WESTMORELANDOf fighting men they have full three score thousand.EXETERThere's five to one; besides, they all are fresh.SALISBURYGod's arm strike with us! 'tis a fearful odds.

William Shakespeare, Henry V, Act 4 Sc 3

As I am sure you have heard the NY Stock Exchange was closed for technical problems from 11:32 AM to 3:10 PM today. There was a problem with their 'FIX' system. This was localized to the NYSE, but there were failures also at the Wall Street Journal site and at popular blog spot Zerohedge.

As you know there are about 11 stock exchanges here in the US now. And they are wrapped within a web of conscious complexity sparked by high frequency trading, which is an abuse of honest markets.

Over 70+% of the stocks on the Shanghai Composite have halted trading for a more fundamental reason: no buyers, at least not at these lofty prices.

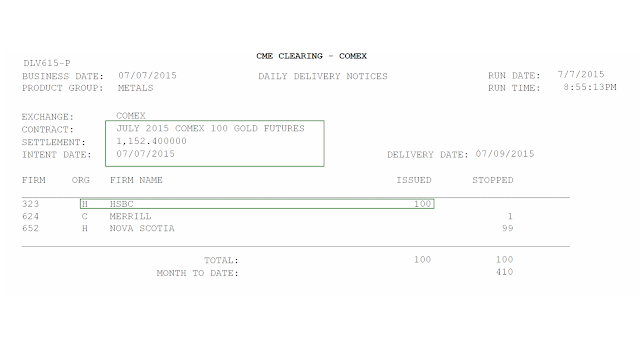

Gold and silver continues to be capped.

At this point it seems to my taste that cash, gold, and silver are the preferred investments. But that is just my opinion and I could be wrong.

I would not listen for one minute to stock touts and analysts at this point. They are accomplished liars, but liars nonetheless.

It is quite entertaining to traffic in rumours and fears, and to drink deeply of the sick cup of despair. But this is not for us.

Security is a practical issue of course. But the only real tragedy is to trade our souls for the illusion of it.

Have a pleasant evening.