09 June 2015

NAV Premiums of Certain Precious Metal Trusts and Funds - Arc of Justice, Rising and Falling

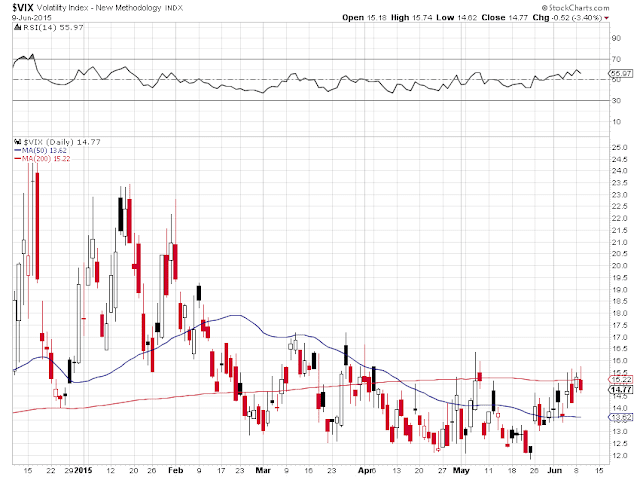

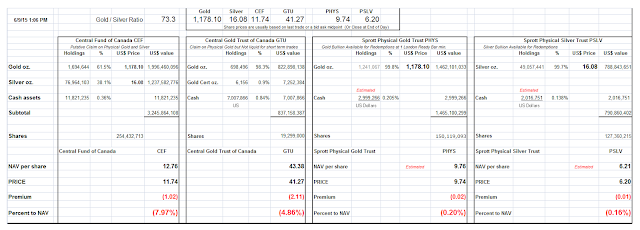

The gold/silver price ratio remains extraordinarily high at 73.

NAV premiums are thin, which is a bit of a change from their more deeply negative trend.

In general, people with whom I speak seem discouraged, disheartened, tempted to hide in apathy and meaningless diversions. Those who promote reform see the monolith of a corrupted governance spoiled by big money that seems impenetrable. Truth is hidden and whispered, with lies and deceptions abounding, spread by the megaphone of the mainstream media.

It can be discouraging indeed, to see the sense of duty and honour so poorly treated in this triumph of the age of greed. There is a temptation to see ourselves at some low point, lower than those who have gone before us, and then to wallow in apathy and inaction, in a kind of a sick hopelessness that 'nothing can be done.'

But this is where a sense of history and of human nature can provide to us a great comfort and encouragement to continue on. Liberty and the hopes and aspirations of the common people are always rising and falling, as is the rise and fall of wickedness, and the darker powers of this world that at times would seem to block out the very light.

And yet if we have read and understood what our fathers and mothers, and our grandfathers and grandmothers and those who went before them faced, it does not seem so terrible now, not at all.

There is only one real difference. Now is our time to take up the reins of humanity, and stand and work and wait for the inevitability of the human spirit to rise once again, if we will only continue on in our struggle and endure with hope and faith in ourselves and a higher power that arcs, if slowly but faithfully, towards justice.

And perhaps we might remind ourselves that we have not lost, we can have a personal victory that matters, if we can maintain the spark of love in our hearts. And bear in mind that the struggle is never over in this world, but that our own struggle only will be over when we go to our final rest, and hand over the instruments of our warfare to those who come after.

This is the nature of the world and of our humanity, always winning and losing, rising and falling. At long last, the world will pass away, and does not matter. Money is necessary, but it is not the end of the game. Power will not sustain our soul when we are stripped naked. These worldly prizes are not winning, they are snares and traps. Having riches will not 'enable you to do good.' It would corrupt and condemn you to a life of graceless desperation. What matters is how we have lived and loved, and what we bring with us when we finally face the last.

But for now it is our time to take up the struggle, and to act to promote justice and to prevent the spread of oppression and deceit. This is our calling. People may ask, 'Look at the way things are. If there is a God, why doesn't He do something about it?' And He did. He sent us.

But for now it is our time to take up the struggle, and to act to promote justice and to prevent the spread of oppression and deceit. This is our calling. People may ask, 'Look at the way things are. If there is a God, why doesn't He do something about it?' And He did. He sent us.

So despite these failings and misgivings, despite the short term triumphs of those who would use the body politic as their personal servant, and harness the moneys of the world as their new armies for plunder and colonization, we might, with some eye to history, take courage in the words of the great lights of history who shine across the ages for us like beacons. As William Gladstone said in the fight for voting rights for the common people:

"You cannot fight against the future. Time is on our side. The great social forces which move onwards in their might and majesty, and with the tumult of our debates does not for a moment impede or disturb-- those great social forces are against you; they are marshaled on our side; and the banner which we now carry in this fight, though perhaps at some moments it may droop over our sinking heads, yet soon again will float in the eye of heaven, and will be borne by the firm hands of the united people of the three kingdoms, perhaps not to an easy, but to a certain and to a not distant victory."William E Gladstone, Representation of the People Act Speech, 1866

08 June 2015

Gold Daily and Silver Weekly Charts - Restless

"For we know that the whole of creation groans and suffers in the pains of expectation, as of childbirth, together until now."

The precious metals were 'hung over' from the drubbing they took last week in honor of the Non-Farm Payrolls Report.

There was intraday commentary on the gold market and the currency war here. It is probably important for you to read this, as it is one explanation of what and why things are happening as they are. This is an essential step in determining where they might go next.

There was no appreciable activity in The Bucket Shops warehouses last Friday.

There seems to be quite a bit of dishonesty and turmoil these days. The discrepancy between how things are described, and how they really are for most of us, is greater than I remember it for some time.

No wonder people are restless.

Have a pleasant evening.

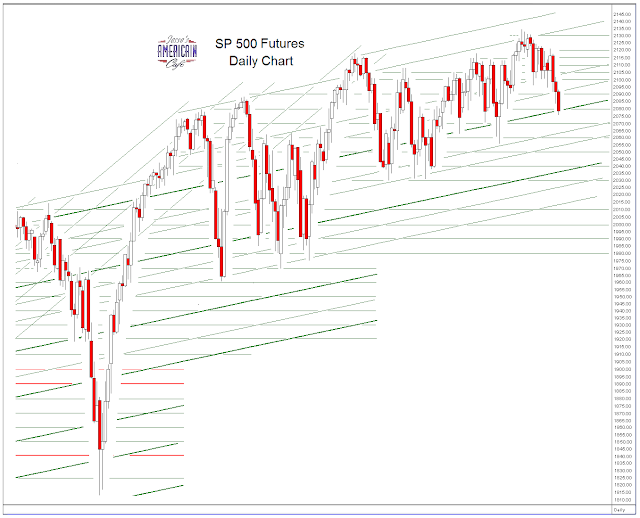

SP 500 and NDX Futures Daily Charts - How Low Can You Go

The Dow Jones Industrials are now negative for the year, which doesn't mean all that much, but the financial networks like to mention this for the benefit of the tourists.

As you can see on the charts, stocks are in a well worn trend channel of washing and rinsing the small specs within a fairly tight uptrend that has been going on since about 2008.

The thinness of the markets, and lack of confident liquidity for paper assets, leaves these markets vulnerable to an exogenous shock. But such shocks are relatively rare occurring on a calendar measure of years, not days.

But the mismeasured risk is there nonetheless. It is just a matter of what may provoke it. As the risk divergence becomes greater, the magnitude of a 'trigger event' necessary to make it evident decreases. It is like snow building up as a prelude to avalanche. At the extreme, even a noise may start things rolling.

I see that Bernanke is being touted as our hero, as Rubin, Greenspan, and Summers were lauded as 'The Committee to Save the World' while they were acting as a Vichy administration for the moneyed interests that were rolling over the real economy.

Different fairy tale, probably with a similar ending in another artificially manufactured financial crisis.

Have a pleasant evening.

The Global Monetary Phenomenon That Almost No One Is Seriously Discussing

I wish to present, in just a few charts, a remarkable monetary phenomenon that almost no one is discussing publicly.

As you can see below, the central banks of the world, largely those of the West led by the US and the UK, were net sellers of gold throughout the 1990's and through the turn of the century.

As the Bankers to the world's reserve currency and sole global superpower, the Western central banks will make no major international policy decisions without the involvement of the Treasury, and especially the Federal Reserve and its constituent global banking machinery including the behemoth

Banks and the SWIFT system.

Gold purchases by central banks, at least those they were willing to publicly acknowledge, turned positive by 2010 at most.

The pundits did not expect this change to continue, as is shown in the 'forecast section' for 2012 and after in this first chart from RBC/Bloomberg below.

This chart shows most clearly perhaps how the Western central banks stepped up their gold selling attempting to control and then crush the price of gold, driving it down to a low of $250 in 1999-2001.

Interestingly enough this came to be known as Brown's Bottom. England, under the leadership of Gordon Brown, then UK Chancellor of the Exchequer, very publicly sold 400 tonnes of its sovereign gold starting in late 1999 and 2001, reportedly to bail out some of the Banks who had gotten over their heads on short sale positions.

The largest net sales amount of gold reserves was in 2005, as the central banks attempted to dampen the price of gold which had risen from $250 to $450. This selling was co-ordinated under the Washington Agreement, which was a so-called gentleman's agreement amongst some of the Western central banks, first created in 1999 and thereafter revised and extended in 2004.

The banks included the ECB, Sweden, Switzerland, the UK. Although it was not a signatory, the Federal Reserve was obviously involved. In August 2009 this agreement amongst 19 central banks was extended for another five years.

Spun positively by the financial media as 'good for gold,' this coordination of selling was designed to allow the Banks to coordinate their efforts, and not clumsily disrupt the markets as the Bank of England had done in 1999, allowing them to manage their sales and announcements for a smoother effect on price.

As can be seen on the chart below, the central bank gold selling was unable to obtain traction, and the price of gold continued to rise as the Banks began to taper off their attempts to control the price through outright physical selling which seems to have had its last hurrah in 2007 as noted by Citigroup.

"Official sales ran hot in 2007, offset by rapid de-hedging. Gold undoubtedly faced headwinds this year from resurgent central bank selling, which was clearly timed to cap the gold price. Our sense is that central banks have been forced to choose between global recession or sacrificing control of gold, and have chosen the perceived lesser of two evils. This reflationary dynamic also seems to be playing out in oil markets."

There are other non-bullion instruments which the central banks may employ to manage the price of gold which include strategic leasing, derivatives, and the use of proxies to influence markets in the manner in which certain financial entities have been recently exposed to be manipulating many other global prices and benchmarks, over periods of many years. Yet there is still a great deal of denial over the central bank attempts to manage the price of gold relative to their currencies, despite an abundance of circumstantial, historical, and direct evidence.

This simple chart more vividly portrays how the forecasts of declining purchases of gold by central banks after 2011 were wrong-footed.

Since that time, central bank purchases have risen to 48 year highs.

One thing that we should bear in mind here is that the central bank numbers are based on 'official' numbers given to the World Gold Council.

There is significant evidence that some of the central banks, notably China, are significantly understating their acquisition of gold as a matter of their own discretion.

One thing that we should bear in mind here is that the central bank numbers are based on 'official' numbers given to the World Gold Council.

There is significant evidence that some of the central banks, notably China, are significantly understating their acquisition of gold as a matter of their own discretion.

Here is my own depiction below of the sea-change called 'The Turn' in global central bank purchases of gold.

This turn coincides with what I along with more important others have called the currency war, most notably in a bestselling Chinese book published in 2007 by Song HongBing called Currency Wars (货币战争), and a book published in Nov. 2011 by Jim Rickards by the same name.

This is different from the 'currency war' which the financial media likes to portray, as the devaluation of national currencies to obtain competitive advantage, is more of an artifact from the 1930's. This new currency war involved a rethinking of the US as the global reserve currency, an unusual condition for a fiat currency which has been in place since at least 1971 when Nixon closed the gold window.

From the end of WWII the Bretton Woods Agreement had set up the US dollar reserve as a proxy for gold, redeemable at least by other central banks and their governments. After the closing of the gold window the world was pushed into a scenario of central monetary authority it had not experienced in recorded history: a single country, through a semi-public banking entity controlled the issuance of the world's global reserve currency unencumbered by a hard reference to some neutral external standard.

This currency regime has been maintained by military and political power, informal agreements, treaties and trade sanctions, between 700 to 900 foreign bases of power and influence, and the indirect control of key global resources such as oil, the so-called petrodollar.

I certainly cannot predict where this will end, except to point to the example of past endeavours such as the London Gold Pool, and suggest that absent draconian government actions, market forces tend to overcome and overwhelm such efforts over time.

As I have forecast for many years, at least from 1999, the natural objective of a global fiat currency regime is a unipolar, or quite possibly a multipartite global government that is more centrally directed oligarchy than sovereign democracies.

The relationships of the various countries with the central authority in the evolving Eurozone are an approachable example on a small scale, a test run for the inverted totalitarianism, or neo-corporatism, of the bureaucrats and their corporate sponsors, to be a bit extrapolative. Although I think that the TTP and TTIP are glaring signposts along the way.

One particular point of frustration has been how slow on the uptake so many economists and financial commentators have been in thinking through the various monetary schemes that they promote. I doubt if they understood where they were leading that they would support them, even as their objectives are thought to be good.

07 June 2015

'Chindia' Physical Gold Demand In May 344.9 Tonnes

The second chart shows the growth of Chinese accumulation in contrast with India.

Charts are from Nick Laird at sharelynx.com.

Category:

Chindia

Subscribe to:

Comments (Atom)