The Gartman Letter Called a Top Last Night

"It is not just over-extended to the upside; it is hyper-extended. It is not just overbought; it is hyper-overbought. We cannot strongly enough urge everyone to avoid buying gold here and we shall go so far as to suggest that those who are long begin the process of quietly heading for the exits and to reduce their positions to the most minimal "insurance" positions possible."

29 September 2010

Gold Daily and Silver Weekly Charts

Category:

gold daily chart,

silver weekly chart

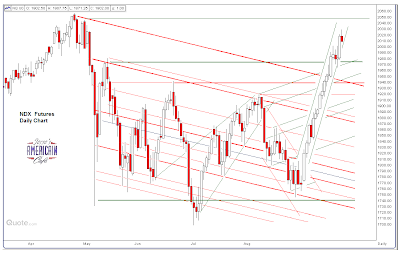

SP 500 and NDX December Futures Daily Charts

The end of quarter is almost here, and the levitation continues. The bulls will have to break this out on thin volumes, or give up the propping effort and let prices find their level fairly soon. The outflow from retail investors continues and hedge funds are challenged by redemption requests.

Category:

NDX Daily Chart,

SP Daily Chart

US Dollar Index Still Up For the Year, But Not By Much

The Dollar has tested key support and broken down lower. The next levels of support are obvious. It appears to be renewing its long term downtrend after the short squeeze in the eurodollar that drove it higher.

The dollar is short term oversold and could find some support around this level.

At some point the DX index needs to be reconstituted as the SDR will eventually be. The weighting to Europe and Japan are much too heavy for the current volumes of world trade and reserves.

28 September 2010

Gold Daily Chart - Cup and Handle Formation

Remarkable action today as the wiseguys 'ran the stops' down to 1285, the top of the support from the cup and handle breakout, on the new holders of October futures contracts from the holders of in-the-money calls in yesterday's options expiration.

The bears 'got stuffed' badly as their raid met heavy physical buying and strong hands who held their positions in the futures markets. The raid fizzled, and turned sharply around with gold running almost the entire range of the trend channel, finishing at yet another new high.

Category:

gold daily chart

Is the Gold Rally Strictly a US Dollar Phenomenon?

One sometimes hears that 'gold is only rallying in US dollars.'

One can always point out that since the US dollar is still the world's reserve currency, it affects everything and everyone that hold it in their reserves or their assets on deposit. A good part of the recent crisis in Europe was caused by the severe deterioration in dollar denominated financial assets held on deposit in commercial banks by private customers, who started to demand their money, in dollars. This precipitated a dollar squeeze and a liquidity crisis.

There is clearly a safe haven trade in gold denominated in US dollars.

But the US dollar is not alone, not the only fiat currency in a bit of a crisis. Since one picture is worth a thousand words, here is the price of gold over the last five years in six of the world's major currencies of the developed nations. Granted, the price of gold may be different in select currencies. One has to make their own investment decisions to suit their own particular circumstances.

But there is an obvious message in these charts for those who care to listen.

The twenty year charts are more impressive, because they almost uniformly show the long bear market coming to an end, with a remarkable bull market in gold bullion underway. Something has clearly changed, something obviously has occurred that is the mark of a sea-change in the structure of the major global currencies, starting slowly at first and then gaining momentum with the most recent financial crisis.

Charts Courtesy of Galmarley via my friend Nick at Sharelynx.

Category:

competitive devaluation,

Gold Pound

27 September 2010

SP 500 and NDX December Futures

AAPL is driving the NDX and CAT is the bulk of the Dow Industrial rally. When stock markets become this narrowly driven on thin volumes it is generally a sign of window dressing, or tape painting, and a decline to come since the foundations are not based on sound investment but mere speculation and price manipulation. This week is the end of month and quarter for the hedge funds.

Category:

NDX Daily Chart,

SP Daily Chart

Gold Daily Chart - Bullion Pauses for Option Expiration

Relatively modest attempt to take gold and silver down for October option expiration. Physical bullion buying is gaining resilience against paper market antics.

Category:

gold daily chart

Subscribe to:

Comments (Atom)