03 January 2011

Taking Private Pensions

I would have liked this article better if it had been a 'straight news story' from the Monitor, which I respect for its objectivity, and not from an associated blog with a strong bias to libertarianism, even though I might sympathize with many of their ideals.

I cannot help but notice that reforming the financial system or taxing the windfall profits from financial fraud are never considered as alternatives. Still, it brings forward some interesting facts, and touches on deep concerns held by individuals in many nations.

I suspect this search for the remnants of the people's wealth will continue by the same ravenous corporations and their friends in governments around the world.

The solution to official corruption is not burning down city hall and firing the police force. This just makes it easier for the white collar criminals behind the corruption to operate in the anarchy that follows. This is the modus operandi that has been practiced by these same institutions throughout the third world for the greater part of modern history. And now they come home to eat their own.

It is the dying ember of the efficient market hypothesis that is backed by Wall Street and its demimonde in the press and the academy, and the romantic fantasies of what used to be called 'useful idiots' who would knock down the laws to chase the devil.

The solution is in the hard work of restoring the rule of law, and taking the crooks and throwing them in jail, and their friends out of public offices. History informs us that freedom for the individual is never natural or easy given the reality of human nature in all its manifestations. Corruption is resilient. People band together for their common protection against danger, both natural and of human invention. The destruction of those bonds of commonality are always the objective of the predator class.

The Adam Smith Institute Blog

European Nations Begin Seizing Private Pensions

By Jan Iwanik

January 2, 2011

People’s retirement savings are a convenient source of revenue for governments that don’t want to reduce spending or make privatizations. As most pension schemes in Europe are organised by the state, European ministers of finance have a facilitated access to the savings accumulated there, and it is only logical that they try to get a hold of this money for their own ends. In recent weeks I have noted five such attempts: Three situations concern private personal savings; two others refer to national funds.

The most striking example is Hungary, where last month the government made the citizens an offer they could not refuse. They could either remit their individual retirement savings to the state, or lose the right to the basic state pension (but still have an obligation to pay contributions for it). In this extortionate way, the government wants to gain control over $14bn of individual retirement savings.

The Bulgarian government has come up with a similar idea. $300m of private early retirement savings was supposed to be transferred to the state pension scheme. The government gave way after trade unions protested and finally only about 20% of the original plans were implemented.

A slightly less drastic situation is developing in Poland. The government wants to transfer of 1/3 of future contributions from individual retirement accounts to the state-run social security system. Since this system does not back its liabilities with stocks or even bonds, the money taken away from the savers will go directly to the state treasury and savers will lose about $2.3bn a year. The Polish government is more generous than the Hungarian one, but only because it wants to seize just 1/3 of the future savings and also allows the citizens to keep the money accumulated so far.

The fourth example is Ireland. In 2001, the National Pension Reserve Fund was brought into existence for the purpose of supporting pensions of the Irish people in the years 2025-2050. The scheme was also supposed to provide for the pensions of some public sector employees (mainly university staff). However, in March 2009, the Irish government earmarked €4bn from this fund for rescuing banks. In November 2010, the remaining savings of €2.5bn was seized to support the bailout of the rest of the country.

The final example is France. In November, the French parliament decided to earmark €33bn from the national reserve pension fund FRR to reduce the short-term pension scheme deficit. In this way, the retirement savings intended for the years 2020-2040 will be used earlier, that is in the years 2011-2024, and the government will spend the saved up resources on other purposes.

It looks like although the governments are able to enforce general participation in pension schemes, they do not seem to be the best guardians of the money accumulated there.

Category:

financial reform,

pension funds

The US Economic Recovery In One Picture

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.

Category:

economic recovery,

Government Statistics,

propaganda

End of Year Window Dressing In the SP 500: 2009-2010 and 2008-2009

I am keeping an open mind on this year's window dressing cycle as to the extent and the timing.

Wall Street desperately wishes to hand off this bubble to mom and pop and foreign hands, but so far the target victims are reluctant to buy in. The standard script is to keep running it higher while protecting your own risks with derivatives. If your derivatives counterparty fails then you obtain public funds to bail out of your losses. The objective is always the same: the public loses.

The Fed and Wall Street *could* conceivably keep this going as they did in the early cycle of housing bubble, or the tech bubble. Never underestimate the recklessness of desperate men caught up in a fraud of their own design. When the suckers start to question the game, double down and act even more resolutely and boldly. The average person will believe because they do not think people are capable of such obvious and blatant deception, since they are not so free of scruples and conscience. And of course greed is a marvellously effective prescription for silence, rationalization, and self-deception.

They may feign ignorance in Washington, New York and London, but they know, and it serves their purpose. This is a classic fraud, not even elegant or complex, but merely clumsy, an obvious abuse of trust and power. It is as noble and productive as running a protection racket on the neighborhood candy store, and robbing little old ladies for their pension checks.

The only thing that is surprising about Wall Street and the US financial frauds is, as Eliot Spitzer famously observed, their scams and schemes are so simple and so obvious when one can pry back the veil of secrecy and see what is actually being done. Old frauds never go way; they come back endlessly with minor variations and different shades of lipstick.

How obvious and bold can they be? How about this obvious and bold?

Setting Your Watch by the Silver Manipulation - WT

It is called 'running the stops' held by the small specs. It is an old and treasured fraud on the Street, like running up the prices of stocks and then selling them to the public at the top while you quietly exit with your profits and fees.

On the bright side the metals manipulation seems to be faltering, with silver soaring to new highs as the lack of physical metal for delivery impedes the ability for a few banks to endlessly run their paper ponzi scheme of naked shorting and leverage.

All Ponzi schemes end badly, but timing is everything. While there are overleveraged spec shorts to squeeze and pensions to plunder the money printing and tape painting can continue. You will run out of real wealth, assets and freedom before they will run out of ink.

Category:

ponzi scheme,

price manipulation,

tape painting,

window dressing

01 January 2011

Gold and Silver Weekly Charts: Currency Wars Continue and then Intensify

Since the rather sharp breakout from the cup and handle formation, gold has assumed what appears to be a steady, sustainable trend.

Yes there will be rallies and corrections. It appears that gold will be bumping into the upper end of its trend channel between 1455 and 1480 in the beginning of 2011.

If it maintains the current tight channel, which I think it will do unless there is a panic liquidation, 1390 *should* hold.

A more serious sell off could test 1250.

Will those waiting for a chance to get back into the gold bull market buy into position if it drops to 1390? Or even 1250?

If they did not buy into the worst correction down to 700-50 on this chart then they will probably not. Once you lose your position in a bull market it is very difficult to swallow your pride and climb back on board. One tends to keep waiting for THE low.

Gold is rising because the fiat currencies of the developed nations are being devalued. So while 'cash' may seem safe, it may not be, depending on what happens next. I am struggling with the notion that a hyperinflation will occur for reasons previously stated. It CAN happen, but it would take a series of policy blunders and some event for it to happen. And the Fed has the means to stop it, although they may not have the latitude politically or the will.

It would also require a spectacular act of self-destructive gullibility on the part of a greater portion of the American people. But in this I have rarely been disappointed in the last twenty years.

Silver is rising dramatically as an epic naked short position held by a relatively few parties is being slowly unwound. I should add that a similar scenario is underway with gold, except the parties holding the short side are being supplied with bullion to stragecially cover their shorts by some of the central banks and the IMF. But the difference in intensity is apparent if you compare Gold and Silver deflated by the Commodity Index (CRB) as shown below. Silver is undergoing a massive short squeeze since some of the big banks started scaling down their prop trading operations. I think the gold manipulation scheme has more official sanctions than the silver market manipulation.

For me the big question in 2011-12 about silver is whether it will be remonetized by countries who will once again include it in their official reserves, and even provide some silver content to the exchange mechanism of international trade.

There is little doubt that the international monetary scheme is changing more dramatically since the first Bretton Woods agreement established the dollar reserve currency in 1944, and even more than when the US unilaterally changed the arrangement by abandoning the gold standard in 1971.

If silver is remonetized, I suspect the impetus for this will come primarily from the BRIC's in conjunction with Mexico and other Latin American countries.

There is relatively little discussion of this amongst economists, and almost no mainstream media discussion in the US and UK. Europe is consumed with its own monetary identity problems. Monetary without political and fiscal union is like dating. What is now occuring is that Germany is pondering its options as the betrothal grows stale.

2011 will likely be a difficult year, and 2012 will be worse if the current trends continue. The recklessness and hubris of the central government is an awful thing to watch. I am afraid that it will likely reach a climax and turn away from the current path when the real economy 'hits the wall.' I am not confident that the developed countries will be able to resist the call to fascism in the name of expediency. Too few did so in the 1930's. And even then the denial and recriminations may be quite alarming and confusing.

I see no viable reform movements in the US and the UK, and Europe seems leaderless. This concerns me more than anything looking forward to 2012.

Category:

gold weekly chart,

silver weekly chart

31 December 2010

Le Jour de l'An

Bonne Année et bonne santé mes amis!

le Réveillon de Saint-Sylvestre

Bon Soir

"True happiness is of a retired nature, and an enemy to pomp and noise;

it arises, in the first place, from the enjoyment of one's self, and in

the next from the friendship and conversation of a few select companions."

Joseph Addison

Watchful * Prayerful * Thankful * Joyful

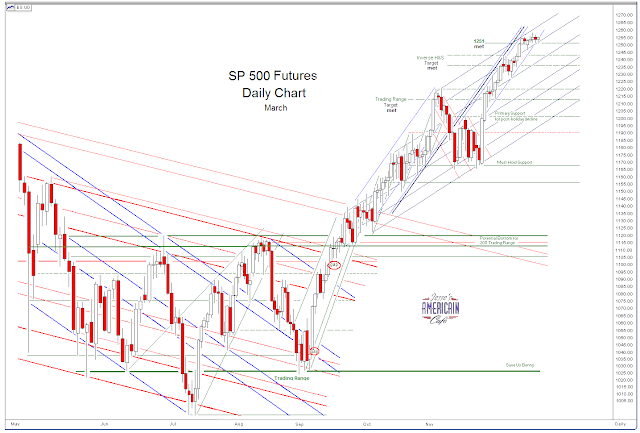

SP 500 and NDX March Futures Daily Charts Final for 2010

Jammed the futures higher into the closing fifteen minutes to finish near unchanged.

I would not be surprised to see a correction in January. Last year it occurred about week two.

Wait for it.

Category:

NDX Daily Chart,

SP Daily Chart

Subscribe to:

Comments (Atom)