"The commercial world is very frequently put into confusion by the bankruptcy of merchants that assumed the splendour of wealth, only to obtain the privilege of trading with the stock of other men, and of contracting debts which nothing but lucky casualties could enable them to pay; till after having supported their appearance a while by tumultuary magnificence of boundless traffic, they sink at once, and drag down into poverty those whom their equipages had induced to trust them."Samuel Johnson, Rambler #189, January 7, 1752

It is a good thing that modern economics has proven, through a series of unstated and wildly unnatural assumptions, that these things as described by Samuel Johnson above cannot happen anymore, the gods of the market being selfless and possessed of perfectly rational self-interest, supported by their higher intellects and superior character.

Dr. Johnson might respond, as he did when considering Bishop Berkley's 'ingenious sophistry to prove the nonexistence of matter,' by stepping outside and kicking a stone quite soundly saying, 'I refute it thus!' Or in this case, instead of a stone, he might choose to plant one on the posterior of some smarmy white collar business cheat, whose hands are filled with other people's money, and refute such nonsense once again.

It is almost comical to see a short lived ball of dust gather itself up, and throw a puffball of a proclamation of its superiority into the vastness of the universe. The lack of self awareness of the self-obsessed is amazing.

Speaking of immaterial and manufactured nonsense, there is quite a bit of it swirling around the precious metals this week. Commentators are inventing strawmen arguments that, as far as I can tell, never existed. One such example is the assertion that precious metals crowd held a consensus that the passage of the Swiss referendum was a sure thing. And then these fellows use that canard to mock the metals crowd gullibility, as a sure sign of their deficiency of both intelligence and character.

As I responded to several correspondents today, it really doesn't matter anymore. There are some enormous changes underway in the world. Whether a few individuals think one thing or not, whether we can truly understand what will happen or not, is a moot point. What is going to happen will happen now, whether some puffed up Wall Street curb crawlers think so or not, or some blogosphere click generators post screaming headlines of an imminent price spike to incredible levels, every other day.

There was intraday commentary called Princes of the Yen, which provides some interesting information on the growth of the Japanese real estate bubble, as well as the bubbles we are now currently enjoying in the West. I strongly recommend that you watch it.

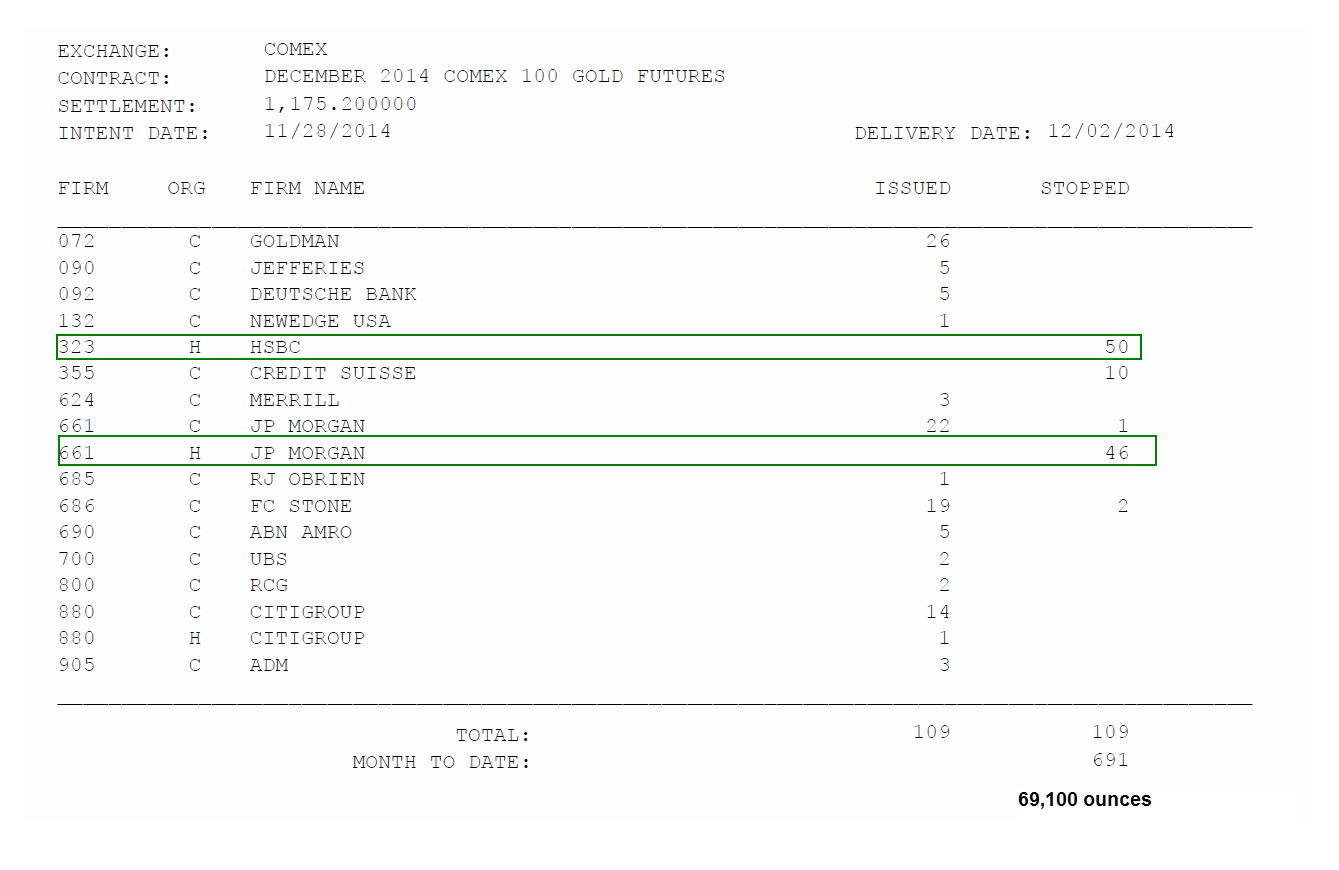

There are some interesting things happening in the Comex warehouses this month. I have included the usual reports below, with an observation about gold in particular, and its concentration in two warehouses. Silver is a bit different, but it always puzzles and fascinated me. When the going for the metals gets rough, silver gets weird.

With regard to the future course of events, I think the die has been cast. This is a currency war, and a time of great historical and political change. So as in all such cases, we are in the hands of fortune now. What is coming will come when it has a mind for it. But the time seems ripe for such a change.

We must wait then, and be watchful. We must be still, and know, that we are not God. Great events occur, in both history and nature, to remind us so. The insubstantial vanity of our pretensions is made all the more hollow by the intensity with which we embrace them.

Men make plans, sacrificing everything around them to raise a mighty empire, designed to last for a thousand years, and the universe laughs. Life is hidden in the little things, and it alone endures. So do not squander your true fortune in the pursuit of shadows and illusions.

Have a pleasant evening.