A reader told me, second hand, that an acquaintance in the CME claims that the action in the CME Hong Kong is 'phony' and that they ought not pay attention to it. The CME is just trying to make an appearance there, it seems.

I have to admit that it is a little funny to see these big withdrawals and deposits of almost the same size each day from the Brink's warehouse. But as I have said, I wish to keep an eye on this for some time.

What I found even odder was that the source of this information apparently takes what the CME says about their US operations very literally. How can someone say, 'oh yes they are crooks and frauds over there,' and not suspect that they are not exactly the pillars of righteousness in their data reporting over here?

I will keep an eye on things and see what happens. But overall I suspect my own opinions of this are fairly clear.

Speaking of which, there was little delivery action in The Bucket Shop yesterday, and they were mostly moving stuff around in the warehouses for the most part.

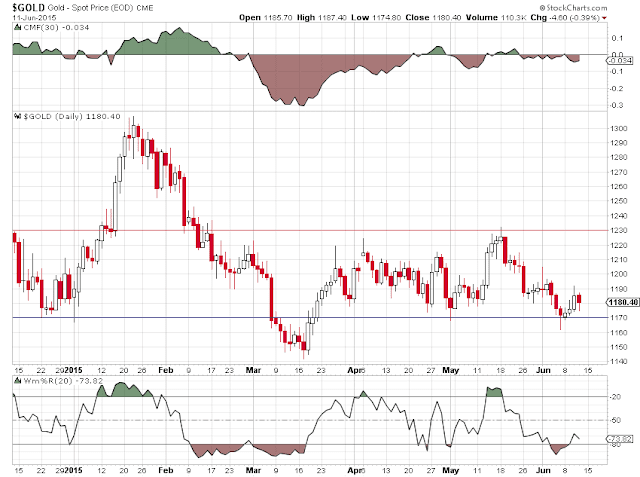

The active month of June for gold started out strong in the first couple of days, and then went completely flat as gold was hit hard in the paper markets.

The physical markets in Asia keep rolling along.

I see some people asking whether gold bugs were wrong, or just early. Allow me to retort.

Since 2000, the SP 500 is up about 38%, plus dividends. Over the same timeframe, gold went from $250 to $1180 today. That's spelled g-o-l-d.

The active month of June for gold started out strong in the first couple of days, and then went completely flat as gold was hit hard in the paper markets.

The physical markets in Asia keep rolling along.

I see some people asking whether gold bugs were wrong, or just early. Allow me to retort.

Since 2000, the SP 500 is up about 38%, plus dividends. Over the same timeframe, gold went from $250 to $1180 today. That's spelled g-o-l-d.

What is going on in the Ukraine, Greece, and with these international treaties like TTIP and TTP is appalling. The political and professional classes in the West are just off the hook and out of control. I am wondering what will bring them back to earth, and restore some sense of proportion to their feeding frenzy of greed.

Generally these sorts of things do not end well, or quietly.

Have a pleasant evening.