Consolidation, acquisitions and mergers, particularly of the junior miners by the larger, well capitalized but lower growth majors, will be a recurring theme as bullion prices rise higher.

Timmins Gold proposes Capital Gold takeover

Monday September 27 2010 - News ReleaseTIMMINS GOLD CORP. MAKES PROPOSAL TO MERGE WITH CAPITAL GOLD CORPORATIONTimmins Gold Corp C:TMM)Capital Gold Corp(C:CGC)Timmins Gold Corp. made, on Aug. 31, 2010, a non-binding proposal to the directors of Capital Gold Corp. to merge on a negotiated basis with Capital Gold based on a value of $4.50 per common share of Capital Gold, which, at the time of the proposal and based on closing prices as of that date, equated to a share exchange ratio of 2.27 Timmins Gold shares issued for every one Capital Gold share. The proposal represented a premium of 26 per cent to the 20-day volume-weighted average price of Capital Gold shares on the Toronto Stock Exchange for the period ended Aug. 31, 2010. Timmins Gold believes that the transaction, if completed, would result in a merger of two equal-sized companies with regional and operational synergies that would benefit both companies' shareholders by creating a mid-tier, low-cost, Mexico-focused gold producer. These benefits include:

- Complementary operating teams and exploration assets;

- Management team with proven ability to access capital markets and create shareholder value;

- Stronger market presence;

- Creation of a company with a larger market capitalization that would be attractive to certain institutional investors.

Despite repeated requests, Capital Gold's board of directors has not been receptive to Timmins Gold's proposal.

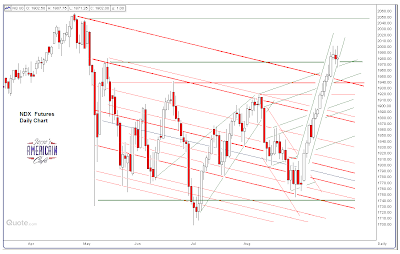

Ratio of XAU Mining Index to Spot Gold

Capital Gold shareholders representing approximately 17 per cent of the outstanding Capital Gold shares have confirmed to Timmins Gold that they would support the proposal (subject to customary conditions).

Bruce Bragagnolo, chief executive officer and director of Timmins Gold, comments: "Our proposed merger with Capital Gold presents a great opportunity for the shareholders of both companies. In putting it forward, we are responding to the expressed wishes of Capital Gold shareholders, including the 17 per cent who have signed support agreements, that this merger take place. The absence of meaningful dialogue with the directors of Capital Gold has driven us to bring this process into the public arena.

"We are prepared to move quickly to arrive at a mutually agreeable transaction. Given our familiarity with Capital Gold's operations and management team, we believe that due diligence will move very quickly."