The Clintons turned the Democrats into the Republicans, while the Republicans were turning into a mob.

Do not be a partisan for either party. Be a partisan for justice. Be committed to fairness, transparency, liberty, and the truth.

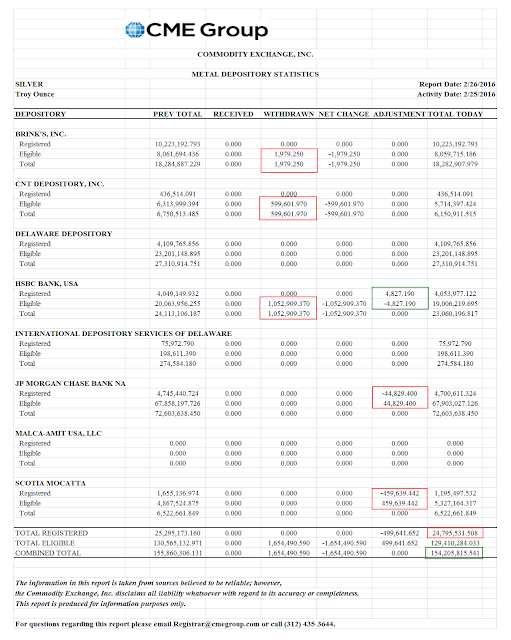

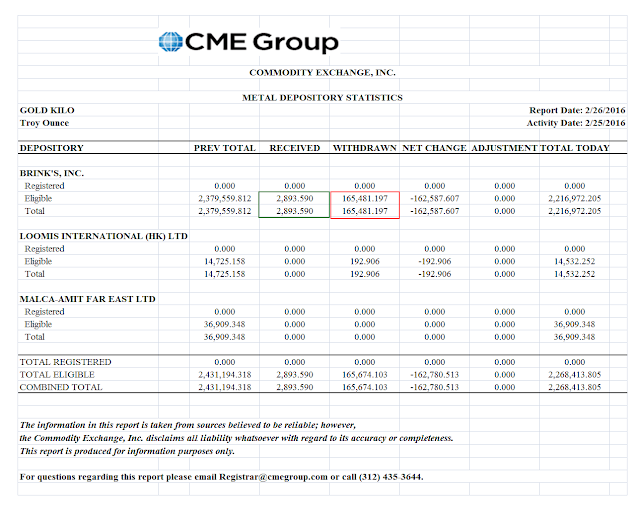

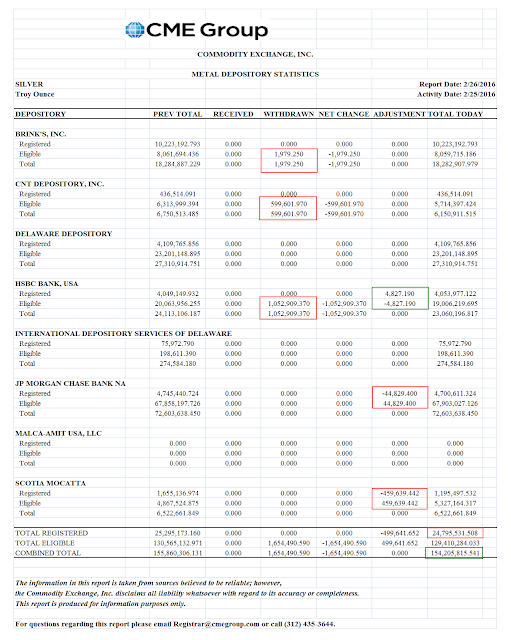

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

The Clintons and Wall Street: 24 Years of Enriching Each Other

by Richard W. Behan

February 26, 2016

For twenty four years the Clintons have orchestrated a conjugal relationship with Wall Street, to the immense financial benefit of both parties. They have accepted from the New York banks $68.72 million in campaign contributions for their six political races, and $8.85 million more in speaking fees. The banks have earned hundreds of billions of dollars in practices that were once prohibited—until the Clinton Administration legalized them.

The extraordinary ambition displayed in the careers of Bill and Hillary Clinton defies description. They have spent much of their adult lives soliciting money from others for their own benefit...

Hillary Clinton’s net worth is forty five million dollars; Bill Clinton’s is eighty million. Measured by family wealth, this puts the couple in the top 1% of American households by a factor of 16. (and they claim to have left the White House 'broke')

The Clintons’ ambition is reinforced by arrogance. Their behavior in the Monica Lewinsky affair is only the most glaring example. Sexual frivolities while holding office are scarcely unusual, having spiced the lives of public figures for centuries, but if the dalliance is exposed, the scarlet official typically resigns in shame and scuttles into obscurity...

That performance pales, however, compared to the Clintons’ self-serving transformation of the Democratic Party, from the champion of working people to the lapdog of Wall Street—and of corporate America in general. Cleverly the Clintons still pander to the traditional constituency, but in serving its new clientele the transformed party abandoned the less fortunate strata of American society, especially the communities of color...

Read the entire article at Counterpunch here.