03 April 2014

Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow

There was intraday commentary about a 'collapse in the international monetary system' here. There are also some words about worrying too much to the point of near hysteria. Granted there are some things to watch closely and are cause for concern. The theory that a major sovereign currency cannot fail because it defines itself and its own value is not consistent with some of the things that we have seen happen with our own eyes..

It reminds me of the old story about a boxer who comes slowly to his corner between rounds. His manager encouragingly says, 'Don't worry, kid, he hasn't laid a glove on you.' And the boxer says, 'then you better have a talk with the referee, because someone is beating the hell out of me.'

Someone asked me if all of the ounces of gold that are claimed in the futures clearing process are actually 'delivered,' and the answer as I have given it before is 'no.'

A party may stop or stand for a futures contract warrant, that is gold in the deliverable category, but that does not mean that they actually have to take that physical gold. They have other methods of settling in kind. And they may also 'take' that gold, but leave it where it is, depending on their intentions for it.

So I would take the clearing report as indicative, rather than the final word which is told by the warehouse stocks, with a lag. And I do not know if that sort of thing is still going on, but I recall a scandal where certain brokers were selling silver and charging storage for bullion that never really existed at allexcept on paper.

But I am sure that sort of thing does not happen anymore, and certainly not on the Comex. Who can imagine that major Banks and prestigious firm rigging prices and selling things that are not on the up and up. That is the talk of malcontents and those who do not give the system the proper amount of blind trust.

But it is a bit moot as I have more recently said. Precious metals and their trading are on the move from West to East. And the Comex is sometimes of the character of theater, where players move objects and money around to provide the appearance of reality, rather than the reality itself. One bigger change is that now one can also say that about the LBMA in London perhaps, with its hot potato trading and paper leverage to physical supply.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Non Farm Payrolls Tomorrow

The economic news this morning was off the mark and not particularly encouraging.

Tomorrow we will get the non-farm payrolls report.

The news reporting on the financial channels is just terrible. No wonder people are so uninformed. With a few notable exceptions these fellows are like actors in extended infomercials.

Have a pleasant evening.

Rickards: Collapse of International Money System - Not Apocalypse, But a Change

I am glad that Rickards came out and said this more clearly. I get worried emails from people from time to time, and I remind them that there is nothing we are facing or are likely to face, outside of an all out nuclear war, that was not faced by our fathers and grandfathers who faced two World Wars and a Great Depression in between.

It seems more frightening now because we are more aware, and we are 'carrying the ball' and are noticing more things. When they are young, most people don't pay attention to much that happens above the waist, unless it is on the radio or TV and is said by entertainers, or on reality shows. I'm talking about their wallets, shame on you. When you are young you are always broke.

I myself have lived through at least one major monetary crisis, quite a few minor ones, an oil embargo, three financial crises, and five major wars. I saw the collapse of a major developed country's currency close up when I was doing business in Moscow and the ruble had to be withdrawn and reissued with a couple of zeroes knocked off. It was wild times there. But life went on, and goes on still.

So take a deep breath, and listen to this as information, and some facts with which to prepare, and not as a portent of doom. Every generation faces the same sort of coming of age from what I can tell, where the history experienced by their forbearers suddenly becomes more than a story, and all too real for them.

I am more concerned about the love of otherwise good people growing cold, and their hearts hardening, and sins against the Spirit, the madness of the sociopaths spreading to a wider swath of misguided but otherwise gentle people, the fashionableness of injustice and growing tolerance for corruption, the plight of the unfortunate and the careless arrogance of the fortunate, the future of the vulnerable among us, and some of the hard truths of diseases that still elude a cure, than I am worried about Mad Max coming to town.

Forget the fear-mongering. Bad things do happen, but we will manage on as we have always done, because life and the Spirit are resilient.

"And though the last lights off the black West wentHere is some knowledge.

Oh, morning, at the brown brink eastward, springs—

Because the Holy Ghost over the bent

World broods with warm breast and with ah!— bright wings."

02 April 2014

Gold Daily and Silver Weekly Charts - 340,200 Ounces of Gold Claimed So Far In April

There was intraday commentary on the moral blindness of the US and UK financial establishment and ruling elites here.

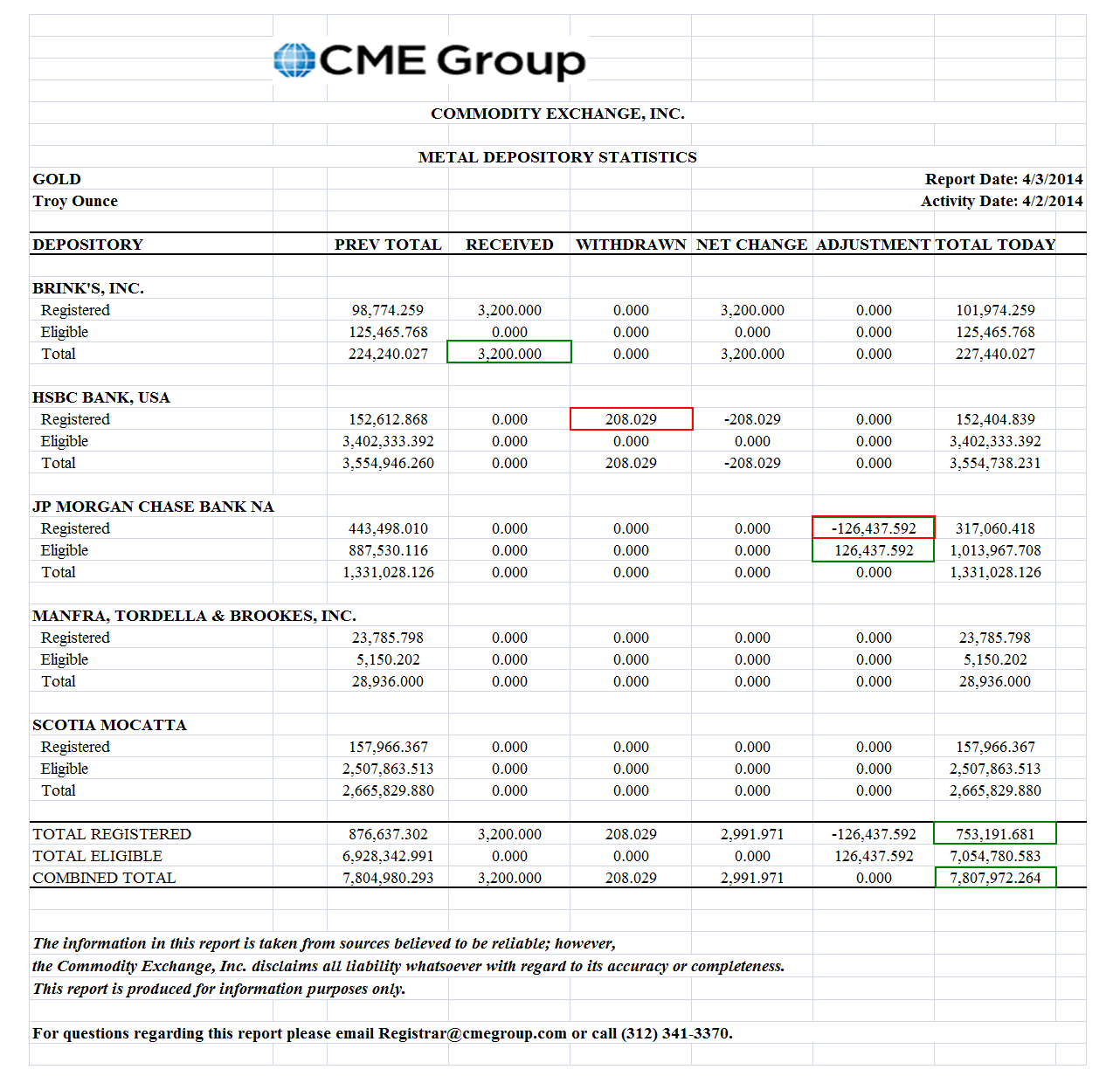

So far in April 3,402 gold contracts have been 'stopped,' that is, holders of those contacts have stood for delivery of the 100 oz bars each contract represents.

There are more than enough ounces at the Comex in the deliverable category now at 876,637 ounces.

This is just part of the paper shell game, but it is interesting to watch its progress. After all, 340,200 ounces of gold is only about 10.6 metric tonnes. Cumulative physical gold delivery in Shanghai alone last year was well over 2,000 tonnes.

Have you ever wondered how a relatively small force, the British East India company and later the British Raj, was able to control the Indian sub-continent? Perhaps that is how New York and London are able to govern the world market for gold, and thereby the foundations of money.

Non-Farm Payrolls on Friday. The stock market seems a bit 'puffy' here, and complacent.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Who Can Stop the Rain

Lofty and complacent.

The wash cycle is almost done.

I think one of the reasons that the Street is defending High Frequency Trading so vehemently is because without it they would be embarrassed at the genuine volumes on the exchanges.

People, from the outside in, are beginning to lose their confidence in US equities and most likely the financial system. Wow, how could that have happened.

Non-Farm Payrolls on Friday. The frauds will continue until confidence returns.

Have a pleasant evening.

Subscribe to:

Comments (Atom)