“I know the capacity that is there to make tyranny total in America, and we must see to it that this agency [the NSA] and all agencies that possess this technology operate within the law and under proper supervision, so that we never cross over that abyss. That is the abyss from which there is no return."

Senator Frank Church, 1975

"The enormous gap between what US leaders do in the world and what Americans think their leaders are doing is one of the great propaganda accomplishments."

Michael Parenti

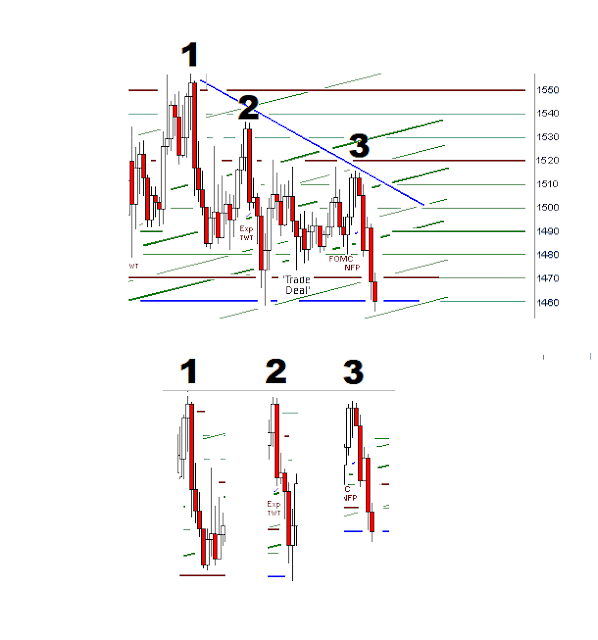

Another wave of contract dumping in the quiet futures market took the prices of gold and silver down this morning.

It looks like the Banks are determined to weasel out of their massive short positions without the paper losses they had been carrying.

This is what happens when you deregulate markets, and cripple the agencies that oversee them. But that is logic, and the free marketeers can't hear about that because they are Utopian cultists.

Stocks also reached for new highs today, but gave up a big portion of their intraday gains into the afternoon hours.

The Fed has flooded the Wall Street Banks with liquidity, and the idea that they are going to turn around and make loans with it is a laughable farce, often bundled under the supply-side economics school of thought.

Sometime between now and next July we are going to see some significant changes in the political and economic trends in the US. I think we might get a solid taste of that by year end.

From just the standpoint of financial reform and reining in the excesses of the Banks, which candidates do you think might be expected to actually do something about this? Or in other words, which candidates are most feared by the moneyed interests and their enablers in the media?

I had the time to stream the latest Season 2 of Jack Ryan on Amazon. From an entertainment standpoint it was fairly good. Certainly not in the class of Peaky Blinders, Bosch, and several other made for streaming series. From an overall perspective it was thinly disguised propaganda, at times very obvious and heavy-handed as the run up to the Iraq war. We'll have to consider the source on this one.

Cold weather is coming this weekend.

Have a pleasant evening.