"The real problem with our financial system is that our economic and political system work together to encourage excessive risk, and this risk in turn leads to cycles of prosperity and collapse. In 1998, a much smaller Lehman Brothers was placed in financial peril by the aftermath of the Asian financial crisis and failure of Long Term Capital Management, a major hedge fund. The Federal Reserve responded by lowering interest rates and other central banks followed suit. This reduced the cost of obtaining funds, effectively bailing out Lehman and other institutions in trouble.

As markets have grown to recognize how quick the Federal Reserve is to bail out institutions (and executives) in trouble, they naturally respond. In the 1990s, people talked about the “Greenspan Put” a term which derisively suggests that it is always safe to invest in risky assets, because the Federal Reserve is ready to bail out investors (a put is effectively a promise to buy an asset at a fixed price if you are unable to sell it to someone else at a higher price – this is a way to lock-in profits or limit losses on investments). However, in months following the collapse of Lehman, we learned that the “Bernanke Put” is even more valuable since Chairman Bernanke, alongside the Bank of England, the European Central Bank, and central banks in much of the rest of the world, is prepared to take drastic measures to prevent asset prices from falling when there are risks of global collapse."

Simon Johnson and Peter Boone, Economic Donkeys

"I have marked my estimates of the quality of the bounce by levels it achieves. Given that this market is running on hot money and adrenaline, I would not tend to underestimate it."

Jesse, yesterday

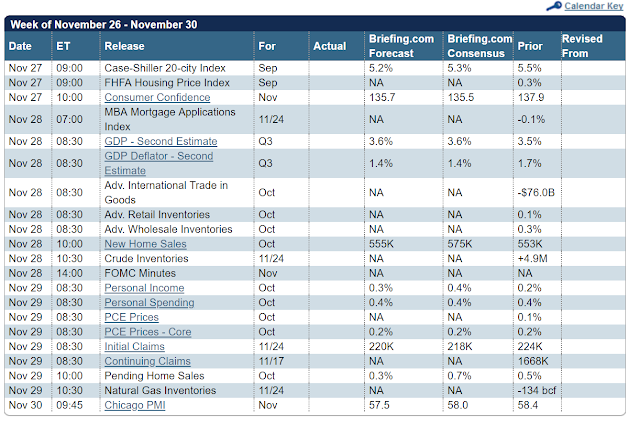

Fed Chair Jay Powell gave the markets a fresh whiff of hot money in his statement today, which was widely interpreted as a dovish 'walking back' of the statement from October 3.

And the markets huffed up that blast of fresh bubble brew and took off to the upside.

Stocks were up sharply, bond yields fell, gold got a big reversal the day after option expiry, and the Dollar took a dive.

Not that the real world matters but it was interesting that a huge chunk of the physical gold inventory in the Comex Hong Kong warehouses took a hike last night. 296,000 troy ounces is about twice the gold that is ready for delivery at these prices in New York.

As you can see from the charts below, the stock futures went through the first two retracement levels pretty handily.

It should be noted that they were stalling around the first retracement target until Chairman Jay spoke around noon.

I found it to be interesting that despite the massive and relentless bear market squeeze, which took off and never once seemed to hesitate, the VIX did not drop by a commensurate amount.

Was this a 'set piece', a contrivance of some sort? A systemic entitlement for the insiders and financiers, another easy score for the informed among so many? No way to tell.

We'll just have to sit in the shadow of these dark markets, and see where it all goes next.

I did notice that the spokesmodels on bubblevision used the terms 'Fed Put' and 'Powell Put' about eighty times this afternoon.

I got a chuckle when one said 'Why not buy APPL if the Fed is protecting it?'

You just can't make this stuff up. We have learned nothing, absolutely nothing, over the past twenty years. And it just gets worse, each time that we allow this, and forget.

And why should things change, when the current scheme of things pays off so well for a few?

Let's see where we go next.

Have a pleasant evening.