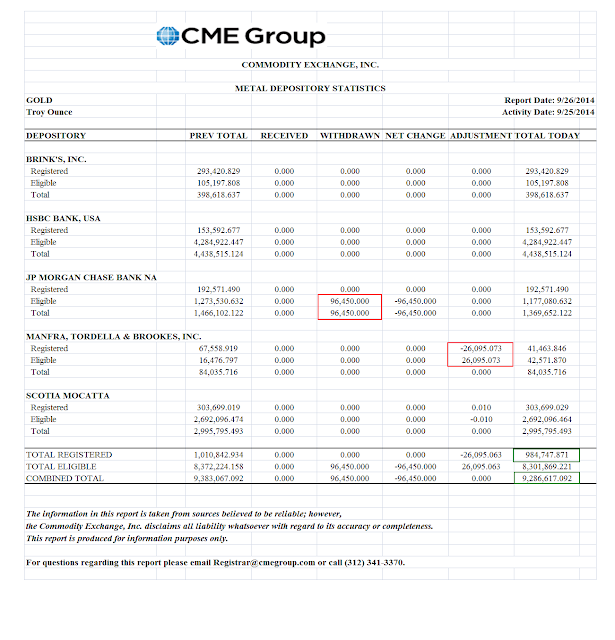

Gold and silver are two such things. Yes, they can engage in all sort of gimmickry on their own exchanges where they make the rules and keep the records. Paper and paper money can symbolically represent precious metals both in quantity and value. Tonnes of imaginary and hypothecated ounces of bullion may be traded all day long, but without requiring a single physical ounce of gold or silver having to change hands. The pricing has been divorced from the constraints of supply and demand. As always, the devil is in the leverage.

Longer term of course there will be effects, very powerful effects. The amount of actual gold and silver that is represented by their paper continues to dwindle, increasing leverage. Physical bullion will flee their system, as it is doing already. That which is unmined will be left in the ground. This is Gresham's Law in action. The 'bad money' will drive out the good.

And they are foolish! There is no real civic need for them to have done this. What does it matter if gold and silver are priced at 1200$ or 3200$ as long as the price increase is orderly and not a panic? All sound economic theory suggests that as the price of gold and silver increase, economic activity will increase to make more supply available. People might choose it as a store of value, or not. It has its advantages and disadvantages, depending on the context of its environment.

You can say that this would cast doubts on the value of the financiers paper, but again, not in any practical sense as long as supply of metal was not constrained and the supply of money was not expanded recklessly without reference to the productive economy. Even Greenspan admitted this.

By aggressively seeking to manage the price of the metals, by continuing to press their leverage and their perceived successes, the Banks have created a façade and blindly run to the precipice of an inevitable reckoning, as the London Gold Pool had done in the early 1970's.

The BRICS see this hubris, like the traders who saw the folly of attempting to hold the British Pound to an untenable valuation. And they will continue to keep pounding the Banks' positions with their trades, accumulating more and more of their physical metals, until the trade is unwound, or a failure comes to stand and deliver.

This is what I think is happening. I do not think a serious market failure is inevitable. But a better outcome would require a level of humility, wisdom, and self-awareness of which our ruling class may longer capable.

Wall Street has become maddened with greed. And by stifling all criticism and dissent, their enablers have only enabled them to go further and further, until the point of no return is reached.

We observers are almost like Harry Markopolos, who wrote of his frustration in Madoff: No One Would Listen. We are like those who warned of the growing housing bubble, and took steps to protect ourselves from it.

We only need to abide, and if we can abide, then we will prevail. Their schemes will eventually fail And in that failure there is both risk, and opportunity.

Have a pleasant weekend.