Well, here we are again.

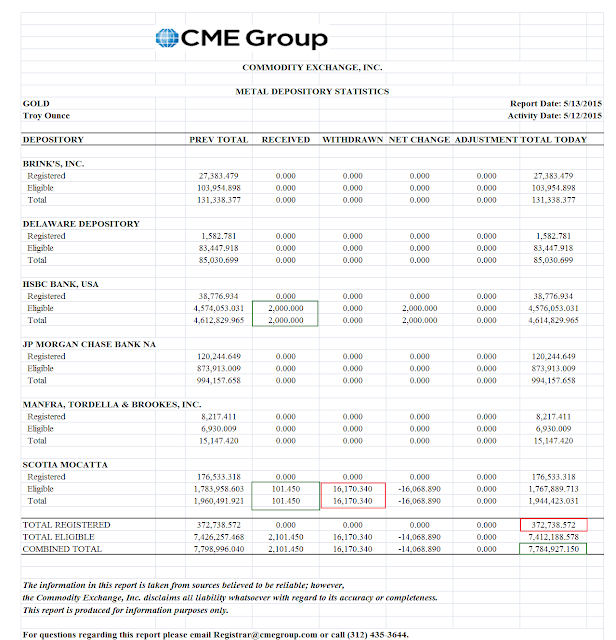

As you may have noticed from my postings of the Comex Warehouse Gold inventories, lately there has been a significant drop in the level of 'registered' or deliverable gold held there. And since the open interest or number of contract held by punters and investors is not dropping commensurately, the number of claims per deliverable ounce has risen. Quite a bit actually.

As a snarky observer pointed out, somewhat presumptuously I thought, there is quite a bit of other gold stored in these warehouses. It is called 'eligible' gold meaning that it is in the proper format for Comex trading.

But, I retort, that which is not marked registered is not available for delivery at these prices, unless the owners change their minds. Or the Comex starts confiscating private gold in storage. And I sincerely doubt they follow the MF Global method of customer metals inventory management. Although no on has yet to pay the price for that one.

Then again, ownership is a flexible concept in The Grift, which is what the US financial system has become. And the exchanges are its Bucket Shops.

This can very well resolve itself neatly as it did last time, especially if a friendly possessor of physical gold, let's say a bullion bank or an official non-profit seeking agency like the IMF or the odd money printing central bank decided to lease or deliver some of their physical holdings into the market without regard to price and profit.

Then again, the players might decide to just roll over their contracts and claim checks and just keep the game rolling, taking the rigging skim from related markets and the vig. This is perfectly acceptable behavior for The Bucket Shop. It seems to be the new thing for stocks and even bonds as well. Its a derivative universe.

Or, God forbid, the price of gold could rise to increase the available supply. But that is very retro economics, certainly not modern, and so yesterday.

Musical chairs with only a limited number of seats is not a problem, if the music never stops and no one tries to sit down. It's all just a game in The Grift. And if they ever go cashless and purely electronic, it will be a brave new world of modern money. Whoops, another bailout, and there went half your savings! You won't even have to play to pay.

So let's see what tune the carnival plays on this go round. And a pleasant time is guaranteed for few, just a few.

These charts are from Nick Laird at sharelynx.com.