The US financial crisis is always and everywhere caused by the triumph of short term greed in support of Ponzi schemes and frauds, perpetrated by a handful of Wall Street bankers and their accomplices in the political process and the media, facilitated by the wholesale weakening of the American mind and character and European and Asian greed and gullibility.Everything else is commentary.

21 October 2009

Jesse's Grand Unified Theory of the American Financial Crisis

Trend Change: Official Purchases from Central Banks Supporting Gold Price

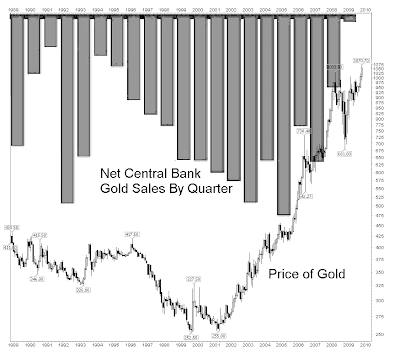

Starting in 1989, the world's Central Banks became steady net sellers of their gold reserves which had been accumulated over the years.

Starting in 1989, the world's Central Banks became steady net sellers of their gold reserves which had been accumulated over the years.

In addition to official gold sales, the banks also began to engage in gold leasing contract with bullion banks such as J. P. Morgan, Goldman Sachs, et al. The gold was leased, and the bullion bank sells it in the market, paying the lease difference in a sort of gold carry trade.

And now for something completely different, it appears that the world's central banks may once again become net buyers of gold, after a twenty year campaign of selling gold from their vaults into the public markets, creating a steady downward pressure on the price of gold, that contributed to its long bear market.

There is some thought that the central bank gold sales had been designed to support the strong dollar as the reserve currency of the central banks. Gold had been viewed as a threat. Documents which have been disclosed and quotations from the transcripts of central bank meetings do support a concern that the price of gold could rise, destabilizing the fiat regime which had been in place since the US went off the international gold standard in 1971.

Starting in 2001, gold began a bull market based in part by the decline of the US dollar as the undisputed reserve currency of the world. And now the banks are reconsidering their position, and in some cases nervous central bankers seeking to recover their leased bullion, even adding to their reserves by new purchases.

This is not to imply that gold will replace the dollar. Rather, if the intended target is indeed the SDR, which comes up for rebalancing in 2010, banks may need to have gold on hand since it is thought to be favored as a component of the basket of currencies of which the new SDR will be created.

With regard to the proposed IMF sale of 403 tons of gold, there is speculation that this amount may be spoken for already by a few central banks who wish to convert some of their existing US dollar reserves to gold. At a market price of $1,050 per ounce, that would be a total sale of about $13.7 billion. That would barely make a dent in China's dollar reserves should be they so inclined to cut a check.

And of course there are the usual rumours of bullion banks who are heavily 'naked short' gold, having sold the leased product, and are unable to buy physical bullion in size with which to deliver it. There is also some talk of bullion banks having engaged in 'fractional gold' sales to customers holding unallocated bullion. This is cited as one reason why the COMEX in the US has a rule that allows deliver in the futures markets to be made in paper,

Whatever the truth may actually turn out to be, there can be no disputing that an end to twenty years of steady selling of gold, a relatively small and tight market compared to most others, in which central gold reserves represent a significant source of supply, is significant news indeed.

"In its just released Gold Survey 2009 GFMS suggested that the official sector in aggregate became a net buyer in the second quarter of 2009 and forecast that the second half of the year would see further net purchases. This represents a remarkable change of direction for a market that has been used to absorbing substantial volumes of gold sold by central banks over the last decade."GFMS Report

"Over the next year or two this new trend may be obscured somewhat by the planned sales of 403 tonnes of IMF gold, assuming, of course, that there is no off-market transfer of some or all of this bullion to an official sector buyer, something we think improbable but by no means impossible. Once the IMF sales programme is completed, however, we would expect the official sector as a whole to have a broadly neutral impact on the market. This would represent a return to the situation prevailing in the 1970s and 1980s when the official sector was a net buyer in some years and a net seller in others. Besides the obvious supply/demand implications for gold, such a change from net sales to something close to ‘neutrality’ would be highly positive for gold prices, as it ought to provide a major boost to sentiment and confidence in the yellow metal."

“Central banks stand ready to lease gold in increasing quantities should the price rise.” Alan Greenspan, July 24, 1998

A 'fractional reserve' bullion bank would be unnerved by this trend, with visions of potential insolvency if it continues and they are not able to cover their obligations. Talking their book would require them to be quite negative, in the hopes of creating supply in the form of a decent pullback, allowing them to cover their 'short positions' and failed to hedge them adequately.

The biggest forward hedger in the sector, Barrick Gold, was recently forced to capitulate and announce the need to raise billions to buy out of their forward obligations. This still does not help those who are in need of the physical product.

The situation in the silver market is even more potentially explosive, since the CFTC has allowed two or three banks to assume enormous short positions, unprecedented for any other commodity market, amounting to a massive naked short without any conceivable hope of being supplied at today's market prices. But as long as they can keep a few steps ahead of the need to deliver the goods, the game can go on.

A truly remarkable financial system, which can only serve to puzzle future generations. "What were they thinking?"

When the Financial Journalists Were Indeed 'Pimping' for Wall Street

Here is a interesting moment in US financial journalism on CNBC. It does not describe the basis of the lawsuit very well, and does become a bit surreal at times. There is a nearly priceless moment at the end when the frustrated Attorney General of California Jerry Brown asks Dennis Kneale and Michelle Caruso-Cabrera, "Are you pimping for (State Street Bank) the defendant?"

You can watch the video and assess things for yourselves.

This question of the role of financial journalism brings to mind a little remembered vignette from the 1930's. After the Crash and the slide into Depression, there were a number of government investigations conducted into the varieties of financial fraud, of which there were many, and became the basis for a number of laws, most of which were overturned just prior to our current series of crises starting in 2000.

There was a particularly colorful character named A. Newton Plummer. He was a culprit, a bagman I think they were called, but also had become a whistle blower, a witness, after having been apprehended.

And a right effective witness he proved to be, since he had kept a suitcaseful of cancelled checks that showed that a great many, if not most, of the financial journalists in the major eastern media were regularly 'on the take' from Wall Street, in promoting certain ideas, certain stocks, legislation, whatever was required. Apparently in those days of stock operators and pools, prior to the SEC, it was a common practice to deceive the small investor through the manipulation of price action and news. Can you imagine that. And in less-regulated, naturally efficient markets.

We do not hear much about A. Newton Plummer. But he did write a book about what he had done as the bagman, after his testimony was buried, deeply. Probably to help restore public confidence in the troubled financial markets of the Great Depression.

The Great American Swindle Incorporated

Plummer, A. Newton

A. Newton Plummer, 1932. 2,000 copies.

I have a copy of his privately published book. It is an interesting read. Everything he said was documented. It was a time when the news media was undoubtedly 'pimping for Wall Street.' And they helped to create a credit bubble, the bubble that broke the world, and blamed it on a spontaneous mass delusion, and financial innovations like consumer credit.

While CNBC has its journalistic standards, this does not seem to be their finest moment. Both Dennis and Michelle are seasoned journalists. But Jerry Brown is a consummate politician, and is to be baited carefully, and at your peril.

CNBC Interview with the California Attorney General

Things are much more sophisticated these days, and the times of 'yellow journalism' with moguls like W. Randoph Hearst starting wars and promoting causes using the power of their media conglomerates are a thing of the past.

But journalists who specialize in a specific sector all the time, whether it be finance or politicians, must be on their guard not to closely identify with the industry which they are supposed to be objectively covering. An emotional attachment can develop, a mindset can be imprinted, when you spend all day speaking with people who have a particular viewpoint of the world based on their own needs and objectives and biases.

And it still bothered me that I came away from this interview without understanding the nature of the lawsuit, and obtaining no real facts about it. Dennis Kneale seems to imply that the Pension funds were promised a specific price and it was delivered, and California was merely griping about the deal unjustifiably. And then Michelle engaged in what might be charitably called an ad hominem attack.

So here are the facts as reported by The New York Times:

Still, the lawsuit raises troubling questions about the bank’s practices and controls. It grew out of an inquiry by California state investigators who were looking into claims made against State Street by unidentified whistle-blowers that accused the bank of adding a secret and substantial markup to the price of their currency trades. The whistleblowers alleged that the scheme cost State Street clients about $400 million annually and dated back to 1998.It sounds to me that State is being accused of conducting trades for a fee, but then padding the associated trades to skim a bit extra. This is not an unheard of practice, especially when a trading firm is dealing with what they consider to be a 'dumb client.' There is a mindset among some trading groups that says if you are dumb enough to do business with me, I am justified in ripping your face off, even if it is a little bit at a time. We will have to see how the court case proceeds to find out if the accusations are true.

According to the California Attorney General, State Street executed about $35.2 billion in currency trades for Calpers, the California Public Employees’ Retirement System, and Calstrs, the California State Teachers’ Retirement System, from 2001 to this fall.

State Street tellingly referred to the state pension funds as “dumb” clients since they allowed the bank to handle foreign exchange transactions for them, according to a complaint filed by the whistleblowers. Smart clients, it said, traded directly with the bank and obtained better rates.

The lawsuit contends that State Street concealed fraudulent pricing practices by entering false exchange rates into electronic trading databases and reporting false prices in the account statements that it provided Calpers and Calstrs. The lawsuit also accuses State Street of deliberately failing to include time stamp data in its reports so that the pension funds could not verify the actual cost of the trade.

Now, would it have been so hard for CNBC to find these facts out and ask about them rather than take such a stumbling and ill-prepared stance into the interview, and then insult the interviewee and disparage his motives?

They are capable of doing much better professional work than this.

20 October 2009

Green Shoots: Morgan Stanley Resumes Its Donations to Congress

Just business as usual. Nothing to see here.

Just business as usual. Nothing to see here.

They all have the feed bag on in Washington these days. Feathering their nests for the long Kondratiev winter which they have created.

Approaching winter perhaps, but there is the smell of graft upon the air. Or is that just the burning of the infrastructure of freedom?

It does take a special kind of greed and arrogance to accept contributions from the very banks which you recently rescued with billions in taxpayer money, and who are still receiving billions in Federal support from the Fed, and dictating the terms upon which they will allow themselves to be 'reformed.' Thank you for watering down the derivatives bill, Barney.

2008 Campaign Contributions to Congressmen:

Finance and Credit

Hedge Funds

Securities and Investment

Bloomberg

Morgan Stanley Resumes PAC Giving After TARP Funding Repayment

By Jonathan D. Salant

Oct. 20 (Bloomberg) -- Morgan Stanley’s political action committee resumed donations in the third quarter of this year after the New York-based investment bank paid back its U.S. taxpayer rescue funds, Federal Election Commission records show.

The PAC had ceased making campaign contributions until Morgan Stanley repaid $10 billion in June under the Troubled Asset Relief Program. After making no donations during the first six months of this year, Morgan Stanley gave $157,500 between July 1 and Sept. 30, including $120,000 in September.

The investment bank made $374,000 in political contributions during the first nine months of 2007; its donation total for the comparable period this year represents a 58 percent reduction.

“Since repaying TARP, Morgan Stanley’s PAC has resumed normal PAC-related activity,” Carissa Ramirez, a spokeswoman for Morgan Stanley, said in an e-mail yesterday.

Most of the other large U.S. financial institutions have reduced their political giving at a time when Congress is drafting new financial regulations. Just two of 10 institutions reported increases in their PAC contributions through the first nine months of this year, compared with the same period in 2007.

Morgan Stanley has long been a major political giver. Its employees contributed $3.7 million for the 2008 elections, fifth among financial companies, according to the Center for Responsive Politics, a Washington-based research group.

Donation to Frank

The company’s PAC donations this year include $2,500 to Representative Barney Frank, a Massachusetts Democrat who chairs the House Financial Services Committee. Frank’s panel is writing the revamp of financial regulations. The PAC also gave $5,000 to Representative Melissa Bean, an Illinois Democrat, and Representative Jim Himes, a Connecticut Democrat. The two lawmakers co-chair the financial services task force of the pro- business New Democrat Coalition.

The PAC of Bank of America Corp., the biggest U.S. lender, gave $195,000 in donations during the first nine months of 2009, as compared with $349,122 during the same period in 2007, a decline of 44 percent.

The US Power Elite: An Alliance of Convenience or a Ménage à Trois?

"I submit that our spendthrift government, the Federal Reserve System and the TBTF banks together now comprise the paramount political tendency in America today. This tripartite "Alliance of Convenience," let's not call it a conspiracy, fits beautifully into the corporatist mold that seems to be America in the 21st Century - but only viewed by the elites in cities like New York and Washington. Many Americans of all political descriptions oppose this corrupt and unaccountable political formulation." Chris Whalen, Institutional Risk Analytics

“Fascism should more appropriately be called Corporatism because it is a merger of state and corporate power." Benito Mussolini

There can be little doubt now that Chris Whalen is not only a subject matter expert of the first order in the field of banking, but is additionally a brilliant mind, being able to step outside his discipline and connect the dots using his knowledge in other diverse fields including politics, history, and organizational behaviour.

I cannot judge where his thinking and my own diverge, because we do not disagree at all in this exemplary characterization of the world economy as it is today, I suspect that the solution, the path to a stable model, might offer some differences in implementation, but nothing beyond that. One cannot tell if there is a taint of the 'Chicago School' of free market romanticism in his views until one sees his detailed model of a post-recovery regulatory regime.

He does seem to be overly dismissive of a Europe in caricature, but makes many good points which are important to address at the EU. 'Europe' is one entity in the same way that New York is New Orleans. Germany has a difficult path to steer, but his criticism is right, and we have been very critical of Peer Steinbrück among others.

There are some enormous implications in the regime of the dollar as the world's currency that most economic commentators just do not 'get.' There can be no serious dollar deflation while the dollar has that role, without the world grinding to a virtual halt. This essay alone is worthwhile if one can understand that, which is a 'difference' between the US in 1929 and 2009.

But the description of the unholy alliance among Washington - the Fed - and the Banks is exceptionally good. Each depends on the other two. Washington wishes to spend while rewarding its friends, the Fed is only too eager to please by printing money to maintain the financial system which they have engineered, and the Primary Dealers on Wall Street distribute and manage the money while taking a hefty slice of the product for themselves.

Chris Whalen calls this an Alliance of Convenience, implying that of course there is no conspiracy per se, but each member of this triumvirate is merely obtaining and enabling from the others.

I would call it a willing Ménage à Trois, literally the eternal triangle, because of course this arrangement has been repeated throughout history among people of certain types who seek each other out by design.

Bootleggers need protection, corrupt politicians need criminals, and the distributors need a product. Kings desire legitimacy, churchmen need powerful defenders, and warlords wish to be paid extremely well.

There is also a great deal of intermingling and changing of positions among the actors in this arrangement. The revolving door between the Congress and the financial interests is obvious. It is hard to tell just who is on top at any given moment.

The only check and balance on this arrangement, besides the intrusion of the law as embodied in the Constitutional limitations on power, is the value, the acceptability of the dollar and the bond.

One cannot tell if Chris has thoroughly thought through the implications of what he has concluded, the Ponzi nature of the US financial system, and the consequences of its collapse. If he does, he should have more sympathy for his colleagues at the Fed who, in the American colloquial sense, should be 'scared shitless' of what they have done, if they have a mind of their own at all.

Institutional Risk Analytics

Are the Fed, the Congress and the Primary Dealers an Alliance of Convenience?

October 20, 2009

+For the better part of a year, many smart, talented people in the worlds of finance and economics have been struggling to describe the causes of the financial crisis and solutions. I witnessed such a debate recently at the international banking conference sponsored by the Federal Reserve Bank of Chicago. It is fair to say that the representatives from Europe, Asia and the Americas continue to have differing views of the crisis and how to address it; more regulation or less, more capital or less, and whether markets should be re-regulated.

Far from being dismayed by such disparity of views, I am encouraged by this difference of opinion and I hope that the debate intensifies in coming months. To recall the words of Alfred Sloan, it is only by sharpening our differences can we understand complex problems and understand those distinctions which matter and those which do not. But as we build a narrative to understand the crisis, we seem to be converging on one view of the causes of the financial "bubble" and thereby ignoring other perspectives and views that might be instructive.

In his books such as The Black Swan, the author Nassim Taleb warns us that the news media and particularly condensed versions of reality such as television force all of us into a view of the world that is often over simplified. As social creatures, we all tend to use narrative to describe and understand complexity. We speak and write and discuss. Gradually we distill our impressions and these views merge together into the collective understanding, the "official" story.

But just as bubbles are probably not a good technical metaphor to describe financial crises, we need to beware the tendency to simplify and categorize complex events when it comes to public policy for our financial institutions and markets. Americans have a wonderful tendency to look at public policy from a vertical perspective, in silos, that suggest we can somehow isolate monetary policy and bank supervision and fiscal policy into neat, separate little boxes that are never affected or disturbed by one another.

In particular, this comes to mind when we hear US economists talk about foreign capital inflows as an externality. Those fiat paper dollars belong to us. We printed them and of course they are returning home in search of at least a nominal return. That's why we have problems such a mortgage market bubbles and a surfeit of capital inflows, then a sudden outflow of these same pools of credit. In a fiat money system, after all, there is no "money" in a classical sense, merely credit. These large flows of fiat paper dollars, I submit, explain the increasingly manic behavior of markets, investors and large banks over the past decade as true investment opportunities are increasingly outnumbered by speculation.

I agree with Vince and the other speakers about the nature of the problem created by America's addiction to debt and inflationary monetary policy, and how difficult it makes it for us to address more basic structural problems in our economy. This is especially true so long as the rest of the world is willing to allow the US to retain a global monopoly on dollars as the primary means of exchange and as a short-term store of value. But I believe to achieve a true understanding of the crisis, we must step back and take a political perspective.

The evolution of the US from a democratic republic into a more statist, more corporate formulation that looks more and more like the states of Europe and Asia every day, is what makes concepts such as too big to fail ("TBTF") and "systemic risk" viable. The migration of the US from a society based on individual liberty, work and responsibility, to a society where a largely corporate and socialist perspective holds sway, in my view, is changing the way we look at our financial and monetary system. Because of the huge and some would say illegal subsidies provided to Wall Street firms during the early part of the crisis, particularly in cases such as the rescue of American International Group, the American electorate is engaged in an intense, sometimes angry debate about financial policy and government.

This debate is also very intense among the bank regulatory community, where you have FDIC Chairman Sheila Bair, the FDIC and state regulators, and smaller banks supporting a traditional if somewhat legalistic American view of banks regarding issues like insolvency and resolution, on the one hand. Then we have the internationalist tendency represented by the large banks, the Federal Reserve Board, Treasury and White House, who like the leaders of the EU advocate a socialist and proudly statist perspective where banks are "too big to fail" and under the table subsidies to well-connected institutions are encouraged. Whereas in the 1800s the New York banks advocated hard money and sound banks, and the inflationists where among the agrarian populist ranks, today it is Washington, Paris and Berlin, among the largest dealer banks and their political allies, that are found advocates of inflation and public sector debt.

Our friends at the Fed and Treasury seem to know nothing about American values when it comes to insolvency or bank safety and soundness. Our founders embedded bankruptcy in the Constitution not out of generosity, but because they knew that prompt resolution and liquidation of claims benefitted all of society. The internationalist set, like their counterparts in Europe and Japan, talk of the ill-effects of resolving zombie banks via traditional bankruptcy, but fail to notice the benefits with equal concern. If we do not have losers and well as winners in our society, then we shall have neither. For every loser in the case of the failures of Lehman Brothers and Washington Mutual, there were winners at JPMorganChase and Barclays PLC, which bought the assets of the failed companies for pennies on the dollar and absorbed thousands of valuable employees.

The internationalist tendency prefers instead to align themselves with the view of foreign nations whose governments are predominantly socialist in economic orientation and authoritarian politically. These politicians and their economists prefer to pick "losers as winners," to paraphrase my friend Bob Feinberg. Look at the situation in Germany, where the political leadership refuses to even acknowledge the depth of the crisis in the state or private banking sector. Germany is a case study illustrating the corruption and incompetence that prevails when you allow the political class to take unilateral control over all financial institutions and markets.

It is both fascinating and troubling for me to watch members of the Fed staff who I love and respect as friends and former colleagues being seduced by the siren song of political expediency when it comes to issues such as "systemic risk," a political concept that has no place in a serious discussion of finance. Certain banks, say Fed and Treasury officials, are "too big to fail." But just as true finance is about the arithmetic certainty of market prices and cash flow rather than speculative models, Fed officials seem to confuse safety and soundness in a financial sense with pleasing the political class that inhabits both of the major political parties in Washington.

I hear my colleagues at the Fed recite the mantra about how Lehman Brothers should not have been "allowed" to fail and large banks are too connected globally to be subject to traditional resolutions, as in the case of the failures of both Lehman and Washington Mutual. When I point out to these same Fed officials that Lehman had been for sale, unsuccessfully, for a year, I hear only silence. When I note that Harvey Miller working as bankruptcy trustee and SIPIC and the good people of the Southern District of New York did a very fine job handling the Lehman insolvency, there is likewise only silence from the TBTF advocates. Instead of being used as an excuse for inaction and delay, the insolvency of Lehman Brothers and WaMu should be held up as examples of the American legal system functioning well.

When you challenge officials at the Fed and Treasury about TBTF and systemic risk, they point to the fact that using bankruptcy to resolve complex institutions is too damaging to "confidence." Vince mentions in his fine presentation that avoiding damage to confidence is a top-level priority for policy makers. We must avoid damaging sacred confidence. But if you have such a rule, then you cannot have a true market system. Markets must be allowed to go from exuberance to terror in order to have a free market system and also a free and democratic society. Investors, bank managers and politicians can only be held accountable if failure is allowed to occur. If we allow government to legislate confidence via the imposition of "systemic risk" regulators and rules such as TBTF, then I suggest that we will not be a free society for much longer.

If you want to see where the US is headed by embracing concepts such as "systemic risk" and TBTF into public policy, then just look at the EU, where whole nations have lost their private banking sector, where there is no private capital formation to create new banks and the state-sector has largely monopolized many areas of personal and commercial finance. In 2008, there were more de novo banks created in the great state of Texas than in all of the EU. By not allowing failure and insolvency for even the largest banks and companies in the US, we deprive our citizens of opportunity.

That the largest portion of the damage done to EU banks in the latest speculative cycle is found among state-sector banks should come as no surprise. Claims by EU politicians as to the effectiveness of regulation in terms of mitigating financial risk seem to be belied by the facts when it comes to regenerating a healthy banking system. EU politicians and bureaucrats may have regulated away bad acts and freedom of choice for private investors, but that only means that the misbehavior has migrated to the public sector and is for the benefit of entrenched political elites. We see the same pattern now in the US.

Let's turn now to Fed policy, an area where Vince spent a great deal of time in his research, in terms of whether the Fed can be both an effective safety and soundness regulator and a monetary authority, especially given the corporatist political evolution already mentioned. If you really analyze the way in which political power flows in the US today, there are three significant groupings:

First we have a central bank that manages a global fiat dollar system based on a currency unit that is not convertible into specie or commodities. The Fed enables the issuance of dollar debt by the Treasury and imposes no effective policy restraint, no check to balance US fiscal policy. In fact, since the October 1987 crisis, the Fed has never said "no" to the Congress or the markets in terms of liquidity or collateral. It has only been a matter of price. When was the last time we had a Fed Chairman willing to say no to the politicians in the White House or the Congress? Paul Volcker? I suggest that it has been far too long.

Second we have a corrupt, entrenched Congress that equates tax revenues with the proceeds of debt. All fiat paper dollars are one and the same to our esteemed Congress, which believes that the borrowing capacity of the US is infinite. There is no effective limit on spending to keep the electorate mollified and the entrenched political class in power. The Fed enables the spending habit of the Congress and whatever administration occupies the White House.

Some of the supporters of former Fed Chairman Alan Greenspan like to argue that no Fed chairman could have stopped the party in housing early; that no Fed chairman could go up to Capitol Hill and say tough things to members of the Congress about housing policy or public spending. I think that tough talking Fed governors is precisely what we need. If the heads of independent agencies are not ready to lose their jobs every day and be willing to take tough policy stands on equally tough issues, then we need new leaders. I would hold up Chairman Bair at the FDIC as an example of a public servant who understands that part of her job is to offer advice to the Congress and the White House, and not to be a creature of politics or special interests as so many of our supposed leaders seem to be today.

Thirdly we have the dealer community, especially the members of the primary dealers of US government securities, who have a special relationship with the Fed and the Treasury, most recently by placing former Wall Street chieftains and their minions as Secretary of the Treasury. Many of these banks created the trillions of dollars in toxic waste that has crippled our financial system and were subsequently bailed out by the extraordinary actions taken by NYFRB President Tim Geithner and the Fed's Board of Governors starting last year.

These large dealers such as JPMorgan, Goldman Sachs, Wells Fargo, Morgan Stanley and Citigroup, enable the US Treasury to sell debt and thereby keep the US fiat dollar system stable for another day. These large, TBTF banks are also the mechanism through which the Fed executes monetary policy or at least used to until the Fed itself grew operationally into a de facto primary dealer in its own right, merging fiscal and monetary policy explicitly.

In order to boost the profitability of these TBTF dealer banks, the Fed and the Congress encouraged the creation of opaque, unregulated over-the-counter ("OTC") markets for derivatives and complex assets. The growth of OTC markets were a retrograde development in historical terms and again illustrate the tendency of the Fed and Treasury, the Congress and the large banks to take an anti-American view of issues like market structure, transparency and solvency, encouraging instruments of fraud like OTC derivatives and private placements, while the FDIC, state regulators and smaller banks tend to oppose such innovations. By allowing the creation of derivatives for which there was no basis, the Fed enabled some of the worst acts by the dealer community.

OTC markets for derivatives and structure assets have been the primary source of "systemic risk" over the past 24 months and have contributed the lion's share of losses sustained by banks and the taxpayers of the industrial nations. Indeed, without the active support from the Congress and the Fed for "innovations" such as OTC and opaque, unregistered complex structured securities, the current crisis might never have occurred. It important to be very specific as to the alien nature of things like "dark pools" and closed, bilateral market structures such as OTC, structures that go against the most basic American principles of transparency and fairness.

When Vince and I were in Chicago for the Fed's international banking conference, I reminded our colleagues that the analog to the political checks and balances revered in the history books is a public, open outcry market. Whether virtual or physical, an open market structure is essentially for having true confidence in markets. When markets start to slip back into retrograde formulations like OTC, we are also eroding the very basis of American markets, namely openness and fairness. If our OTC markets are deliberately opaque and unfair, deceptive by design as I told the Senate Banking Committee earlier this year, then can we reasonably hope that our financial institutions and markets will be stable?

I submit that our spendthrift government, the Federal Reserve System and the TBTF banks together now comprise the paramount political tendency in America today. This tripartite "Alliance of Convenience," let's not call it a conspiracy, fits beautifully into the corporatist mold that seems to be America in the 21st Century - but only viewed by the elites in cities like New York and Washington. Many Americans of all political descriptions oppose this corrupt and unaccountable political formulation. I hope and expect that these differences will become even more pronounced as the election approaches next November.

The difference that separates the United States from the rest of the world is the difference which has always divided us, namely our at least theoretical devotion to individual liberty and free markets. Until we break the Alliance of Convenience between the Congress, the Fed and the large, TBTF banks and force our public officials to embrace core American values regarding transparency, insolvency and accountability, we will not in my view find a way out of the crisis. In may ways, the differences that separate the popular view and the views of our political elite have been turned on their heads compared with a century ago, but this does not mean that the debate and resulting political competition for ideas will be any less intense.

19 October 2009

Matt Taibbi: Wall Street's Naked Swindle

This is worth reading.

Wall Street's Naked Swindle by Matt Taibbi.

Closing quote from this story:

"The new president for whom we all had such high hopes went and hired Michael Froman, a Citigroup executive who accepted a $2.2 million bonus after he joined the White House, to serve on his economic transition team — at the same time the government was giving Citigroup a massive bailout. Then, after promising to curb the influence of lobbyists, Obama hired a former Goldman Sachs lobbyist, Mark Patterson, as chief of staff at the Treasury. He hired another Goldmanite, Gary Gensler, to police the commodities markets. He handed control of the Treasury and Federal Reserve over to Geithner and Bernanke, a pair of stooges who spent their whole careers being bellhops for New York bankers. And on the first anniversary of the collapse of Lehman Brothers, when he finally came to Wall Street to promote "serious financial reform," his plan proved to be so completely absent of balls that the share prices of the major banks soared at the news.

The nation's largest financial players are able to write the rules for own their businesses and brazenly steal billions under the noses of regulators, and nothing is done about it. A thing so fundamental to civilized society as the integrity of a stock, or a mortgage note, or even a U.S. Treasury bond, can no longer be protected, not even in a crisis, and a crime as vulgar and conspicuous as counterfeiting can take place on a systematic level for years without being stopped, even after it begins to affect the modern-day equivalents of the Rockefellers and the Carnegies. What 10 years ago was a cheap stock-fraud scheme for second-rate grifters in Brooklyn has become a major profit center for Wall Street. Our burglar class now rules the national economy. And no one is trying to stop them."

Where David Einhorn Sees Value in Today's Markets

Greenlight Capital's David Einhorn was speaking today at the 5th Value Investing Congress in New York City.

Two years ago he appeared as a highlight lecture of the show, and laid out his reasons for shorting Lehman Brothers stock. Needless to say there was quite a bit of attention to what he had to say today.

Here are some highlights:

1. A very bleak outlook for the US economy

2. US has a lack of political will to adopt needed financial reforms.

3. Right now he would like to hold gold rather than cash because "gold benefits from poor fiscal policy."

4. Buying long dated options on much higher interest rates in the US and Japan

5. Singled out GE as thwarting financial reform due to their intense lobbying efforts.

Transcript of David Einhorn's presentation.

PBS Frontline Presents: The Warning - Roots of the Financial Crisis

Many of the same players that were involved in this have been brought back to Washington under the Obama Administration. This is the source of our initial disillusion with Obama as a 'reformer.' He was reforming nothing, just bringing back the crew that started the ball rolling.

Several Republicans played a key role in this sabotage of sound regulation even during the Clinton Administration, including Phil Gramm's crippling of the regulatory process. What was started under Clinton reached its fruition, if not a generalized looting, under the free market ideologues in the Bush Administration and in particular with Treasury Secretary Henry Paulson.

We have not seen it yet, but it is a story that deserves to be told. We hope that Frontline does it justice.

We hope that this is not the phase of the financial crisis when they start trotting out patsies and scapegoats to be thrown under the bus for the amusement and diversion of the crowd from the serious work before us. The US financial system needs a thorough investigation and substantial reform, not more headlines and high profile perp walks. Or we will be back at the brink most assuredly, if we are not there already. It will happen again.

PBS FRONTLINE Presents

PBS FRONTLINE Presents The Warning

Tuesday, October 20, 2009, at 9 P.M. ET on PBS

The Warning (Video Preview)

"We didn't truly know the dangers of the market, because it was a dark market," says Brooksley Born, the head of an obscure federal regulatory agency -- the Commodity Futures Trading Commission (CFTC) -- who not only warned of the potential for economic meltdown in the late 1990s, but also tried to convince the country's key economic powerbrokers to take actions that could have helped avert the crisis. "They were totally opposed to it," Born says. "That puzzled me. What was it that was in this market that had to be hidden?"

In The Warning, airing Tuesday, Oct. 20, 2009, at 9 P.M. ET on PBS (check local listings), veteran FRONTLINE producer Michael Kirk (Inside the Meltdown, Breaking the Bank) unearths the hidden history of the nation's worst financial crisis since the Great Depression. At the center of it all he finds Brooksley Born, who speaks for the first time on television about her failed campaign to regulate the secretive, multitrillion-dollar derivatives market whose crash helped trigger the financial collapse in the fall of 2008.

"I didn't know Brooksley Born," says former SEC Chairman Arthur Levitt, a member of President Clinton's powerful Working Group on Financial Markets. "I was told that she was irascible, difficult, stubborn, unreasonable." Levitt explains how the other principals of the Working Group -- former Fed Chairman Alan Greenspan and former Treasury Secretary Robert Rubin -- convinced him that Born's attempt to regulate the risky derivatives market could lead to financial turmoil, a conclusion he now believes was "clearly a mistake."

Born's battle behind closed doors was epic, Kirk finds. The members of the President's Working Group vehemently opposed regulation -- especially when proposed by a Washington outsider like Born.

"I walk into Brooksley's office one day; the blood has drained from her face," says Michael Greenberger, a former top official at the CFTC who worked closely with Born. "She's hanging up the telephone; she says to me: 'That was [former Assistant Treasury Secretary] Larry Summers. He says, "You're going to cause the worst financial crisis since the end of World War II."... [He says he has] 13 bankers in his office who informed him of this. Stop, right away. No more.'"

Greenspan, Rubin and Summers ultimately prevailed on Congress to stop Born and limit future regulation of derivatives. "Born faced a formidable struggle pushing for regulation at a time when the stock market was booming," Kirk says. "Alan Greenspan was the maestro, and both parties in Washington were united in a belief that the markets would take care of themselves."

Now, with many of the same men who shut down Born in key positions in the Obama administration, The Warning reveals the complicated politics that led to this crisis and what it may say about current attempts to prevent the next one.

"It'll happen again if we don't take the appropriate steps," Born warns. "There will be significant financial downturns and disasters attributed to this regulatory gap over and over until we learn from experience..."

More Hedge Funds Face Indictments As Federal Wiretaps Uncover Insider Trading Rings

It is about time the Feds started tracking some of the more eyebrow raising examples of insider trading. Whenever there is new, you see a spike in the volume and the options ahead of the announcement these days.

This is most likely the tip of the iceberg, and the hedge funds are not the only culprits.

Its a step in the right direction. Let's hope it is not diversion to placate people because of the lack of serious market reform from Washington.

Bloomberg

U.S. Plans to Charge 10 More After Rajaratnam Arrest

By Joshua Gallu and David Scheer

Oct. 19 (Bloomberg) -- Federal investigators plan to charge at least 10 securities professionals with insider trading, some linked to the criminal case against billionaire hedge-fund manager Raj Rajaratnam that shook Wall Street last week, people familiar with the matter said.

The pending crackdown, more than two years in the making and among the biggest undercover operations into insider trading, may yield charges against hedge-fund managers and their associates as early as this week, the people said, declining to be identified because the cases aren’t public. Authorities had planned to arrest Rajaratnam this week as part of a broader sweep, expediting it after learning he had bought a plane ticket to travel to London on Oct. 16, one person said.

The case against Rajaratnam, built on recorded conversations within a web of alleged conspirators, offers a glimpse of how U.S. investigators are using more aggressive tactics to identify illegal trades hidden within a blizzard of hedge-fund investments. Additional probes stem from a secret Securities and Exchange Commission data-mining project set up to pinpoint clusters of people who make similar well-timed stock investments. Some probes, like the one against Rajaratnam, rely on wiretaps.

“If you’re going to shoot the king, you better shoot to kill,” said Bradley Bennett, a law partner at Baker Botts LLP in Washington who formerly focused on insider-trading cases as an SEC investigator. “If they’re going to take on a billionaire, they need to have the strongest possible cases. The defendant’s own words are the strongest possible evidence....”