Wash and rinse. Best way to get that stubborn money out of the public through fees, commissions, and of course front running for those perfect trading profits at the faux banks.

Chart Updated at Market Close

Now that option expiration is over gold is back to where it was a week ago, trying to break out of its large cup and handle formation. Silver is on the cusp of activating a massive and bullish multi-year chart formation of its own. It is an open question whether gold or silver will lead the way.

But I have to say that the CFTC is a disgrace. Eventually they will clean up their markets, but the foot dragging and dissembling is a mark against them. Chairman Gary Gensler knows better, but he is a Goldman alumnus, so what else would we expect? There are always many frustrated people in every organization trying to do a good job, so we should not paint them all with the same brush. The boss sets the tone, and Gensler's tone seems to be the status quo and crony capitalism. But that is the overall flavor of the Obama economic team.

Chart Updated at Market Close

Most people have a profound misunderstanding about the function that gold, and to a somewhat lesser extent silver, perform in the currency markets and wealth preservation trade.

The meme is that gold is a hedge against inflation. Over the past 100 years or so in particular, the greatest threat to the US dollar, and indeed to most currencies, has been inflation, which is the debasement of the value of a currency through printing or expanding supply faster than real growth in productive economic activity.

But was it really inflation that drove the gold hedge, or something more properly called 'currency risk.' Inflation through expansion of supply is just one facet of currency risk.

The risk today is not a gradual inflation through an overexpansion of the broad money supply, but something insidiously different, not seen since the last Great Depression. It is the risk of the default and devaluation, and the erosion of the assets backing the currency itself, which is not yet showing up in the conventional inflation figures.

What backs the US currency? Often referred to simply as 'the full faith and credit of the government,' it is the ability to collect taxes and service the debt with real returns, and of course and importantly the Fed's and the Treasury's balance sheets. I should have to say no more about this to anyone who has been following recent developments. The erosion of the ability of the government to produce revenue by taxing real income, and the rapidly declining quality of the assets held by the Fed, are obvious. Yes the US dollar may look good when compared some of the other wretched alternatives, but that appearance is like the portrait of Dorian Gray, not capturing the rapid decline in its own worth and well being.

So perhaps this will prove to be some help to those who are expecting debt deterioration and monetary deflation to deliver to them a stronger dollar and stable wealth. They fail to notice that this did NOT happen in the 1930's, and in fact quite the opposite occurred. I am now *hoping* for stagflation as an outcome because it seems better than the alternatives where the US and Europe now appear to be heading.

Yes, it can do so in the short term, particularly if you own the world's reserve currency, and that largely an illusion. But the decay is there for any who care to see it, and the rush to gold by the smarter money is also there to see, for those who will not willfully blind themselves to it.

There is nothing more disheartening than to watch otherwise good people fighting the last war, or perhaps most properly the wrong war, painfully unaware that their tactics and assumptions are misconstrued and self-defeating, and that they are committed to following 'leaders' who are articulate, persuasive, often very loud, and wrong.

25 June 2010

Not So Much Deflation as the Decay of Value: SP 500 Futures and Gold Daily Charts Updated at Market Close

19 June 2019

Stocks and Precious Metals Charts - The Game's Afoot - Gold Breaks 1350 - China Trade Looms

The Fed did as expected today.

While they did not cut interest rates, they did make the appropriately dovish sounding noises.

And dot plots, yada yada.

So gold and silver moved higher, stocks not so much, and the dollar dropped.

I had my eye on stocks in the afternoon since gold had obviously decided that 1350 was going down. 1350 is now support. Gold must hold 1340 to continue making the cup and handle active.

Target for the cup and handle is $1530. The short term objective is $1370 as has been marked on the chart for some time.

There is a stock market option expiration on Friday.

Stocks are going to be watching the macro global economy, specifically through the lens of the US-China trade situation.

Let's see what the stock market does tomorrow after a night to think about things. I did not make a move in stocks today. The metals are a nice long to keep riding for now as long as they can make it through any backfilling and retests.

On the situation chart below scenarios 1 & 2 are now the most probable. Can you tell which way I was leaning? We still have to see what happens with China next weekend in Osaka.

The metals went out on the highs of the day, so we know pretty much what the market thought about it.

The usual suspects may attempt to try capping it again at some new level, perhaps a bit higher or lower from here. Next resistance is at 1370 and then around 1400-1410. I put my thoughts on the charts as always.

Grab some popcorn. This will be interesting to watch.

And throughout all this bear in mind what is most important, the three great gifts that give us life: repentance, forgiveness, and thankfulness.

Have a pleasant evening.

16 November 2015

SP 500 and NDX Futures Daily Charts - Neither Rain, Nor Snow, Nor Gloom of Night

The economic news this morning in the form of the Empire Manufacturing number was awful.

Nevertheless, stocks had plenty of incentive to ramp today, having fallen into an oversold condition and tagged to the point the support levels one would expect them to match if we are seeing a W bottom or a 'cup and handle' setup to ramp equities higher into the end of the year.

The terror attack in Paris, which was horrible and vicious, nevertheless gave Wall Street the chance to look brave and patriotic, and rally paper assets just to spite those who are jealous of our freedom and prosperity.

So what next.

Let's see if stocks can really keep in going and set up that cup and handle and make it active. We have fallen to the middle of the 'W' if you allow for the slant, so stocks cannot go lower than today's intraday lows or the chart formation is invalidated most likely.

When you are winning, nothing matters.

Have a pleasant evening.

24 August 2010

Gold Daily Chart With Cup and Handle: 50 Day Moving Average

Gold Daily Chart

The cup and handle formation remains active, and the trend channels appear to be working as gold climbs the wall of worry in the 'handle.'

Gold Daily Chart with 50 DMA

Gold did a quit but precise hit on the 50 Day Moving Average today and then rebounded with a vicious rally higher. This speaks of the strength of the physical market underlying the paper market, and the role that gold played today as a store of wealth in a period of perceived risk.

29 December 2016

Charts at the Close of Trade on a Blustery Winter Afternoon

"It would not be an overstatement that demonetisation announced by the Prime Minister of India on November 8th might have been one of the largest self-inflicted macroeconomic shocks on a country in the absence of a short term crisis.

Given the sheer size - the decision to withdraw 85% of the cash in circulation has thrown India into disarray. Such a large and unexpected policy change naturally carries with it a large collateral damage at least in the short run."

Areendam Chanda, Notes And Anecdotes on Demonetisation

"Plunderers of the world, when nothing remains on the lands to which they have laid waste by wanton thievery, they search out across the seas. The wealth of another region excites their greed; and if it is weak, their lust for power as well.

Nothing from the rising to the setting of the sun is enough for them. Among all others only they are compelled to attack the poor as well as the rich. Robbery, rape, and slaughter they falsely call empire— and where they make a desert, they call it peace."

Tacitus

There is a major snowstorm moving on the northeastern United States that is centered now on Massachusetts and is moving up the coast as a classic nor'easter. I hear that they are expecting several feet of snow from this.

Luckily for us, the weather here is too warm for snow, but certainly cold and raw enough to discourage any thought of working outside, although feeding the birds, God's little ones, is a high priority.

There are more storms coming. Many of them have been caused by the greed and arrogance of people who lie so often to other people and their friends that they lose touch with common reality.

And so they may be shocked when the consequences of their actions come home to roost. They will say, 'no one could have seen this coming,' and what is worse, some of them may actually think they believe it.

Gold and silver had a bit of a rally today, off a deeply oversold short term condition. Bloomberg TV was quick to challenge that, and show a longer term chart of gold in an intact downtrend.

Funny they did not mention silver at all. I would suggest that if we do rally from here that we have a confirmation of a massive cup and handle formation that is only visible on the weekly chart. And it is one that is also nested within an even bigger formation that can only be seen on the long term monthly charts. Silver is reflecting more of the natural market action than gold.

But that is a big if, although many of the usual suspects will be quick to pounce on anything positive to generate breathless excitement without waiting for confirmation.

Things will be more impressive and exciting when gold and silver start moving limit up, with triple digit and triple dollar moves to the upside overnight, as the precious metal manipulation pools begin to fall apart. History suggests that they must, and eventually that they will.

Of course one cannot rule out some sort of official reaction bordering on the madness of the bureaucrats, as we have been seeing with Mr. Modi in India and his crackpot demonitisation actions.

Violence begets violence. And frightened people who are caught badly enough in a credibility trap will be tempted by extremities, after first depersonalizing those whose differences are a nuisance, and then an embarrassment, and finally a perceived challenge to power. The deplorables, the parasites, the other.

Let us remember that violence is rarely justifiable on another human being except in the most obvious acts of self-defense. That is not to say that violence doesn't happen, because it does every day.

We are such sophisticated barbarians that there are schools of thought, among them the neo-cons in foreign relations and the neo-liberals in economic policies, that see violence of whatever sort as a first choice to another people's failure to submit to their grandiose schemes of power.

Hubris warps vision, and the policies that proceed from the heights of arrogance have often produced cold-bloodedly horrific results, to which the parties are blinded, at least for a time.

Because a group is well-dressed, and covers their barbarous hearts with the trappings of culture, does not mean that they are 'civilised.' Their murders are merely more calculating and efficient— grotesquely passionless.

And finally, let us remember each other in our prayers, so that we will not allow our love to grow cold, if there should be an increase in wickedness. Although we all do what we must do, this holding on to our own hearts and souls is the only transaction that in the very long run really matters.

If you love the Lord, truly as He loves you, then you cannot be afraid.

Have a pleasant evening.

31 August 2015

Gold Daily and Silver Weekly Charts - Charts Undecided - Goldman Takes A Little More

"Don't get involved in partial problems, but always take flight to where there is a free view over the whole single great problem, even if this view is still not a clear one."

Ludwig Wittgenstein, Notebooks, Nov 1914

We say goodbye to August, and the active month for gold at The Bucket Shop, and welcome the first stirrings of September, which promises to be much more interesting for silver.

Prices were heavy for the metals most of the day, with silver showing a little more perkiness, but gold doggedly hanging on to close for a slight gain.

We have an interesting, if yet undecided, chart formation on the daily gold chart in a potential cup and handle formation that, if activated and confirmed, will target a minimum objective of around $1,255 and even a likely test of the big prior support from the trading range at $1,270.

To put this potential formation to 'work' gold must continue to hold its successful retest of 1120 on the 'handle,' and move to take and break the top of the cup at 1170. This is no mean feat, since gold is being pressed upon so heavily by the meddlers in the forex crosses. Despite the propaganda, it most certainly is a currency of the world.

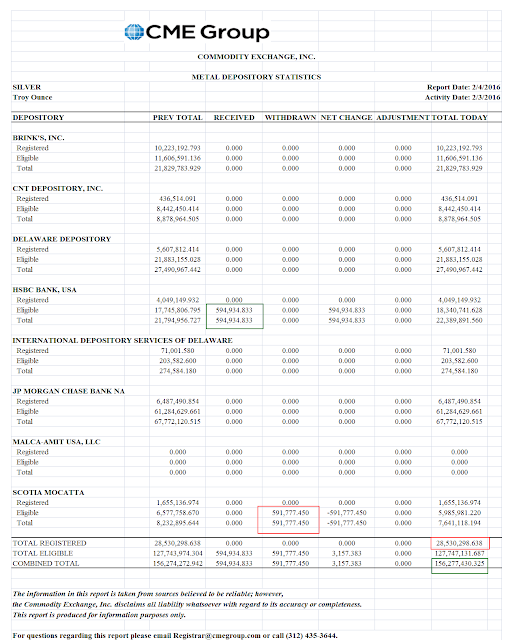

Silver is just coming into its own and September will most likely to provide some fireworks for the beta rocket, depending on which way the black swans start coming home to roost. We have already seen the first deliveries taken for September, as noted on the clearing report below, of about 835,000 ounces.

I keep hearing stories of retail shortages and premiums that are certainly interesting. I will be more interested if we start seeing some pressures at the wholesale level.

Gold went out quietly, with Goldman stopping another 49 August contracts for their 'house account.'

I am hearing some talk about leaner times for gold bullion supplies at the LBMA for this booming physical gold market in Asia and India. There is certainly not much bullion up for sale at these prices in NY. Perhaps the bullion banks will use a quiet September to regroup and reform, if they get a quiet month that is.

Better not to try and guess, and look ahead too much however. These pool operations, which we are almost certainly seeing now in my judgement, take a long time to reach their natural conclusion. But they always seem to get there one way or the other.

So perhaps we can use this time to get our own houses in order, to put our pieces on the board where we are sure that we will have them if things get more interesting. I certainly would not wish to put them in an unallocated pile in some vault managed by the status quo, since possession is nine-tenths of the law to these jokers, as we saw with MFGlobal's default.

I am ambivalent about the miners here, mostly because I am in the position of owning some, which I have not done for quite some time. But silver is too temping with its 77:1 ratio to gold, and the absolutely beaten down into the ground place of some fairly tempting mining stocks.

Oh well, let's see if we can get something more substantial to hang our hats on, like the activation of a chart formation or some especially bullion friendly news for a change. The gold trolls were out in force today on the financial networks, so we will have to see what this means if anything.

There was a greater than usual amount of information about the metals posted over the weekend, so you may wish to scroll down and have a look if you have not done so already. There are quite a few odd little things happening that seem to be missed by most.

Have a pleasant evening.

26 January 2016

Gold Is In a 'Flight To Safety' - Cup and Handle?

Maybe not so much in the US where the people are still largely unaware of most global financial events and currencies, and certainly of the historical role of gold.

But the strong upward correlation of the US Dollar and Gold of late are evidence of a strong 'flight to safety' trade.

In a flight to safety the price of gold bullion would likely lead silver and the miners. If at some point silver can pick up the baton and run higher, then we might think a proper bottom has been set and a new bull leg could be forming.

Speaking of that, as I have noted previously, gold *might* be forming a rounded or cup and handle bottom. I am watching it forming on the gold chart although I have not yet marked it explicitly.

We have not seen many chart formations come to fruition because of the relentless capping of the prices with synthetic gold.

01 January 2011

Gold and Silver Weekly Charts: Currency Wars Continue and then Intensify

Since the rather sharp breakout from the cup and handle formation, gold has assumed what appears to be a steady, sustainable trend.

Yes there will be rallies and corrections. It appears that gold will be bumping into the upper end of its trend channel between 1455 and 1480 in the beginning of 2011.

If it maintains the current tight channel, which I think it will do unless there is a panic liquidation, 1390 *should* hold.

A more serious sell off could test 1250.

Will those waiting for a chance to get back into the gold bull market buy into position if it drops to 1390? Or even 1250?

If they did not buy into the worst correction down to 700-50 on this chart then they will probably not. Once you lose your position in a bull market it is very difficult to swallow your pride and climb back on board. One tends to keep waiting for THE low.

Gold is rising because the fiat currencies of the developed nations are being devalued. So while 'cash' may seem safe, it may not be, depending on what happens next. I am struggling with the notion that a hyperinflation will occur for reasons previously stated. It CAN happen, but it would take a series of policy blunders and some event for it to happen. And the Fed has the means to stop it, although they may not have the latitude politically or the will.

It would also require a spectacular act of self-destructive gullibility on the part of a greater portion of the American people. But in this I have rarely been disappointed in the last twenty years.

Silver is rising dramatically as an epic naked short position held by a relatively few parties is being slowly unwound. I should add that a similar scenario is underway with gold, except the parties holding the short side are being supplied with bullion to stragecially cover their shorts by some of the central banks and the IMF. But the difference in intensity is apparent if you compare Gold and Silver deflated by the Commodity Index (CRB) as shown below. Silver is undergoing a massive short squeeze since some of the big banks started scaling down their prop trading operations. I think the gold manipulation scheme has more official sanctions than the silver market manipulation.

For me the big question in 2011-12 about silver is whether it will be remonetized by countries who will once again include it in their official reserves, and even provide some silver content to the exchange mechanism of international trade.

There is little doubt that the international monetary scheme is changing more dramatically since the first Bretton Woods agreement established the dollar reserve currency in 1944, and even more than when the US unilaterally changed the arrangement by abandoning the gold standard in 1971.

If silver is remonetized, I suspect the impetus for this will come primarily from the BRIC's in conjunction with Mexico and other Latin American countries.

There is relatively little discussion of this amongst economists, and almost no mainstream media discussion in the US and UK. Europe is consumed with its own monetary identity problems. Monetary without political and fiscal union is like dating. What is now occuring is that Germany is pondering its options as the betrothal grows stale.

2011 will likely be a difficult year, and 2012 will be worse if the current trends continue. The recklessness and hubris of the central government is an awful thing to watch. I am afraid that it will likely reach a climax and turn away from the current path when the real economy 'hits the wall.' I am not confident that the developed countries will be able to resist the call to fascism in the name of expediency. Too few did so in the 1930's. And even then the denial and recriminations may be quite alarming and confusing.

I see no viable reform movements in the US and the UK, and Europe seems leaderless. This concerns me more than anything looking forward to 2012.

04 February 2016

Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow

Gold continued to advance higher and silver joined in, edging up to the cusp of the 15 handle.

They are a little short term overbought, and we are going to be enjoying another chapter in the ongoing fictional story of the US Economic Recovery tomorrow.

I refuse to draw the tentative 'cup and handle' formation on the charts for fear of jinxing it. I know, but hey its hard for any trader to be perfectly rational ALL the time, especially in the teeth of a three year bear market that seems to defy all the facts and fundamentals.

There was little to no delivery activity for the PM's at The Bucket Shop yesterday. The movement of bullion being shoved around the plate at least in the case of silver is noted in the reports below.

Let's see if gold can push up to that 'blue line' overhead on the chart and stick a close sometime this active month of February.

Everything about these markets and our glorious recovery reminds me of a predetermined decision about the future course of events, and monumental efforts to bring about their appearance by The Fed, the financial establishment's Adjustment Bureau.

And who then, after our little noted financial coup d'etat, is now the real Man in the High Castle?

Much Ado About Not So Much

Speaking of the Fed, I heard from a friend about a video from Mike Maloney that highlights a big drop in the Federal Reserve Banks aggregate Balance Sheet of about $20 Billion in December of last year.

There was some questioning and speculation about this being due to some behind the scenes banking crisis.

Although I don't read them as much anymore, a quick look at the Fed's H.4.1 release from December revealed this statement below by way of explanation.

Net-net the change was a bookkeeping maneuver in response to the 'Fixing America's Surface Transporation Act' (FAST) which was enacted on 4 December 2015. They were required to transfer certain amounts in excess of $10B to the Treasury, where they would eventually end up anyway after expenses. The Fed is a cost-based entitlement to the Banks.

Our first impulse when encountering an interesting diversion from the familiar ought to be to examine the available evidence and ask a lot of questions, especially with regard to facts.

But that does not mean that irregularities and unexplained things do not occur. Sometimes they do. And they are dismissive by the same type of 'normality bias' and ludicrous arguments by the apologists for the serial felons who have been rigging almost every market there is for the last ten years or so.

And there are plenty of odd things going around these days, swirling in the fog of 'currency war.'

Have a pleasant evening.

FEDERAL RESERVE statistical release

For Release at

4:30 P.M. EST

December 31, 2015

Publication Note

The Board's H.4.1 statistical release, "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks," has been modified to reflect the policies under which Federal Reserve Banks make payments of their residual net earnings to the U.S. Treasury.

The Fixing America's Surface Transportation Act (FAST), which was enacted on December 4, 2015, requires that aggregate Federal Reserve Bank surplus not exceed $10 billion. Therefore, any amount of aggregate Reserve Bank surplus that exceeds this limit will be remitted to the U.S. Treasury.

The line "Interest on Federal Reserve Notes due to U.S. Treasury" on table 6 has been replaced with "Earnings remittances due to the U.S. Treasury" and footnotes to tables 1, 5, and 6 have been similarly modified.

The amounts of the line items "Other liabilities and capital" on table 1, and "Surplus" on tables 5 and 6 reflect the payment of approximately $19.3 billion to Treasury on December 28, 2015, which was necessary to reduce aggregate Reserve Bank surplus to the $10 billion limitation in the FAST Act.

07 June 2010

Gold Attempting To Break Out to New Highs

Gold is attempting to break out and confirm its cup and handle formation. It moved sharply higher on increasing volume right after the PM fix ($1,215) at the LBMA in London. If it can surmount resistance just above it may do a breakaway gap higher some evening and keep going. I will be a little surprised if it can break out quickly and in one move. Backing and filling the breakout is more likely, unless there is some sort of default in progress, or a heightened risk of a failure in the paper markets somewhere. I thought it was interesting that the rally was triggered off the PM fix in London, the 'fractional reserve' bullion market.

Some accuse me of being too conservative in my gold forecasts. Or at least they do when it rallies. Others think I am far too optimistic, but from economic theory most appropriately described as faith-based, but profanely so.

Let the charts speak for themselves. But however it develops, I will say that what we are witnessing is a generational monetary phenomenon, at least for those who have the eyes to see it. This is one of the few things of which I have been certain, and looked for it starting in 1999 when it became obvious that the dollar could not sustain its role as a gold substitute with the stability that is required of the world's reserve currency.

I am getting more anecdotal information of panic buying of physical bullion especially from substantial holders of 'old money' and amongst some of the average investors in Europe and Asia. I do not think that the public by and large has even started to buy bullion in the States. When they do the Comex will be overwhelmed and simply default, and then the situation will intensify as even more financial frauds and semi-official corruption begins to be revealed across many markets and institutions that have been operating in secrecy.

"Every thing secret degenerates, even the administration of justice; nothing is safe that does not show how it can bear discussion and publicity." John Emerich Lord ActonFor the most part Americans, and perhaps it would be fair to say even most of the English speaking peoples, are still moving through life blissfully and largely unaware of the global currency crisis and its implications for them, with a few notable exceptions. The trust they have placed in their politicians and institutions is being badly abused, and they will be shocked if the extent of its breadth and depth, the secret dealings and corruption, are ever exposed.

The details of each chart are unique, as is every breakout. So far the gold action suits the overall framework, but it would be a mistake to look for a perfect duplication, particularly in markets that are tainted with paper manipulation and semi-official fraud.