"We live in deeds, not years; in thoughts, not breaths;

In feelings, not in figures on a dial.

We should count time by heart-throbs. He most lives

Who thinks most, feels the noblest, acts the best.

And he whose heart beats quickest lives the longest:

Lives in one hour more than in years do some

Whose fat blood sleeps as it slips along their veins.

Life's but a means unto an end; that end,

Beginning, mean, and end to all things—God.

The dead have all the glory of the world.

Why will we live and not be glorious?

We never can be deathless till we die."

Philip James Bailey, Festus

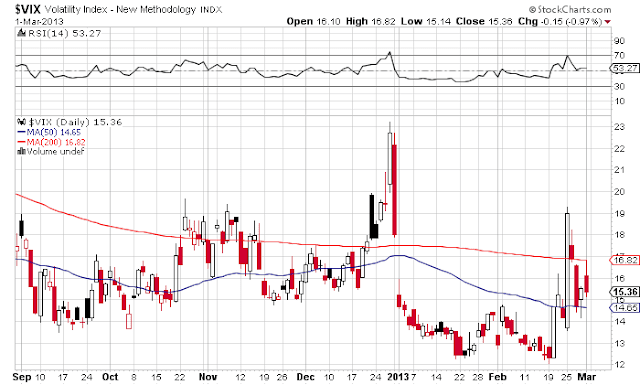

Complacency reigns.

The pounding in some of the miners today was pretty impressive.

The relationship between stocks and the metals are fascinating.

I am still refining my list of mining stocks, but I am not buying here as my price targets are much lower than current prices. I could be wrong on them as I am quite pessimistic about stocks in general, and the miners are catching it from both sides, being metals related. But for now I see no reason to buy.

And I may not get those buys. But this ability to be 'picky' is one of the benefits of having a substantial long term position which one does not touch. You do not feel pressured to buy bottoms or sell tops, because your greater concentration is always on the long term prize.

You may trade around it if you will, but never, ever, give up your position entirely in a bull market.