"As a dog returns to its vomit, so a fool returns to his folly. "

Proverbs 26:11

"And in some ways, it creates this false illusion that there are people out there looking out for the interest of taxpayers, the checks and balances that are built into the system are operational, when in fact they're not. And what you're going to see and what we are seeing is it'll be a breakdown of those governmental institutions. And you'll see governments that continue to have policies that feed the interests of -- and I don't want to get clichéd, but the one percent or the .1 percent -- to the detriment of everyone else."

Neil Barofsky, 2012 interview with Bill Moyers

"Now why don't you just take it easy, Group Captain, and please make me a drink of grain alcohol and rainwater, and help yourself to whatever you'd like."

General Jack D. Ripper (Sterling Hayden), Dr. Strangelove

"Where are the leaders? Has our political process become so compromised by powerful interest groups and the threat of character assassination that even the best among us will not dare to speak honestly about the solutions that might bring us back to common sense and fundamental fairness?"

Senator Jim Webb, A Time to Fight, 2008

"General Turgidson, I find this very difficult to understand. I was under the impression that I was the only one in authority to order the use of nuclear weapons."

President Merkin Muffley, Dr. Strangelove

From Wall Street to the White House, it's all about serving the oligarchy, the 1 percent, while maintaing plausible deniability.

The market came in broadly expecting a whipsaw, with the FOMC standing pat with dovish verbiage, and then Jay Powell coming in and raining on the parade with skeptical cautions.

No way Zimbabwe Jay.

Although it must be said that the Street took it much further than he allowed. It reminded me of a college friend who kept seeing 'signs' from a girl for which he pined, but would not actually approach.

I think it would have been interesting to see the FOMC commentary on bubblevision performed by the voice-over actor from The Curse of Oak Island.

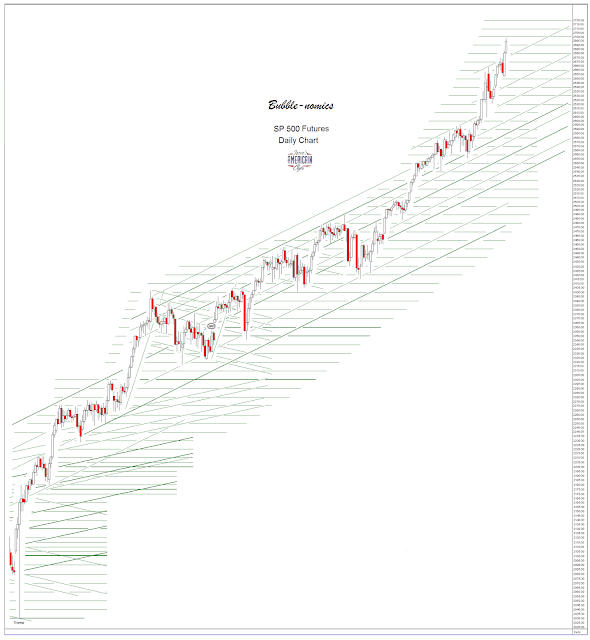

Stocks rallied very hard, parabolically surpassing their bubble peaks.

The Dollar dropped off a cliff.

Gold and silver rallied like rockets.

And there is the second phase of the wash and rinse.

VIX did not drop but marked time in place.

Stock option expiration on Friday.

I can feel the hammer getting closer, and closer, to the retail bulls.

But give it some time.

This is not sour grapes. I snagged some serious coin in the miners today, buying them into this recent pounding down the last two days. It was just too contrived and cliché.

Pretty much like all the official 'verbiage' we get these days.

You know how they ran gold up to a new high, ran all the short stops, and then smashed it down into yesterday?

Patented move.

And I think they may have the same play in store for stocks.

But timing and leverage are everything.

Meanwhile, we've got two wars a leaping.

Changed my mind about not using twitter.

Have a pleasant evening.