"This election was lost four and five and six years ago and not this year. They didn't start thinking of the poor old common fellow until they started out on the election tour.

The money was all appropriated for the top in the hopes that it would trickle down to the needy. Mr. Hoover was an engineer. He knew that water trickled down. Put it uphill and let it go and it will reach the driest little spot.

But he didn't know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night anyhow. But it will at least have passed through some poor fellow’s hands.

They saved the big banks, but the little ones went up the flue."

Will Rogers, 5 December 1932

I said yesterday that 'I have a hunch that gold and silver are being capped here for a reason. Maybe. It's hard to tell with the non-linear Fed.'

And today I think that things are becoming clearer, as suspected. The Fed needs to raise rates to cool down the economy, in a pig's eye. They want to raise rates for their own policy purposes, so they can lower them again when their latest paper asset bubble fails.

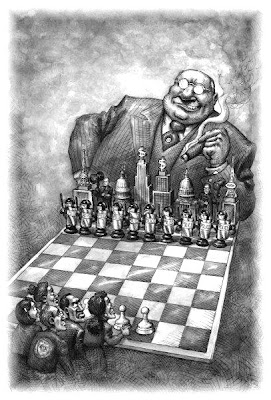

The common person may not understand all this, and the lessons from history. But the 'experts' most certainly should understand them, and quite frankly they do. They may not say so, they may never admit it, they may let themselves be convinced, and even convince themselves and quiet the nagging doubts, but at the end of the day they know exactly what they are doing, what they are abiding, what they are enabling if only by their silent acquiescence.

Then why do they keep pursuing the same failing policies, and try to justify them with wildly inaccurate forecasts and flat out misstatements of fact? Why do the wealthy prosper while the country as a whole stagnates, and for years?

Why do the politicians go all out to try and maintain things as they are, even though they can clearly see with their own eyes that they are failing the people whom they have pledged to serve by oath?

Herein lies the credibility trap. They wish to keep things as they are because, at least for them and their friends and cronies, the times are good, and for some wildly so. Innovation is risky, but the wrongheaded consensus of the insiders is safe. Insider do not speak ill of other insiders, and therein can keep their sinecures, their connections, and the camaraderie of the fortunate few.

They are caught between the age old Scylla and Charybdis of pride and profit. They fancy themselves to be exceptional, a credentialed elite, but the sad truth is that their conceits and self-delusions are as old as Babylon, and evil as sin.

BILL MOYERS: And you say that this oligarchy consists of six megabanks. What are the six banks?

JAMES KWAK: They are Goldman Sachs, Morgan Stanley, JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo.

BILL MOYERS: And you write that they control 60 percent of our gross national product?

JAMES KWAK: They have assets equivalent to 60 percent of our gross national product. And to put this in perspective, in the mid-1990s, these six banks or their predecessors, since there have been a lot of mergers, had less than 20 percent. Their assets were less than 20 percent of the gross national product.

BILL MOYERS: And what's the threat from an oligarchy of this size and scale?

SIMON JOHNSON: They can distort the system, Bill. They can change the rules of the game to favor themselves. And unfortunately, the way it works in modern finance is when the rules favor you, you go out and you take a lot of risk. And you blow up from time to time, because it's not your problem. When it blows up, it's the taxpayer and it's the government that has to sort it out.

BILL MOYERS: So, you're not kidding when you say it's an oligarchy?