03 December 2010

Miss In US Non-Farm Payrolls Number 39,000 Vs.150,000 Expected - Unemployment Up to 9.8%

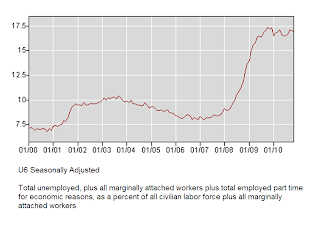

Reality briefly penetrated the fog of appearance this morning as US Non-Farm Payrolls came in at 39,000, a significant miss from the expected 150,000. Unemployment ticked up higher from 9.5% to 9.8%.

An analysis of the data showed a slight indication that the recovery has stuttered and stopped, but it will take a few more months data to confirm this.

The adjustments seems to dampen the potential headline number but are within bounds of the prior six years. The Birth Death Model actually came in negative which was a bit of an outlier but certainly a refreshing nod to reality.

Looking at the historical Oct-Nov growth in the unadjusted numbers for the past six years shows a clear downward trend from the high in November 2005, with the low coming in November 2008. The growth as it stands in 2010 is roughly the same as it was in 2004, although the 2010 numbers will likely be revised in the next two reports.

Stocks and the Dollar initially plunged on the news while gold rallied threatening to take out psychological resistance at 1400. I guess we now know why gold and silver were obviously hit by sharp manipulative selling yesterday, in order to take the prices down below breakout levels. Be on watch for shenanigans in the markets today, especially the SP futures markets.

There can be no sustained economic recovery until the median wage and employment improve and this requires specific reforms and programs to repair the damage caused by twenty years of irresponsible monetary, regulatory, and fiscal policy and a growing imbalance in the balance sheets of the middle class. Repairing the status quo merely restores the unsustainable.

The Fed's approach to quantitative easing is nothing more than an adjunct to the trickle down, supply-side approach. Provide money to the banks and the people will borrow; provide subsidies and tax cuts to those who have the most already and the condition of the many will improve. Trickle down, supply side, and efficient markets hypothesis are at best mistaken economic theories, and at worst coldly calculated propaganda by the same people who co-opted the political process and brought forward the control frauds that led to the financial crisis.

Category:

Non-farm Payrolls

02 December 2010

Gold Daily and Silver Weekly Charts

Silver got a very stiff gutcheck from the wiseguys when it hit resistance at 29 intraday. Gold followed it down on the same bear raid. It could not have been more obvious. Someone came into a thin market and started dumping contracts.

Tomorrow is the Non-Farm payrolls report and those that follow these things know that the metals are often hit around this event. Don't ask me why, as it makes less sense than the same sort of action around delivery dates and options expiration.

Perhaps this is about perception management. Some of the economic analysts talk as those perception were everything, all that really matters, as if they were from the Fernando Lamas School of Financial Management.

"It is better to LOOK good than to feel good, and dahling, you look MARVELOUS."And so we are witnessing the Persecution and Assassination of the Middle Class as Performed by the Inmates of the US Financial System under the Direction of the Wall Street Banks.

When appearance finally meets reality the dissonance it throws out will shake the world's financial markets to their very foundations.

Mundus vult decipi, ergo decipiatur. T. Petronius

(The world wills itself to be deceived, so let it be deceived.)

Category:

gold daily chart,

silver weekly chart

Currency Wars: China's Gold Imports Soar 500% As the International Banks Pressure Their Markets

China seems to be encouraging gold and silver ownership amongst its people as a matter of policy, the better to cushion them against a bubble and collapse. This is also a means of diversifying their reserves without engaging the US and the fiat countries directly through more official actions with their banking reserves.

It also appears that the other BRIC countries are doing similar things as a response to a perception that rogue elements in the US and UK have co-opted the US financial system, and therefore the dollar reserve currency and the multinational banks for their own personal gain. This has been previously seen in more select economic gambits, generally in the Third World, referred to colloquially as the work of the economic hitmen.

To that point, China Stock Crash Reportedly Caused By Bank Manipulation

I was also struck by this historical quote from a recent piece in the Financial Times by Tom Palley titled: Deaf to History's Rhyme: Why President Obama Is Failing.

“For 12 years this nation was afflicted with hear-nothing, see-nothing, do-nothing government. The nation looked to government but the government looked away. Nine mocking years with the golden calf and three long years with the scourge! Nine crazy years at the ticker and three long years in the breadlines! Nine mad years of mirage and three long years of despair! Powerful influences strive today to restore that kind of government with its doctrine that that government is best which is most indifferent.”An indifferent government, one that is either lax or complicit with powerful private interests, is the ally of the frauds and schemes and abuses that proliferated over the last twenty years. But control frauds, being an unproductive transferal of wealth, are based on growth and new victims, and so the impulse to find new venues is strong by necessity as the old haunts are drained of their economic vitality.

Franklin D. Roosevelt, October 1936

The rhyme of history being what it is, the hard money versus soft money wars have not gone away and seem to be heating up.

From Goldcore:What I find most disturbing are the actions of the English speaking peoples, who seem to be falling in line and marching off at the direction of their handlers without any meaningful protest.

"China's growing importance to the precious metal markets was underlined by the news that Chinese imports have surged by more than 500% due to increased investment demand. Incredibly, China's gold imports were five times higher in the first ten months than in the whole of last year. Imports hit 209 tonnes compared to 45 tonnes for all of 2009, according to the Shanghai Gold Exchange. Trading volume of gold on the exchange in the first 10 months rose 43 percent from a year earlier to 5,014.5 tonnes.

Chinese buyers are concerned about inflation and the depreciation of the fiat yuan/renminbi and looking to gold as a store of value. Chinese people do not have trust in paper currencies due to their experiences with authoritarian government and hyperinflation.

Most of the 1.3 billion people in China only began to acquire and own gold in 2003 as gold ownership was banned from 1945 to 2003. The gold market was liberalised in 2003 and their demand is increasing from a near zero base. This means that the increase in demand is very sustainable and will likely continue. Concerns of an overheating economy, inflation and a housing bubble will lead to further Chinese diversification into gold."

Category:

currency wars

01 December 2010

Gold Daily and Silver Weekly Charts

One of the more interesting things that happened recently was the decoupling of gold and silver bullion from the equity market and the US dollar.

This is most likely an example of the primary trend reasserting itself after a short term period of artificial price manipulation for option expiration and the first week of the important December delivery at the Comex.

Another way of saying this is that in the short term markets often trade on 'technical factors,' that is, one group of market players may take an overweight position, as we saw this week in the put-call ratio in stocks. So today we had a sharp short covering rally.

Does that really mean anything fundamentally changed? Well, the spinsters can always find 'a reason' for the short term moves in stocks, but it is hard to imagine that what was a disaster last week suddenly becomes all wine and roses this week. Real economies do not shift gears that quickly, thank God. But the wiseguys will use their market positioning, news sources, and rumours to 'manage perception' as do other powerful groups such as the government.

By the way, I hope you have noticed that much of what you hear on the mainstream and from 'experts and analysts' verges on pure propaganda these days. Bloomberg has gotten so outrageous that I can barely stand to watch their shows during the day.

Today for example a nice young lady came in and explained how Social Security was really broke as of 2015 because 'the money was not really there.' Her point was that the trust fund is in US special obligations and since the government spent the money on general things (like tax cuts for the wealthy) it is gone and so cuts must be made.

Well, the US has also spent all the money it is using to pay the interest and redeem the principal on US Treasuries, and so by the same reasoning it ought to cavalierly default on those obligations as well. In fact it ought to default on those obligations first because a Trust is senior as a pre-allocated fund to a non-specific general obligation. But of course that never came up. But that is in effect what is happening with the Fed's quantitative easing. And this is making those who recently looted the system nervous because they have not yet had the opportunity to transfer their dollars into other hard assets and rents producing property.

The problem is that the system has never been reformed, and the money is not reaching the real economy, but merely being used to bail out the creditors who were principally responsible for the financial fraud and subsequent crisis in the first place.

Let's see how this plays out. But expect things to get more disruptive and blatantly unjust because of a lack of moral leadership from the top down and a general deterioration in the concept of duty, honor, and obligation to country and the people in our national leaders and the pampered princes of the 'me generation.'

Category:

gold daily chart,

silver weekly chart

SP 500 and NDX December Futures Daily Charts

Postnote: I have subsequently updated these charts to show the early action for Thursday 2 December. It appears to me that the market will either reestablish a trading range or make a breakout play to the higher targets around 1250 into the year end, setting up an early 2011 decline.

Category:

NDX Daily Chart,

SP Daily Chart

30 November 2010

Gold Daily and Silver Weekly Charts

I have put up a longer term silver chart with an Inverse H&S formation that calls out 30.50 to 31 as a minimum measuring objective.

Category:

gold daily chart,

silver weekly chart

Subscribe to:

Comments (Atom)