"Gold is looking like the dog that just did not bark -- but not uniquely so. Most safe-haven assets are looking distinctly lackluster, including the VIX index. Either 5,000 years of safe-haven buying has just become bunk, or there is a desire to portray what is evidently a financial and economic crisis as nothing to be concerned about."

Ross Norman, Sharps Pixley

“In keeping silent about evil, in burying it so deep within us that no sign of it appears on the surface, we are implanting it, and it will rise up a thousand fold in the future. When we neither punish nor reproach evildoers, we are not simply protecting their trivial old age, we are thereby ripping the foundations of justice from beneath new generations.”

Aleksandr Solzhenitsyn, The Gulag Archipelago

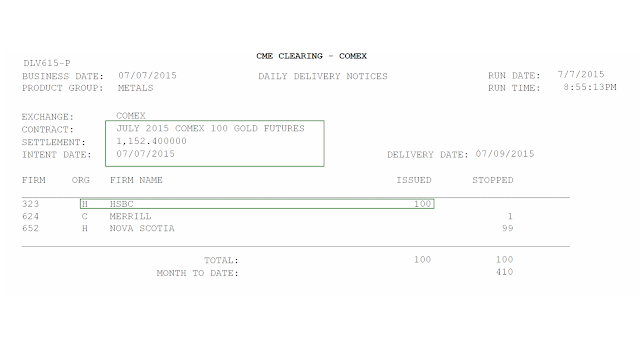

At least in my judgement, the precious metal markets are being consistently rigged.

I believe the reason that they are being rigged is that the financiers have convinced the political class that this is a necessary action in order to prevent a panic, a run on the dollar and the bonds, and a seepage of critical funds into an unproductive investment as compared to equities for example.

We are just defending what is ours, right? And what is ours is the global dollar hegemony.

This is really just another excuse for looting, picking both the global public pockets and the Treasury's.

This sort of thing seems to happen periodically, at least once per generation, and the system generally has to get washed out badly, and then reform may come. You can see a clear trend back to the early Reagan years for this particular dalliance with the overreach and madness of the moneyed interests.

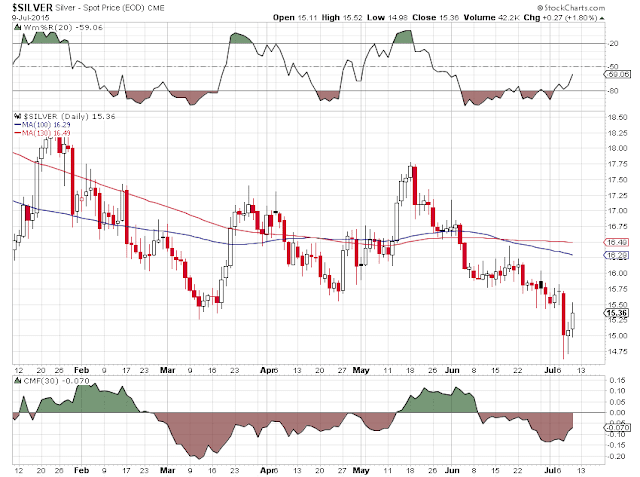

Protracted market rigging tend to distort supply profoundly. And there should be no doubt that the distortions and excesses of our current round of economic quackery have caused an historic imbalance of wealth and power. And the rigging of the gold and silver markets have badly affected the ability of supply to meet demand.

Oh well. Interesting times.

Have a pleasant evening.