Otherwise the action in the warehouses and 'delivery' was moribund as usual, more like a morgue than a market, where the mourners are in the hallway and parking lot smoking cigarettes and playing liar's poker.

It is like a morgue, where values go to die. Kind of like the Congress.

There is some intraday commentary on NAV and the precious metals here. I thought it was interesting that the discount to NAV on the Central Gold Trust widened back to the Pre-Sprott Offer levels.

Gold is still in a trading range from 1170 to 1230, although it appears to be breaking out in some other currencies.

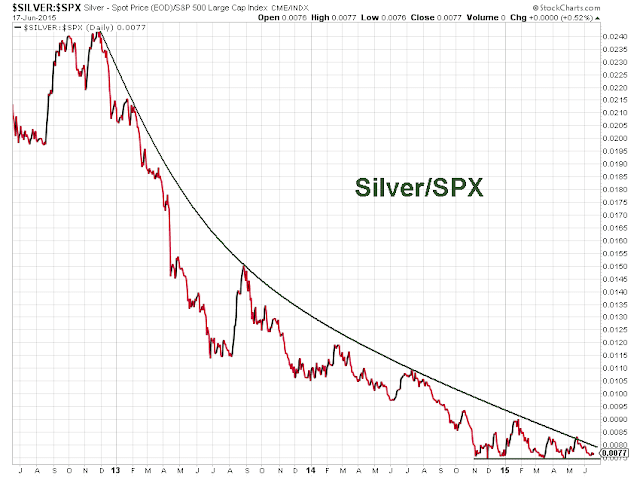

I am becoming more enthusiastic about the longer term potential for silver. I have some observations and charts about that from last night here. I do not know why there is such a lid on the price of silver, but it is certainly there for those who would have eyes to see it.

This gaming of the markets will end, and badly. But the timing is problematic.

We are being served badly by our leadership. I do not see how this can fail to bring about change. And I doubt that they will bother to initiate that change until they feel the heavy hand of history, clutching the backs of their collars. Alas, that is often too late.

Have a pleasant evening.