China Stakes

BRIC, SCO Discuss "Super-Sovereignty" Currency, USD Alternatives

By Scott Zhou

June 16,2009

Shanghai

China continued to consider a “super-sovereignty” currency among the countries of Shanghai Cooperation Organization (SCO), an intergovernmental mutual-security organization that met today in the Russian city of Yekaterinburg, in the Urals at the division of Asia and Europe. Members include China, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, and Uzbekistan, with India as one of its four observers.

Right after the SCO meeting, the BRIC country (Brazil, Russia, India and China) leaders met formally for the first time. It is not merely coincident that three of them have expressed a desire to adjust their foreign exchange reserve portfolios by reducing the share or volume of US dollar assets.

China has just halted the increase its holding of US Treasury debt. By the end of April, China held $763.5 billion of it, a fall of $4.4 billion, month on month, the first time China has reduced its Treasury holdings. Since May, 2008, China has increased its holding by $260 billion.

Inside China, USD is a hate-more-than-love story. Analysts have long argued that China should be very cautious on buying US government bonds since dollar is bound to weaken. Others hold that US treasury debts are still the best and first choice for China's near $2 trillion foreign exchange reserve.

In March, Madam Hu Xiaolian, the chief of China's State Administration of Foreign Exchange and a deputy governor of the People's Bank of China, China's central bank, said that investing in US national debt is an essential part of China's reserve management. But while continuing to buy US national debt, China is concerned about the risk of the fluctuation in value of its assets.

China has announced that it would buy up to $50 billion in bonds issued by the International Monetary Fund (IMF). Meanwhile, Russia and Brazil have said they are planning to buy up to $10 billion in IMF bonds, which would mean selling Treasury bonds. India has expressed the same interest. In April, China, Russia, and Brazil all reduced their holdings of US treasury debt.

China now believes that a long-term dollar decline is inevitable, and the risk to the value of its $2 trillion foreign exchange reserve has become realistic, if not imminent.

China has been a huge beneficiary of the order of the world economy and a monetary system with the US dollar as the reserve currency. China's economy has been anchored by a stable dollar exchange pegged by China's currency, RMB.

But the financial crisis has given China a wake up call that the present monetary system is not sustainable, and neither is China's foreign exchange regime and mode of economic growth, which has been largely based on relentless exporting.

What, then, is the role RMB can play in the future? Russia has been urging China for years to settle their bi-lateral trade in their respective currencies. Brazil intends to trade with China by RMB and the real. Recently Russia suggested making RMB convertible to become an international reserve currency.

China can not challenge US directly. The BRIC summit is a convenient platform for China and the other BRIC powers, set to become the 4 of the 6 largest economic entities by 2050, to put a bit of pressure on the US. Held before the first China-US Strategic and Economic Dialogue in late July in Washington DC, the BRIC summit may give China some leverage in dealing with the US.

Russia is ready to use its exchange reserve to buy securities issued by BRIC countries. In return, Russia hopes the others will be willing to buy financial instruments issued by Russia. The leaders discussed increasing of the share of settlement currencies for trade among them. They also discussed adjusting their reserve assets portfolio in a coordinated way.

At the SCO meeting held just before the BRIC summit and attended by China, Russia and India, China proposed to research the feasibility of using a super-sovereignty currency among SCO member countries.

Kazakhstan president Nursultan Nazarbayev proposed that trade among SCO countries be settled by currencies of member countries. He also suggested that a super-sovereignty currency used inside the SCO eventually become a SCO reserve currency. Russian President Dmitry Medvedev also supported the idea.

16 June 2009

The Alternatives to Uncle Buck Being Considered

SP Futures Hourly Chart

This is a quad witch option expiry week. The futures front month is rolling over but we have not yet made the change to September futures.

Volumes remain remarkably light even for June.

Support is obvious.

Keep a close eye on the VIX volatility.

And the Winner Is.... the SDR?

This is a significant development.

It appears clear now that the preferred alternative to the US dollar reserve currency regime for international transactions is going to be the Special Drawing Rights (SDR) units from the International Monetary Fund. We have seen indications that this was going to be the alternative, as compared to the euro, but it was not so confident a probability as it seems today.

Now it seems to be. And those SDR units will be an adjusted basket of commodities and currencies that will be more reflective of the current global economic picture. This may be phased in over time if the US and its political supporters have their way.

This is important because it is feasible, a realistic alternative, much more practical than the complete replacement of the US dollar by something else like the euro for example. We may also see more bilateral agreements based on local currencies.

Achieving the concurrence of the Saudis and other US client states will be important, because the dollar reserve strength has been largely based on its political connection to oil and military power. Most commentators and analysts miss this, but it is essentially at the heart of the matter. History may look back on this as a period of neo-colonialism since it has been so pervasive and uneven in its geopolitical relationships, especially since the 1970's: a Pax Americana.

This is not to say that the IMF's SDRs will be THE solution. They may very well falter. But if one is looking for a politically and financially palatable alternative to break the Big Dollar cartel, this looks likely to us. If it falters, it will be replaced with something else, most likely after some 'tinkering' with the basket composition first.

Let's keep an eye on this. But it is our judgement that the US dollar will continue to decline in signficance, in a relatively orderly fashion for the forseeable future, looking out perhaps over the next ten years, barring a major exogenous event, most likely of a geopolitical or military nature.

Russia calls for revision of SDR currency basket

By Gleb Bryanski

Tue Jun 16, 2009 3:58pm IST

YEKATERINBURG, Russia (Reuters) - The International Monetary Fund (IMF) should expand the basket of Special Drawing Rights to include the Chinese yuan, commodity currencies and gold, a senior Kremlin official said on Tuesday.

The SDR is an international reserve asset allocated to member countries with its exchange rate determined by a basket of currencies, at the moment including dollar, euro, yen and sterling. A review of the basket is due in November 2010.

"The rouble, yuan deserve to be included in the SDR basket," Kremlin economy aide Arkady Dvorkovich told a news conference ahead of the first summit of Brazil, Russia, India and China, known as BRIC, in the Russian city of Yekaterinburg.

"It is important that the composition of the basket also reflects the role of commodities in the global economy," Dvorkovich said, naming Australian and Canadian dollars as possible candidates.

"We also think that gold has a potential as a possible participant. The price of gold has a negative correlation to the dollar. Therefore it is beneficial to tie these two instruments into one so that investors feel safer," he said.

Dvorkovich said he doubted Russia would complete its transition to an inflation-targeting regime which implies a freely floating exchange rate for the rouble next year when the IMF basket's review takes place, as announced by the central bank.

Dvorkovich said BRIC leaders will discuss new reserve currencies at the summit but called for caution in the currency debate, saying it was in no-one's interest to ruin the dollar.

Russia rattled financial markets last week when a central bank official said Moscow will cut the share of U.S. Treasuries in its forex reserves in favour of IMF bonds and bank deposits.

Finance Minister Alexei Kudrin played down this statement over the weekend saying the dollar's status as the world's main reserve currency would unlikely change in the near term. Dvorkovich said new reserve currencies were inevitable.

"The world economy will grow... In the future we are sure growth will resume. This growing pie should be divided in a fairer way. We are not talking about excluding the dollar but the share of other currencies should increase," he said.

He said BRIC leaders will discuss investing their reserves, which are among the seven largest in the world, in each other's currencies, settling bilateral trade in domestic currencies and striking currency swap agreements.

"It would make sense for us if our partners agreed to place some of their reserves in Russian roubles," Dvorkovich said.

He said BRIC countries had a common position regarding the reform of the International Monetary Fund while a decision by China, Brazil and Russia to purchase SDR-denominated bonds issued by the IMF would boost the role of SDRs.

"Any expansion of the IMF's resource base implies ... strengthening of SDRs' role in the international currency system," Dvorkovich said.

15 June 2009

Ennui

Although the Cafe is open, the proprietor is temporarily overcome by a state of ennui regarding the financial markets.

Although the Cafe is open, the proprietor is temporarily overcome by a state of ennui regarding the financial markets.

From the volume today it appears to be a more widespread condition than those managing this distribution rally would have preferred.

No positions taken into the close except of course those very long term ones so firm as to be not worth discussing.

"Notre ennui, nos mœurs fades sont le résultat du système politique." Balzac La Femme de Trente Ans 1832

(Our boredom, our insipid customs, are the result of the political system.)

12 June 2009

Wall Street's Toxic Message Carried in the Winds of Change

Joe Stiglitz writes an important essay, and it is suggested that you take the time to read it. It helps to explain many of the things we have been saying, including the forecast that 'a new school of economics will rise from the ashes of this crisis, as Keynesianism rose from the Great Depression.'

These are changes of an historic nature, and as such they will progress slowly, and be largely unnoticed by those going about their daily business.

But the tides of change have been loosed, and what we have known, and relied upon, and expected will be shaken to its foundations.

Wall Street's Toxic Message by Joseph Stiglitz - Vanity Fair (pdf)

09 June 2009

Price, Demand, and Money Supply as They Relate to Inflation and Deflation

There are three basic inputs to the market price of something:

1. Level of Aggregate Supply

2. Level of Aggregate Demand

3. Relative Value (purchasing power) of the Medium of Exchange

Let's consider supply and demand first, since they are the most intuitively obvious.

The market presents an overall demand, and within that demand for individual products in particular.

Supply is the second key component to price. We are not going to go into more detail on it since what we are facing now is a decrease in Aggregate Demand.

It can seem a little confusing perhaps. Just keep in mind that if the aggregate demand decreases for goods and services for whatever reasons, such as severe unemployment, and supply remains available then prices will drop overall, with some variance across products because of their differing elasticity to price changes.

This is known as the Law of Supply and Demand.

How we do know when aggregate Demand is decreasing?

Gross Domestic Product = Consumption + Investment + Government spending + (exports − imports),

or the famous economic equation GDP = C + I + G + (X − M).

Consumption, or Aggregate Demand, is a measurable and key component of our GDP figures.

Given the huge slump in GDP, it should be obvious that we are in a demand driven price deflation on many goods and services. People are saving more and consuming less.

Now, that covers supply and demand as components of price, but what about money?

Money

Notice in the above examples we talk about Price as a value without a label.

Money is a medium of exchange. It is the label which we apply to give a meaning to our economic transactions.

If you are in England, or France, or Argentina, or China, the value label you apply to Price is going to be different according to local laws and customs.

Money is the predominant medium of exchange that a group of people have agreed to use when engaging in economic transactions that are not based on pure trading of goods, known as barter.

The source and store of wealth are the 'credits' within the system which one uses to exchange for products. The money is the medium of exchange.

If you work for a living, you are exchanging your time and your talent, which is your source of wealth, for products. The way in which this is labeled and facilitated in the United States is through the US dollar. I n Russia and China is it something else completely.

The Value of Money

How do we know what some unit of money is worth? Try not to think about your domestic currency. Since we use it so often every day, we tend to think of it with a set of assumptions and biases. Most Americans have little practical exposure to foreign exchange, and tend to think of themselves as living in a dollar-centric world.

Let's use the Chinese yuan. What is the yuan worth? What if I offered you a roll of yuan in exchange for a day's work? How would you know if it was a 'fair trade?"

Since there is no fixed standard for money in our world, you would most likely inquire in the markets what you could obtain for those yuan I offered to you in an accessible market.

But what sets the rate at which yuan are exchanged for a given product?

In a free market system, it is a very dynamic system of barter. When you offer something for money, I know how much of my source or store of wealth I must exchange for the yuan to provide for the product offered.

Money is just a placeholder. We hold it because we expect to be able to trade it for something else which we really desire. You don't eat or wear money; you exchange it for things which you wish to eat or wear.

If the value of money changes, the price of all the things to which you have been applying that label changes. This is why it is important to distinguish between price changes because of changes in demand, and changes because of money supply. They are different, and require very different responses.

Money supply

In a very real sense, there is a relationship between how many goods and services are available, and how much money exists.

Let's say we are in China. I give you 100 yuan. Tomorrow the Chinese government triples the amount of yuan in the economy by giving each of its citizens ten thousand yuan for essentially doing nothing, for not producing anything more or less.

Do you think the 100 yuan will be worth as much as they were the day before? No, obviously not.

In real economies these changes tend to happen with a time lag, or gradually, between the action and the reaction. This is necessary because people can only adjust their daily habits, their economic transactions, gradually. Otherwise it becomes too stressful, since our daily routines and decisions are based so heavily on habits and assumptions of value and consequences.

But in general, if the supply of money is increasing faster than real per capita GDP over a longer term average the money supply is inflating, that is, losing real purchasing power.

Seems simple? Well its a bit more complicated than that unfortunately since these things relate to free markets, and if there is any other thing you need to remember, we do not have free markets, only free to varying degrees.

The logical question at this point is to ask, "What is the money supply?" That is, what is money and what is not?

We dealt with this at some length, and suggest you look at this Money Supply: A Primer in order to gain more knowledge of what is money and money supply.

We would like to note here though, that there is a difference between money supply and credit, between real money and potential money.

If I have 100 Yuan in my pocket, there is a real difference between that money, and my ability to work at some job tomorrow and be paid 100 yuan, or have you repay 100 yuan to me which I gave to you yesterday, or my hopes that I can borrow 100 yuan from some third party.

If you do not understand this, you will not understand money. It is one of the great charades of our time that risk has been so badly distorted out of our calculations. We cannot help but think that some future generation will look at us as though we had all gone barking mad.

The subject becomes even more complicated these days because we are in what is called a fiat regime. Fiat means 'let it be done' as we will it, and we are if anything in a very relativistic age in which we think we can will just about anything.

The major nations of the world get together and attempt to manage the value of their currencies relative to one another, primarily through their finance ministries and central banks.

Countries will interfere in the markets, much more than they will admit, to attempt to maintain certain relationships among currencies of importance to them. Sometimes they are overt about it, as when nations 'peg' one currency to another, and at other times they are more subtle and merely influence other currencies through mass purchases of debt and other forms of persuasion and the molding of perception.

I hope this helps. I don't intend to answer loads of questions on this, particularly from those who immediately start inventing complex examples to try and disprove this. Most of the time the examples betray a bias that person has that defies patience and a stubborn belief that everything is relative. In the longer term it is most assuredly not.

Each will learn at their own pace what is real and what is not. But they will not be able to say that they have not been warned that sometimes appearance is different than reality.

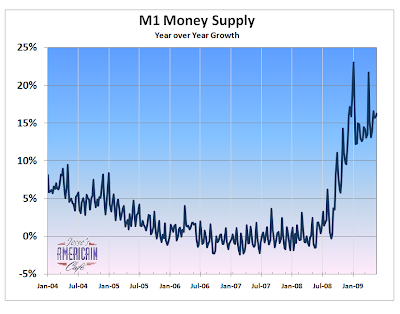

Here are some examples of money supply growth in the US. If you read our Primer you will know that MZM is by far the most important now that M3 is no longer reliably available.

Is money supply growing faster than real per capita GDP? Yes, decidedly so. And unless this trend changes significantly we will face a whopping monetary inflation.

Here is a chart that shows the buying of US debt that other countries have been doing through the NY Fed Custodial Accounts for a variety of motivations. Without this absorption of US money supply the value of the dollar would be greatly diminished relative to several other currencies. This is probably not a sustainable relationship but it has had a good long run because it is supported by the US as the world's superpower.

Other countries are essentially exchanging their productivity, their per capita GDP, for our excess money supply. This is why a US monetary inflation has remained manageable. Other countries are providing an artificial Demand for US debt at non-market prices.

One of the great errors of our generation has been the gradual and erroneous mispricing of risk through a variety of bad assumptions and convenient fallacies. Without the appropriate allowance for risk, there is no ability to discover valid pricing and allocation of capital.

The consequences of this abuse of reason are going to be enormous.

I do not see this improving quickly because the manipulation of risk for the benefit of the few, and the transfer of that risk to the public and the rest of the world, has tremendous value to the powerful status quo.

But the day of reckoning and settlement of accounts is coming, and as it approaches it will accelerate and come with a vengeance. For after all,

"Life is a school of probability." Walter Bagehot

School is almost out.

08 June 2009

SP Futures Hourly Chart at 2:30 PM

The volumes remain thin, and the market appears to be in the control of the big trading desks, flush with TARP money, and the demimonde of hedge funds and daytraders.

Be in this market for the short term only, or not at all. The manipulation of certain funds, options and indices makes this a 'professionals only' market.

Let's see if any serious support breaks, ahead of the second quarter earnings. The mainstream media is preoccupied with bread and circuses, and the financial news media is an extended informercial, if not propaganda machine.

There is no economic recovery, only a paper chase. The Obama Administration is failing to take the next steps of creating an industrial policy that places the US labor force and economy on an equal footing with the rest of the world, and reforming the financial system which is unbalanced to the point of deformity and inefficient to say the least.

06 June 2009

Is the USO Oil Fund "Like a Pyramid Scheme?"

Some very hard words being said about the USO Oil Fund ETF, sparked by comments from the Schork Report.

Some very hard words being said about the USO Oil Fund ETF, sparked by comments from the Schork Report.

Certainly the USO oil fund has not been tracking the performance of the commodity it attempts to represent, and has severely lagged the recent rally in West Texas Intermediate Crude.

This is in contrast to ETFs which target a percentage of the continuous commodity contract such as GLD or SLV. However, one should never mistake the commodity for what is essentially a derivative position, with little or no underlying guarantee of taking delivery of the commodity, as opposed to the futures markets.

This is different from the issue with levered ETFs which we reported on back in December, which reset their basis every day. But we think they also are contributing to volatility particularly in the last hour of trade.

Here is the information on USO. We do not believe in holding the ETFs for long periods of time, which in our lexicon is more than a couple of weeks. We understand that the CFTC is setting revised rules for "commodity pool operators."

"So how is this like a pyramid scheme? A pyramid scheme is funded by a constant flow of dollars into the venture by new investors. The second investor knowingly and willingly pays the first investor on the assumption he will get paid by the third investor… and so on. It’s similar to a Ponzi/Madoff scheme, with the key difference, investors don’t know (or don’t want to know as long as those alleged returns keep rolling in) they are being scammed.

The USO is being funded by a proliferation of new retail investors looking to diversify into “alternative investments” (which as far as we have been able to ascertain, alternative investment is a euphemism for Las Vegas style bets on commodities by retail investors tired of watching their 401Ks drop). More importantly, these investors are obviously out of their league, i.e. taking buy-and-hold positions in a contango which raises their cost basis every month they roll into the higher priced deferred contract.

We assume they are buying the USO because they are bullish. But in a peculiar way, their actions could be helping to prevent the market from rallying. These new investors are not funding a pyramid per se, but they are helping to fund storage. That is to say, with global demand in the doldrums, the contango will persist. And, as long as it lasts, traders will continue to front-run the rolls, which in turn will exacerbate the contango, which will then incentivize storage builds further, which will then ultimately weigh..."

USO: A Self-Propelled Pyramid? - Financial Times

USO Oil Fund or Just a Pyramid Scheme? Stockmaster.com

USO Oil Fund: All of the Drop and Some of the Gain - Phil's Stock World

Special thanks to Ilene over at Phil's Stock World for the comparison chart. We also enjoyed this quote from their article.

"In fact, it’s very possible that if you did an proper investigation (perhaps a Congressional one) you would find that MOST of the oil traded on the NYMEX has nothing to do with real demand at all but is pure speculation that is sold to retail investors as "commodity investing" or "inflation hedging" but what kind of inflation hedging loses 33% a year PLUS TRANSACTION FEES before a profit can be made? Oh and a funny note - who handles USOs cash and places trades on the ICE and NYMEX for them? Aw, you guessed it - Goldman Sachs!

So here you are giving your money to an ETF that gives its money to the biggest shark in the ocean, who chews off your legs in transaction fees and contango spreads BEFORE they even bother to circle around for the kill by gaming the market. NOT ONLY THAT, but the idiotic rules of the fund lead them to PUBLISH THE DAYS THEY ARE ROLLING IN ADVANCE so every little shark in the sea knows exactly when and where to feast on your bloody, bobbing carcas this month - and the next and the next and the next. Don’t worry though, once you are chewed up and digested, there will be a fresh round of suckers herded back into commodities and the commodity pushing stocks and ETFs every time GS, MS or Cramer need another payday. "

Should a bank guaranteed by public funds and the FDIC be active operators in speculative markets? Or should they be confined to the more conservative realms of commercial banks as they were under the Glass - Steagall regime?

We think the answer is obvious, especially given the fact that a great deal of the problems we face today are a direct result of the repeal of Glass-Steagall and the mixing of public funds with private greed in a coopted political and regulatory regime.