“Man has places in his heart which do not yet exist— and into them enters suffering, in order that they may have life.”

Léon Bloy

"Yes, we shall be in chains, and there will be no freedom, but then from our great sorrow we shall rise again to joy, without which man cannot live nor God exist, for God gives joy: it's His privilege— a grand one. Ah, man should be dissolved in prayer! What should I be there, underground without God? If they drive God from the earth, we shall shelter Him underground."

Fyodor Dostoevsky, The Brothers Karamazov

"The days are coming, said Almighty God,

when I will send a famine throughout the land.

Not a famine of bread, or a thirst for water,

But of hearing of the words of the Lord."

Amos 8:11

“Go straight for souls, and go for the worst.”

William Booth, founder of The Salvation Army

Booth ought to have established his missions not only amongst the poor and the wretched in their East end slums, in material misery and deprivations, but in the drawing rooms of Mayfair, and the counting rooms of the City of London.

Among those fine and gleaming tombs is where one will find the very worst, the souls most lost, the hollow dead who think that they are in control, the most alive and shining forth, while wandering damned in blindness.

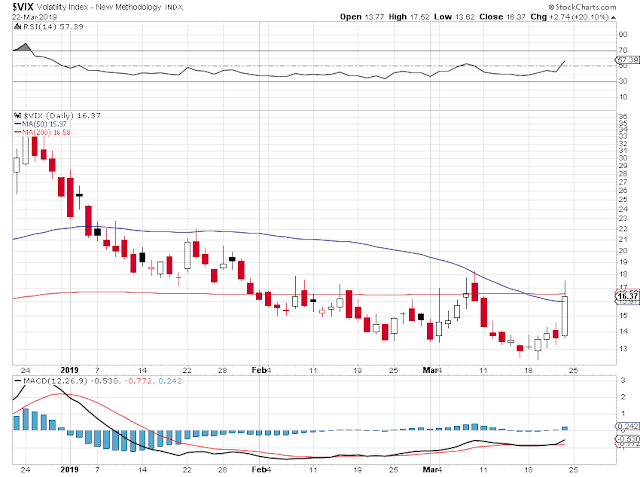

Stocks were swooning by mid-day, but managed to take back some of those losses into the close.

This is not constructive action for the bulls.

Gold and silver lost a bit of luster as the Dollar moved a bit higher.

Yesterday was an option expiration for silver on the Crimex. And there will be another minor expiration tomorrow for gold.

And if, in the end, no one else will listen, I will play my song for those most innocent of souls, for dogs and cats, and passersby.

Have a pleasant evening.