There are several fallacies making the rounds of the economic community, often put forward by pundits on the infomercials for corporate America, and also on the internet among well-meaning but badly informed bloggers.

The first of these monetary fallacies is that 'the output gap will prevent inflation.' The second is that a lack of net bank lending or other 'debt destruction' will require a deflationary outcome. Let's deal with the output gap theory first.

Output gap is the economic measure of the difference between the actual output of an economy and the output it could achieve when it is most efficient, or at full capacity.

The theory is that when GDP underperforms its potential, with unemployment remaining high, there can be no inflation because demand is weak and median wages will be presumably stagnant. This idea comes from neoliberal monetarist economics, and a misunderstanding of the inflationary experience of the 1970s.

The thought is that sustained inflation is due to a 'wage-price' spiral. Higher wages amongst workers cause prices to rise, prompting workers to demand higher wages, thereby fueling inflation. If workers do not have the ability to demand higher wages there can be no inflation.

While this is in part true, it tends to confuse cause and effect.

The cause of a monetary inflation, which is a broadly based inflation across most products and services relatively independent of demand, is often based in a monetary expansion of the currency resulting in a debasement and devaluation.

A monetary expansion is relatively difficult to achieve under an external standard since it must be overt and often deliberative. A gradual inflation is an almost natural outcome under a fiat currency regime because policy-makers can almost never resist the temptation of cheap growth and the personal enrichment that comes with it.

There can be short term non-monetary inflation-deflation cycles that tend to be more product specific in a market that is not under government price controls. But this is not the same as a broad monetary inflation or deflation.

The key difference is the value of the dollar which has little or nothing to do with a business cycle or product demand/supply induced inflation/deflation.

In the modern era the Federal Reserve can increase the money supply independent of demand by the monetization of debt, with the only restrictions on their ability to increase supply being the value of the dollar and the acceptability of US sovereign debt. This requires the acquiescence of the Treasury and the cooperation of at least one major money center bank.

People tend to invent 'rules' about how the money supply is able to increase, and confuse financial wagers and credit with money. This is in part because the average mind rebels at the reality behind modern currency and the ease at which it can be created. Further, people often invent facts to support theories that they embrace in an a priori manner.

In a pure fiat currency regime, the swings between inflation and deflation are almost always the result of policy decisions, with the occasional exogenous shock. A government decides to inflate or strengthen their money supply relative to productivity as a policy decision regarding spending, central bank credit expansions, banking requirements and regulations, among other things.

As a prime example of a rapid inflation despite a severe economic slump, what one might call uber-stagflation, is the Weimar experience.

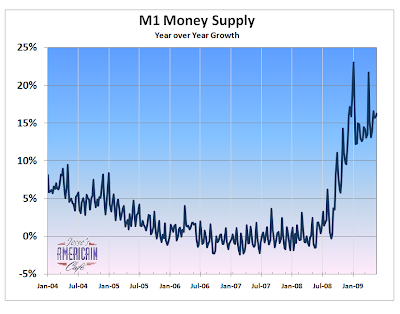

Since pictures are worth 1000 words, let me be brief by showing you a few important charts.

The basic ingredients of the Weimar experience are...

A high level of official debt issuance relative to economic growth

High unemployment with a slumping real GDP

Wage Stagnation

I should stop here and note that although the statistics at hand involve union workers, in fact unemployment was widespread in the Weimar economy. The saving grace of being in the union was that one was more often able to retain their jobs and some level of nominal wage increases.

Anyone who has read the history of the times knows that unemployment, underemployment and slack demand was rampant, and that hoarding was commonplace as people refused to trade real goods for a rapidly devaluing currency.

Rapidly Rising Prices Despite Slack Demand and High Unemployment

So much for the wage price spiral and the output gap.

A Booming Stock Market, at Least in Nominal Terms

Booming Price of Precious Metals as a Safe Haven Even While Basic Material Prices Slumped

Notice the plunge in the price of copper as the economy collapsed and gold and silver soared.

If one can obtain a copy, as it is out of print, one of the best descriptions of the German inflation experience is When Money Dies: the Nightmare of the Weimar Collapse by Adam Fergusson. There is a copy of the book available online for free here.

From my own readings in this area, the people who tended to survive the Weimar stagflation the best were those who:

1. Owned independent supplies of essentials including food and shelter and were reasonably self-sufficient.

2. Had savings in foreign currencies that were backed by gold such as the US dollar and the Swiss Franc

3. Possessed precious metals

4. Belonged to a trade union and/or had essential skills or government position which guaranteed a wage

5. Were invested in foreign equity markets, and even in the domestic German stock market for a time

People will argue now that the Fed understands that inflation is caused by perceptions, and that by managing those perceptions inflation can be avoided because even those prices are rising and the currency is being devalued, if they ignore it the inflation cannot reach harmful levels.

People will argue now that the Fed understands that inflation is caused by perceptions, and that by managing those perceptions inflation can be avoided because even those prices are rising and the currency is being devalued, if they ignore it the inflation cannot reach harmful levels.

This is what I call the "psychosis school" of behavioral economics.

Granted, perception is important, and managing perception may delay outcomes for a period of time. But unless the underlying cause of the problem is remedied during what is at best is an extended interlude, the resulting break in perception will ignite a firestorm of cognitive dissonance, loss of confidence, and social unrest.

In summary, in a purely fiat currency regime a sustained monetary inflation or deflation is an outcome of policy decisions regarding fiscal policy, monetary policy, and economic balance and output.

As long as the government is able to generate debt, deflation is a highly unlikely outcome. And when the government reaches the practical limits of debt creation, the underpinnings of the currency give way and the economy tends to collapse in a stagflationary slump.

There are no predetermined outcomes in a fiat monetary regime. Deflation, stagflation and hyperinflation are not 'normal' but are certainly possible if the central authority is permitted to abuse the real economy and the money supply for protracted periods of time.

What about Japan? Japan is the perfect example of a policy decision made by a fiat currency regime in what was decidedly NOT a free market, but under the de facto control of a highly entrenched bureaucracy, a single political party, and large corporate giants in pursuit of an industrial policy that favored exports and domestic deflation.

The difference between the Japan of the 1980s and the US of today could not be more stark. Choosing a deflationary policy and high interest rates as a debtor nation is economic and political suicide. It would be interesting to see what happens if the US elites try to take that path.

We will know if there is a true monetary deflation in the US because the value of the dollar will start increasing dramatically with regard to other hard assets, other currencies, goods and services, and precious metals and commodities. Prices will decline especially for imports as the dollar gains in purchasing power.

Remember that a true monetary inflation and deflation would only show up over time. Even in the Great Depression in the US, as demand slumped and prices fell, the stage was set for a significant devaluation of the US dollar and a rise in consumer prices well in advance of the eventual recovery of the economy that caused the Fed to tighten prematurely. As I recall the actual contraction in money supply lasted two years. This again highlights was an amazing piece of bad policy that Japan represents in its 'lost decade.'

People embrace beliefs for many motivations. So often I find they are not 'rational' and based on a scientific study of the facts, even on the most cursory level. Fear and greed and prejudice are often motivations that are surprisingly resilient, even in the face of overwhelming evidence against them. Leadership understands this well.

There are often appeals to private judgement. I do not care what you say, this is what I believe, what I think, what I feel. This is appropriate in the supra-natural realm, but in the natural realm there may be private judgement but the facts are public, and the outcomes are well beyond the complete control of the most fully-managed perceptual campaigns, at least so far in human experience.

"The lie can be maintained only for such time as the State can shield the people from the political, economic and or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State." Joseph Goebbels, of the perception modification school of economic thought

What is truth? It is difficult to estimate but not completely out of reach.

Our own view is that a serious stagflation with further devaluation of the US dollar as it is replaced as the world's reserve currency is very likely, after a period of slackening demand and high unemployment. A military conflict is also a probable outcome as countries often go to war when they fail at peace.

Weimar was not an anomaly although the level of inflation was indeed legendary. Argentina, post Soviet Russia, and most recently Zimbabwe are all similar examples. Serious Instances of Monetary Inflation Since World War II

There are many, many variables in play here, and policy decisions yet to be made. It is highly discouraging to see Obama's Administration fail so miserably to do the right things, but there is always room for hope, less so today than six months ago however.

Argue and shout grave oaths and wave our hands though we might, we are in God's hands now.

Let's see what happens.

A very special thanks to our friend Bart at Now and Futures who makes these charts, among other things, available on his highly informative web site for public review. If you are not familiar with his work you might do well to view it. We do not always agree, but he demands attention because of the rigor which he applies to his work for which we are grateful, always.