"It is not possible to found a lasting power upon injustice, perjury, and treachery. These may, perhaps, succeed at first, and limp along on hope for awhile with a flourishing appearance. But time betrays their weakness, and they eventually fall into ruin of their own designs."

Demosthenes

"Monetary and regulatory policy encourage asset bubbles to proliferate. Hot money seeks out the conscious mispricing of risk. Capital, in the form of both money and personal talent, increasingly flows into malinvestment and the gaming of markets. The productive economy languishes, left wanting for the lack of creative resources and attention. The bubble rises to unsustainable valuations— and fails, and a nation's capital is consumed."

Jesse 5 August 2019, The Men Who Sold the World

"This is going to end badly. Big changes are coming. What has been hidden will be revealed. Rough seas ahead, mateys."

Jesse, 22 January 2020, I See It Coming

"It is precisely this — high-powered computers and the swagger of those who operate them — that is causing worries over high-frequency trading’s increasing sway. 'The markets used to be about capital formation,' said Mr. Quast, the consultant. 'Now 80 percent of trading is driven by some form of statistical arbitrage. We are buying into a statistical house of cards that could unravel very quickly.'”

Landon Thomas, Inquiry Stokes Concern over Trading Firms that Shape Markets, 3 September 2009

“They were careless people, Tom and Daisy — they smashed up things and creatures and then retreated back into their money or their vast carelessness, or whatever it was that kept them together, and let other people clean up the mess they had made.”

F. Scott Fitzgerald, The Great Gatsby

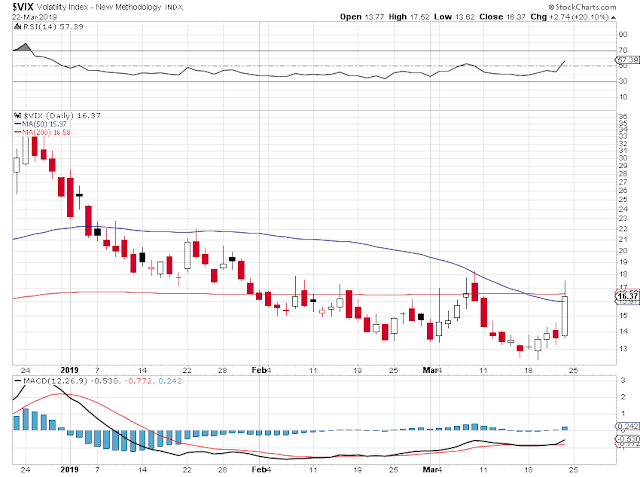

Stocks were utterly hammered today, with the stock futures going out on the lows, and continuing to fall in selling after the bell.

Let's see, are we going to blame Bernie or the Deep State or CNN today?

Or maybe just the Fed.

The Fed certainly is culpable to a degree, again, because they went all in for not-QE in the 4th quarter, bending to pressure from the White House and the Banks, mostly the Banks.

And after the last crash the Fed held up their hand and kept volunteering for more and more regulatory responsibility.

They and their cronies and paymasters put the cherry on the top of this bubble. Until it was just a matter of what trigger event was going to set it off.

Despite the spin and narratives, the financial system, like the rest of the economy, was interconnected, over-extended, poorly regulated, and fragile.

And the coronavirus is a big cherry on top, despite the self-serving happy talk being put out about it by the usual suspects in politics and the media.

And who could have seen it coming?

Not you, if you get your news from conmen and spokesmodels for the oligarchy.

We are very oversold here for the short term. And a bounce, like the ones that they attempted to provoke the last couple of mornings, is possible. And it might finally stick for a day.

Let's see if the Fed and Treasury step in and tries to save this bubble. I am sure Trumpolini has Mnuchin and Kudlow on the job.

The longer term damage to the nation is going to tax the future for the working public.

The Dollar finished lower. Silver was off a bit.

Gold was off $3 per ounce today. Gold, unleveraged is a safe haven.

Things are going to be getting very real this year, even as some continue to deny reality, to an almost astonishing degree of self-absorption and denial.

What is it going to take?

Have a pleasant evening.