People who follow price alone, and believe that this is the truest indicator of future value, have a point. And it is valid, based on a very short timeframe, most likely appropriate to a day trader.

And it is no coincidence that most day traders go broke.

Most traders overall go broke. They may have great runs for a time. I have seen runs at the crap table that were amazing. I had a run at poker that was astonishing, and that lasted for a couple of years. I had one night at the tables that was almost exhilarating. I made some short term profits playing the futures that were almost jaw dropping.

But they passed. And then came the steady losses. The most enduring profits I have made were done over a long time with a steady position, being right and sitting tight. The key to that is 'being right.' It is never easy.

People have different styles as traders. Some like the thrill of the short term, and others prefer what is called 'value investing' and the longer term. You have to pick what suits you.

But at the end of the day, most everyone loses except the casino, unless you can find and exploit some kind of edge.

That is the best that I can and will say regarding a commentator about the precious metals who might say that all that matters is price, because it does not matter who is buying or selling. Or why.

You don't need to know that. You do not need to know the players or their possible motivations. It is a point of view. And a good one if you wish to be a price follower and a day trader, and not have a real clue about the opportunities one may have to make some serious money.

The market makers and professionals all too often paint 'pictures' with price action. To somehow say that price contains all useful information and the truest picture at that moment is a corollary of the efficient markets hypothesis. And I would like to think after umpteen price rigging scandals, that we would reflexively know that this is all rubbish. And enough about that nonsense.

There are great changes underway in the world of money. And you will either understand them now, or understand them later. True, all sellers become buyers and all buyers become sellers given enough time. But that is the kind of timeframe about which Keynes remarked that 'in the long run we are all dead.' Someday will come. But its an odd logical fallacy to take the extremely short and the extremely long and reason from those examples, ignoring the great bulk of experience which is in-between.

As you may have noticed, most of the antics from yesterday's markets were erased today. The sharp rally in stocks dissipated, and the big hit on gold was largely erased.

As I had said, we had a real test for the precious metals this week, most notably gold, which is the metal of controversy. We had an option expiration, a first position day on a new active contract, an FOMC meeting, and a first estimate of 4Q GDP.

So far so good. If gold wanted to find a place to bounce, today's was about as good of a bounce as any.

The bounce in stocks with the subsequent flop was not surprising. The Fed hates to leave the market feeling like it has failed, perception management-wise.

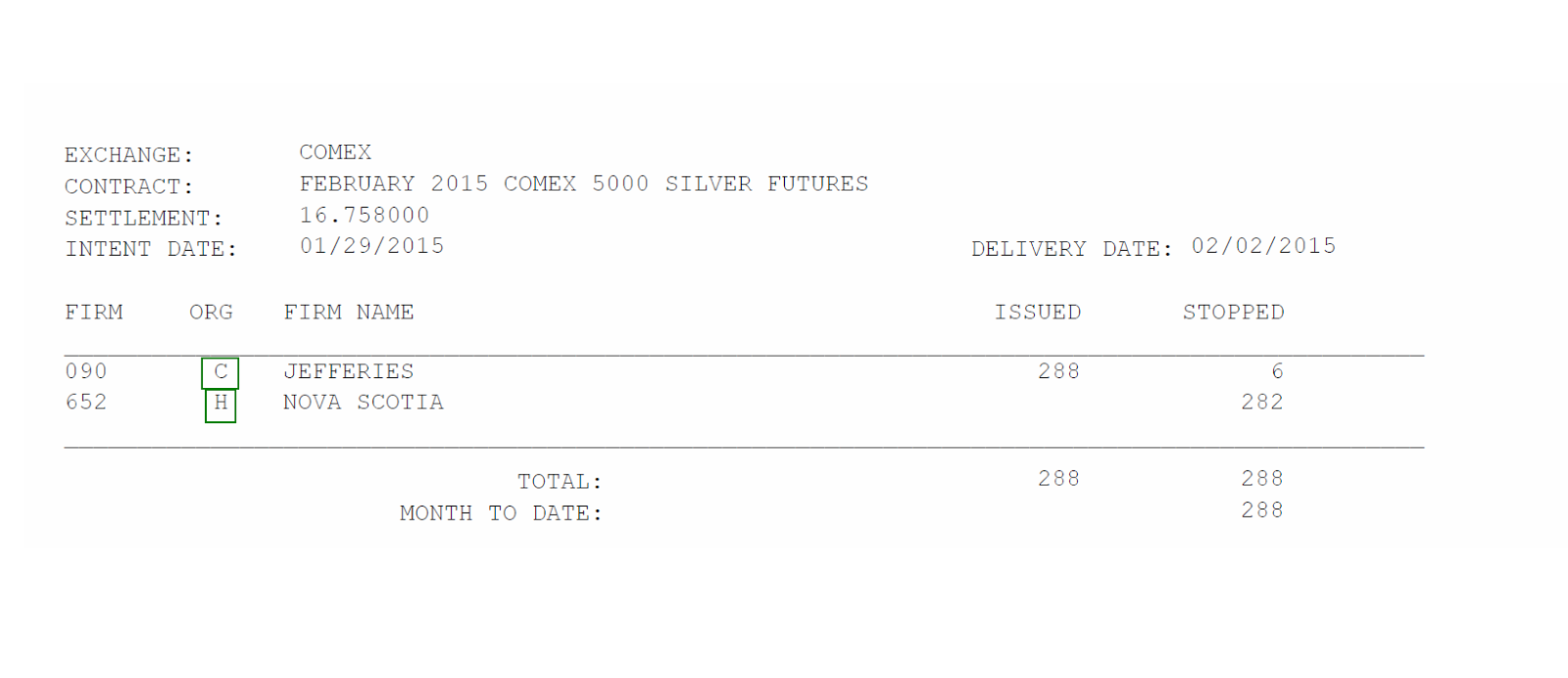

Follow through is absolutely everything for gold and silver here. We are now in an 'active month' and the first delivery reports have reflected that. Deliveries were coming out of 'customer accounts' and the house accounts were the takers. But you don't need to know that.

What you do need to know is that gold bullion is flowing steadily and heavily from West to East. And that we are nearing the natural end for a currency cycle. And that the price of gold and silver are based on leverage, and rehypothecation, and that these things have failed in the micro level, such as at MF Global, and can fail at the macro level, as in the failure of the London Gold Pool.

Please remember the poor. Their lives are very hard, and they are easy to forget. And not just the people who are poor in things, but also those who are poor in spirit, and unable to love. Don't just worry and count your money, although that is practically important.

Remember the only things that really endure, that will stay with you, as you truly are, a soul that happens to have a body, for now. And that is measured not in dollars, but in love.

Have a pleasant weekend.