Gold just will not give us a signal to buy for the short term here yet. So I remain sitting tight on all my long term positions. Same with silver.

I did buy a little short side on stocks themselves today.

The action in the precious metals the past few days seemed exceptionally artificial, and that is saying a lot in these markets.

I suspect some of this was end-of-month shenanigans.

The December gold contract is a fairly significant force, and we should start feeling its effects sometime in November.

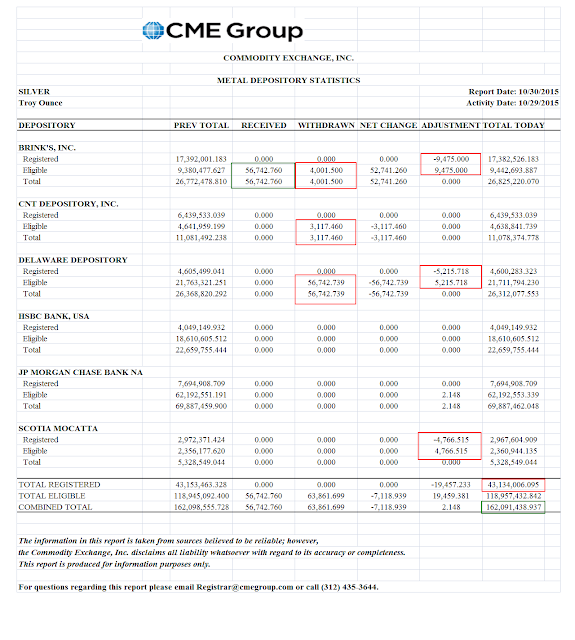

The Bucket Shop warehouses showed a little more gold passing to the house account at JPM, and the usual slow leakage out of the silver stores.

The 'nested W' bottom formation is off the table, and now we are in the uptrending range trade, if that can hold as shown on the first chart below.

It has been a long time since we have seen any kind of chart formation working. This is not a surprise given the obvious price manipulation in gold and silver, similar to what we have seen in so many other markets including the forex which is a cousin to the metals trade.

A Russian bank has joined the Shanghai Gold Exchange, which continues to move impressive amounts of gold bullion from various sources, especially Switzerland and London, into China.

As I have noted previously, the completely new phenomenon of spiking leverage with paper over physical gold in New York and London coincides with the attempt to take the price down after its increase in the most recent leg of the bull market.

I am inclined by what I can see to think that unless the exchanges and the regulators get their act together and rein in the big bullion traders and the mispricing of risk that they are going to have a real mess on their hands if these high levels of leverage get forcibly unwound.

I think the facts bear this out, despite the 'down your nose' scoffing at any risks by apologists and insiders. But that's just my own opinion, and I doubt anyone involved in the money flows from this trade will care. And if it does fall apart, 'no one could have seen it coming.'

As Kyle Bass pointed out, no one with a fiduciary (or regulatory) responsibility can ignore what has happened in the gold market since 2013. But some are, and with an almost reckless disregard.

Let me be clear, since one of the tactics that the apologists use is to purposely misconstrue any warnings. I am not concerned about a 'default' on the exchange, in the form of a failure to deliver.

Rather, I am saying that the factors that effect tail risks are now so extended in the gold market that even a relatively small imbalance or exogenously driven spike in demand can result in a market dislocation in price that will bring the exchange and perhaps some participants to their knees, and result in a global cascade of grossly mispriced counter-party risks.

Non-Farm Payrolls for October will be reported next week.

Have a pleasant weekend.