“Global central banks are getting more serious about diversification, whereas in the past they used to just talk about it,” said Steven Englander, a former Federal Reserve researcher who is now the chief U.S. currency strategist at Barclays in New York. “It looks like they are really backing away from the dollar.”

If

The Independent and Robert Fisk can be dismissed as the tabloid fringe by the mainstream media and those desperately clinging to status quo, here is a piece on the diminishing dollar from the radical paparazzi known as Bloomberg news.

Currencies can have significant volatility even within long term trends, due to short squeezes and official intervention. Forex trading is for professionals only, as most amateurs become fooled by the leverage and the opacity of the market's positional dynamics, ie. they don't know who the patsy is at the table.

That being said, there is an interesting aspect to the

currant position of the dollar as the long time, but fading,world's reserve currency known as

The Prisoner's Dilemma.

In a situation such as this, the country which quietly sheds dollars first takes a lesser loss on their reserves than those who hold, but also risks punishment by the US and the G7 for deviating from the consensus of central banks and their financial engineers.

This is further complicated by the entanglement of some exporting countries in their own mercantilist support for large dollar surpluses. This requires a replacement for the dollar to be phased in slowly, and to gain support amongst non-US trading partners of the major exporting countries. The matter of the petrodollar is also an important aspect, but can probably wait until the move out of the dollar is well underway.

Is there anyone buying US dollar Agency Debt these days besides the Fed? It used to be a favorite among the Central Banks, but was dumped them in an amazingly short period of time once the perception of risk changed around the world. Almost overnight in Central Bank time.

As we pointed out several times previously, the SDR, which is a basket of currencies, is a logical replacement for the US dollar reserve. It is rebalanced in its composition every five years, and the next remix is going to occur in 2010.

If the equity market breaks and the US dollar carry trade reverses, the dollar may catch a sharp rally, which will bring the strong dollar crowd, especially deflationists, out of their funk and kicking their heels in "mission accomplished" mode. The celebration is most likely to be, once again, a kind of a 'false Spring' that merely serves to draw them deeper into losses, and ultimately over a cliff.

This sort of historic change always starts slowly, first a trickle, then a trend, but thereafter can quickly become a torrent.

Bloomberg

Dollar Reaches Breaking Point as Banks Shift Reserves

By Ye Xie and Anchalee Worrachate

October 12, 2009 00:40 EDT

Oct. 12 (

Bloomberg) --

Central banks flush with record reserves are increasingly snubbing dollars in favor of euros and yen, further pressuring the greenback after its biggest two- quarter rout in almost two decades.

Policy makers boosted foreign currency holdings by $413 billion last quarter, the most since at least 2003, to $7.3 trillion, according to data compiled by

Bloomberg.

Nations reporting currency breakdowns put 63 percent of the new cash into euros and yen in April, May and June, the latest

Barclays Capital data show. That’s the highest percentage in any quarter with more than an $80 billion increase.

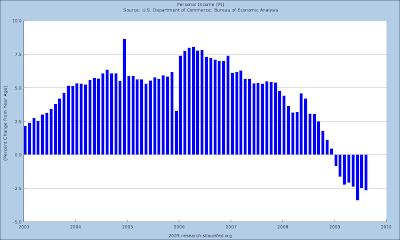

World leaders are acting on threats to dump the dollar while the Obama administration shows a willingness to tolerate a weaker currency in an effort to boost exports and the economy as long as it doesn’t drive away the nation’s creditors. The diversification signals that the currency won’t rebound anytime soon after losing 10.3 percent on a trade-weighted basis the past six months, the biggest drop since 1991.

“

Global central banks are getting more serious about diversification, whereas in the past they used to just talk about it,” said Steven Englander, a former Federal Reserve researcher who is now the chief U.S. currency strategist at Barclays in New York. “

It looks like they are really backing away from the dollar.”

Sliding ShareThe dollar’s 37 percent share of new reserves fell from about a 63 percent average since 1999. Englander concluded in a report that the trend “accelerated” in the third quarter. He said in an interview that “for the next couple of months, the forces are still in place” for continued diversification.

America’s currency has been under siege as the Treasury sells a record amount of debt to finance a budget deficit that totaled $1.4 trillion in fiscal 2009 ended Sept. 30.

Intercontinental Exchange Inc.’s Dollar Index, which tracks the currency’s performance against the euro, yen, pound, Canadian dollar, Swiss franc and Swedish krona, fell to 75.77 last week, the lowest level since August 2008 and down from the high this year of 89.624 on March 4. The index, trading at 76.489 today, is within six points of its record low reached in March 2008.

Foreign companies and officials are starting to say their economies are getting hurt because of the dollar’s weakness...

Dollar’s Weighting

Developing countries have likely sold about $30 billion for euros, yen and other currencies each month since March, according to strategists at Bank of America-Merrill Lynch.

That helped reduce the dollar’s weight at central banks that report currency holdings to 62.8 percent as of June 30, the lowest on record, the latest International Monetary Fund data show. The quarter’s 2.2 percentage point decline was the biggest since falling 2.5 percentage points to 69.1 percent in the period ended June 30, 2002.

“The diversification out of the dollar will accelerate,” said

Fabrizio Fiorini, a money manager who helps oversee $12 billion at

Aletti Gestielle SGR SpA in Milan. “People are buying the euro not because they want that currency, but because they want to get rid of the dollar. In the long run, the U.S. will not be the same powerful country that it once was.”

Central banks’ moves away from the dollar are a temporary trend that will reverse once the Fed starts raising interest rates from near zero, according to Christoph Kind, who helps manage $20 billion as head of asset allocation at Frankfurt Trust in Germany.

‘Flush’ With Dollars

“

The world is currently flush with the U.S. dollar, which is available at no cost,” Kind said. “If there’s a turnaround in U.S. monetary policy, there will be a change of perception about the dollar as a reserve currency. The diversification has more to do with reduction of concentration risks rather than a dim view of the U.S. or its currency...”

Dollar Forecasts

The median estimate of more than 40 economists and strategists is

for the dollar to end the year little changed at $1.47 per euro, and appreciate to 92 yen from 90.13 today.

Englander at London-based

Barclays, the world’s third- largest foreign-exchange trader, predicts

the U.S. currency will weaken 3.3 percent against the euro to $1.52 in three months. He advised in March, when the dollar peaked this year, to sell the currency. Standard Chartered, the most accurate dollar-euro forecaster in

Bloomberg surveys for the six quarters that ended June 30, sees the greenback declining to $1.55 by year-end.

The dollar’s reduced share of new reserves is also a reflection of U.S. assets’ lagging performance as the country struggles to recover from the worst recession since World War II...

“

The world is changing, and the dollar is losing its status,” said

Aletti Gestielle’s

Fiorini. “If you have a 5- year or 10-year view about the dollar, it should be for a weaker currency.”

To contact the reporters on this story: Ye

Xie in New York at yxie6@bloomberg.net;

Anchalee Worrachate in London at aworrachate@bloomberg.net

Team coverage today on Bloomberg by the Money Honeys as the Dow Jones Industrial Average crossed 10,000 intra-day, led by J.P. Morgan, in a move that surely epitomizes the illusions of wealth granted by modern accounting practices.

Team coverage today on Bloomberg by the Money Honeys as the Dow Jones Industrial Average crossed 10,000 intra-day, led by J.P. Morgan, in a move that surely epitomizes the illusions of wealth granted by modern accounting practices.