"We are slow to master the great truth that even now Christ is, as it were, walking among us, and by His hand, or eye, or voice, bidding us to follow Him. We do not understand that His call is a thing that takes place now. We think it took place in the Apostles' days, but we do not believe in it; we do not look for it in our own case.

Caravaggio, The Calling of Matthew the Tax Collector

I am a link in a chain, a bond of connection between persons. He has not created me for naught. I shall do good, I shall do His work. I shall be an angel of peace, a preacher of truth in my own place while not intending it, if I do but keep His commandments.

Therefore I will trust Him. Whatever I am, I can never be thrown away. If I am in sickness, my sickness may serve Him; in perplexity, my perplexity may serve Him. If I am in sorrow, my sorrow may serve Him. He does nothing in vain. He knows what He is about. He may take away my friends. He may throw me among strangers. He may make me feel desolate, make my spirits sink, hide my future from me— still He knows what He is about.

Let us feel what we really are— sinners attempting great things. Let us simply obey God's will, whatever may come. He can turn all things to our eternal good. Easter day is preceded by the forty days of Lent, to show us that they only who sow in tears shall reap in joy.

The more we do, the more shall we trust in Christ; and that surely is no morose doctrine, that leads us to soothe our selfish restlessness, and forget our fears, in the vision of the Incarnate Son of God."

John Henry Newman

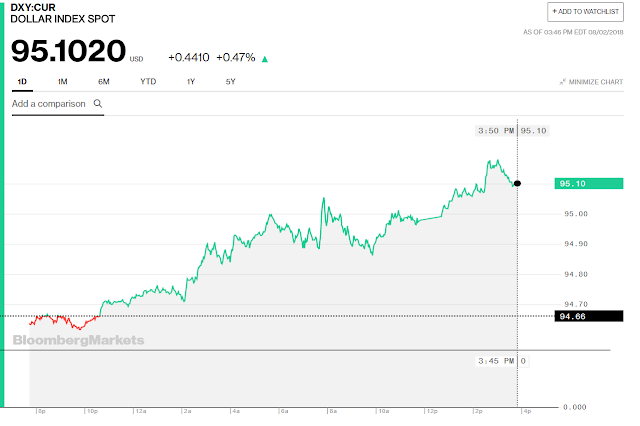

The Non-Farm Payrolls Report came in light this morning, both in terms of jobs added and real wage growth.

The unemployment percentage went down a bit, but this is relatively meaningless.

I have included the US Labor Participation Rate as the first chart below.

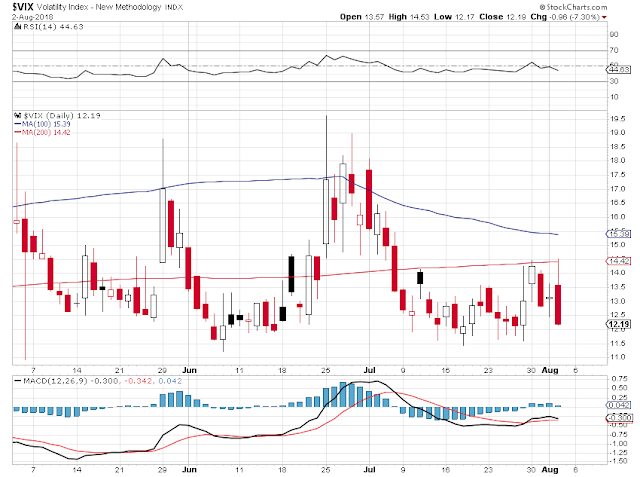

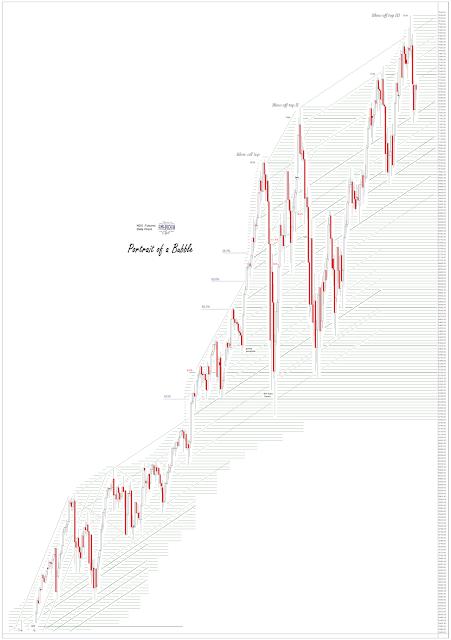

Stocks managed a modest rally based largely on the momentum from this week led by Apple.

The US Dollar was flat.

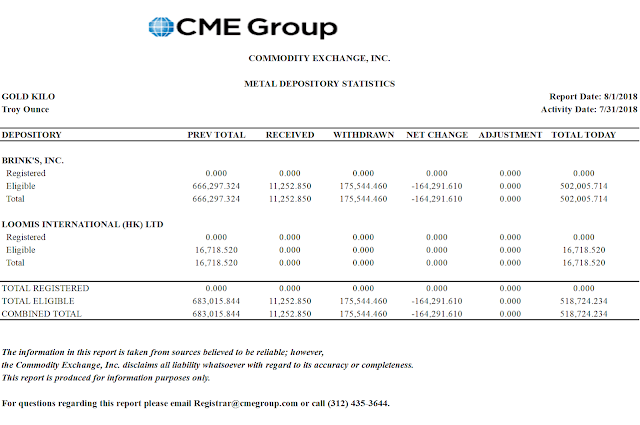

Gold and silver managed to rebound from another short term oversold condition. Let's see if they can rally next week.

This may have some relationship with the US Dollar and the currency crosses. This was discussed intraday commentary that you may wish to read here.

Please remember Koos Jansen, one of the gold analysts from Bullionstar who specializes in Asian gold flows your prayers, that he may return to full health. His commentary is missed.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.

.