21 September 2019

20 September 2019

Stocks and Precious Metals Charts - Risk Off On the Quad Witch - Oligarchy Follies

“When Fascism came into power, most people were unprepared, both theoretically and practically. They were unable to believe that man could exhibit such propensities for evil, such lust for power, such disregard for the rights of the weak, or such yearning for submission. Only a few had been aware of the rumbling of the volcano preceding the outbreak.”

Erich Fromm, Escape from Freedom

"I understand why an equality that was founded upon God involved neither contradiction nor disorder. Demagogy enters at the moment when, for want of a common denominator, the principle of equality degenerates into the principle of identity."

Antoine de Saint-Exupéry, Flight to Arras

"Fascism begins the moment a ruling class, fearing the people may use their political democracy to gain economic democracy, begins to destroy political democracy in order to retain its power of exploitation and special privilege."

Thomas Clement Douglas

As you know today was a quad witch in stocks, and shenanigans were expected to be at a high level.

Stocks traded wobbly most of the morning and Europe closed for the weekend quietly.

But around one stocks started dropping precipitously. I happened to be watching the stock futures and noticed the sharp change in trading 'tone' right away. They were dropping steadily and with some conviction on both the SP and the NDX. Something had clearly happened. So I pulled the trigger on a short order I had teed up for the weekend, and went looking.

Bloomberg TV was showing nothing. Even on their news headlines on the right side there was nothing showing except for a headline 'Breaking News' that Walmart was dropping e-cigarettes. The on air discussion was some infotainment discussion about how to play the next rally, yada yada.

I flipped over to Fox Business, which is something I almost never do, and bam, they were showing breaking news that China had just cancelled a visit to Montana to discuss agricultural purchases, and Trump was making noises about what a hard and complete deal he was going to be driving with China. Fox was covering the hell out of the story, and putting it in context with the market decline.

Back to Bloomberg and there was nothing. Even when their most seasoned news pro Mark Crumpton came on with the headlines at 1:30 there was nothing, and nothing on the sidebars.

Finally when she did a review of the markets, which were clearly dropping pretty hard, Scarlet Fu read off a piece of paper that the Chinese had cancelled their Montana meeting, and that some thought this is why stocks were dropping. And while they mentioned it a few more times in the afternoon, it was never really covered as news per se, although Joe Weisenthal had a chuckle about it, when they said that he was watching it.

So I was wondering if this was a real thing, or just some quad witch shenanigans. If so they should say so, not just ignore it.

Well I let it ride, since I wanted to have some short side coverage for my long holdings over the weekend.

But it seemed more than odd. Fox Business scooping Bloomberg on financial news that moves the markets is like the Orioles sweeping a three game series against the Yankees.

Let's see what happens next week. This is where the fog of corruption has descended over the markets.

There will be a fairly important gold option expiration on the Comex on the 25th. October is an active month for gold, not so much for silver.

Stocks went out near to their lows. Gold and silver went out near their highs. The VIX was higher along with the Dollar.

That precious metals market rigging charge, with RICO overtones, against JPM was such a big nothing, like some wiseguys have claimed, that the gold leverage lords of the LBMA just kicked the head of JPM's precious metals desk off their board. Is this like the time Lucky Luciano booted Dutch Schultz out of the Five Families for excessive moral turpitude? QED

And so we had a quiet flight to safety, ninja-style.

Have a pleasant weekend.

Category:

LBMA,

quad witch

18 September 2019

Stocks and Precious Metals Charts - Fed Lightly Spikes Punch Bowl, But Fails to Roll Out the Barrel

"Experience, however, shows that neither a state nor a bank ever have had the unrestricted power of issuing paper money without abusing that power; in all states, therefore, the issue of paper money ought to be under some check and control; and none seems so proper for that purpose as that of subjecting the issuers of paper money to the obligation of paying their notes either in gold coin or bullion."

David Ricardo

"When depreciated, mutilated, or debased coinage or currency is in concurrent circulation with money of high value in terms of precious metals, the good money automatically disappears.

Bad money drives out good."

Thomas Gresham

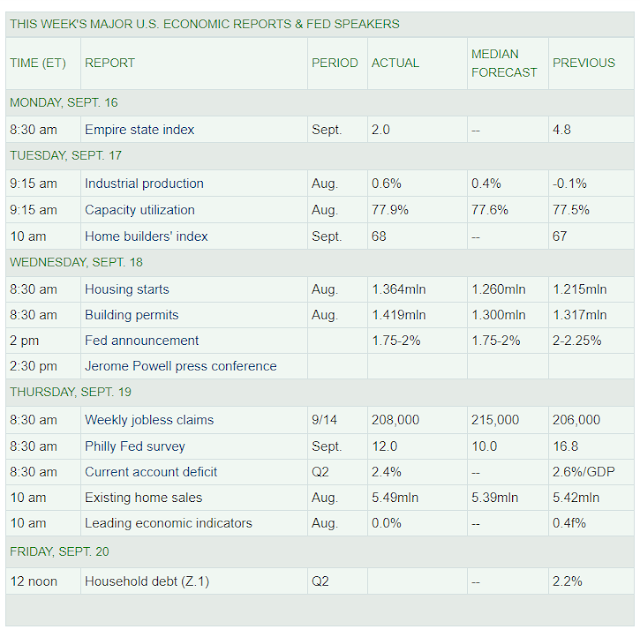

The Fed cut 25 basis points today as was broadly expected by the markets. Or at least aware market observers.

What surprised the markets was the somewhat hawkish flavor to their rate outlook, which apparently took any more cuts for 2019 off the table.

Indeed, there is clearly less enthusiasm at the Fed for easy money to stimulate the economy than many of the beta-seekers in the markets had expected.

So the Dollar went higher, the precious metals went lower, and stocks sold off.

During the press conference Fed Chair Powell indicated the reasons for what they had done and their data dependency in future decisions. And probably most importantly there will be a bias towards expanding the Balance Sheet to accommodate the needs for liquidity demands of an economic expansion, in addition to as needed interventions by the NY Fed to relieve any short term overnight liquidity concerns.

In my own estimation the liquidity problems stem from the unusual amounts of debt that the Treasury is having to shove into the market, coupled with the Fed's own contraction of its Balance Sheet after years of QE. This seems to be confirmed by the FOMC, but so what.

I think some of the hysterical warnings were due to the Banks and their enablers lobbying for more easy money and lower reserve requirements, so that they might carry on their campaign of leveraging themselves into an increasingly large piece of our financialized economy.

I think some of the hysterical warnings were due to the Banks and their enablers lobbying for more easy money and lower reserve requirements, so that they might carry on their campaign of leveraging themselves into an increasingly large piece of our financialized economy.Trumpolini had a tweet fit as one might expect. You can discount anything he says about interest rates heavily, because he knows less about money and banking than he does about foreign policy, or astrophysics for that matter. But like most NY real estate developers he likes easy money.

Can you imagine if the Trump Treasury held the power of the printing press, independent of a central bank or the discipline of the debt markets or some other external standard?

MMT = LOL2

There will be a stock market option expiration, a quad witch no less, this Friday.

I bought back gold positions today that I had let go of some days ago.

Let's see how that works out.

Have a pleasant evening.

Category:

FOMC

Subscribe to:

Comments (Atom)