"Here and there an individual or group dares to love, and rises to the majestic heights of moral maturity. So in a real sense this is a great time to be alive. Therefore, I am not yet discouraged about the future.

Granted that the easygoing optimism of yesterday is impossible.

Granted that those who pioneer in the struggle for peace and freedom will still face uncomfortable jail terms, painful threats of death; they will still be battered by the storms of persecution, leading them to the nagging feeling that they can no longer bear such a heavy burden, and the temptation of wanting to retreat to a more quiet and serene life.

Granted that we face a world crisis which leaves us standing so often amid the surging murmur of life's restless sea. But every crisis has both its dangers and its opportunities. It can spell either salvation or doom. In a dark confused world the kingdom of God may yet reign in the hearts of men."

Martin Luther King

"However, I have learned that in times of crisis, the dodos always charge in to make matters worse."

Andrew Greeley

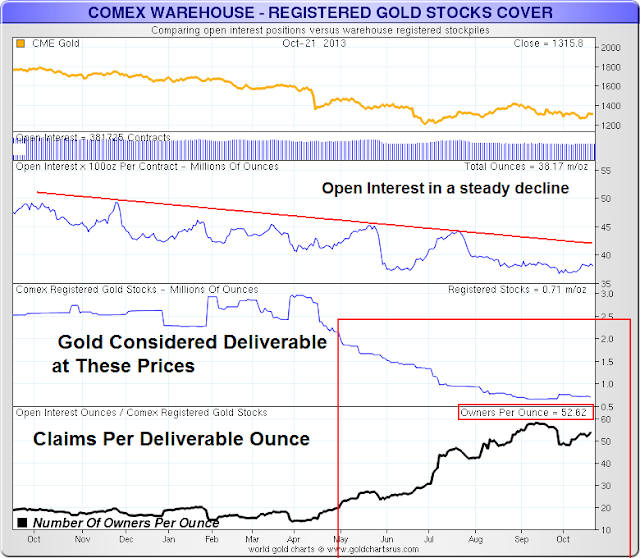

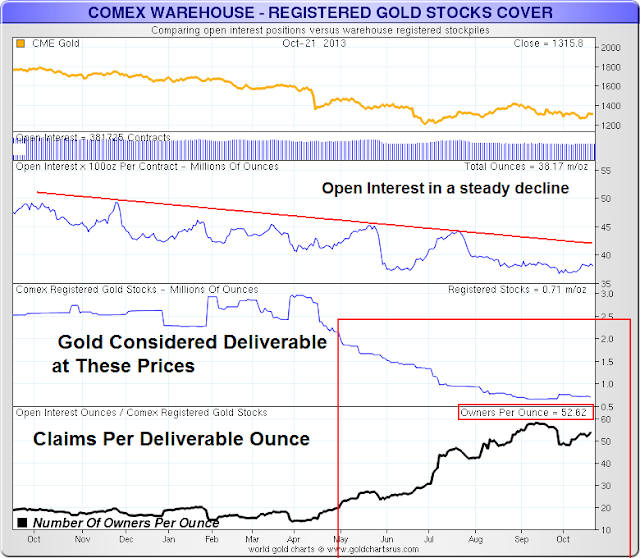

Here are three charts that capture the somewhat uniquely dangerous situation in the gold futures market on the Comex. It reminds me of watching a child playing with a chemistry set, or a drunk getting behind the wheel of a car. Disaster is not assured, but the situation cries out for adult supervision and intervention.

The first chart shows all gold in storage at Comex certified private warehouses. The major bullion banks control the vast majority of this storage. Among these are JPM, HSBC, Scotia Mocatta. Storage and delivery services are also provided by Brinks and Manfra, Tordella, and Brookes, a large NYC coin and bar dealer.

The year long decline in open interest on the Comex is a phenomenon worth noting. It is marked on the third chart. Even as gold bullion purchasing is soaring, gold futures interest in the US is in a secular decline. But even with this decline, the 'claims' of ownership as represented by futures contracts over ALL gold in the warehouses is a bit high.

Not to say that futures contract owners can have any claim on gold merely held in storage. But they can try. I include this because some people consider it to be important. If the price is allowed to rise high enough, that customer gold might be tempted into the deliverable category and offered for sale. The key question is 'how high.'

The better metric to watch is the number of claims per registered, or deliverable ounces of bullion on the Comex. This gives us a current 'temperature reading.' And that measure remains near all time highs at 52.62 claims per ounce at these prices. My friend Nick Laird at Sharelynx, who does a wonderful job of charting and data gathering, prefers to call it 'owners per ounce.' But since a single ounce of gold cannot have 53 owners if the music stops, I prefer to call them 'claims' or virtual ownership.

Every prior deep decline in registered gold bullion during this bull market has marked an intermediate price trend change. I do not think this time will be different, all other things being equal.

What exacerbates this situation is the absolutely remarkable drawdown in gold bullion from the ETFs around the world, but most heavily in GLD and on the Comex. We have not seen anything like this in silver, platinum, or palladium. It is significant. See

The Amazing Disappearing Gold Bullion

As you know, I am persuaded that the request from the Bundesbank for the return of Germany's gold, and the deferral of this by the Fed for seven years, set off a chain of overreactions and market maneuvers that in retrospect will be viewed as foolhardy.

If the price of gold is allowed to rise closer to the $1650 to $1750 trading range by the end of January, preferably the end of December, I think the Comex might avert what for them could become a potentially disastrous situation. And they need to get started on this fairly quickly so that the rise is gradual and controllable. The higher it riser this year, the less pressure there will be on physical gold early next year.

If the bullion banks continue to game the system, and scalp profits with other peoples' money, my forecast is for a market break and dislocation in the gold market that will imperil quite a few smaller trading houses, and greatly impact confidence and global trade. I would not be surprised to see a halt called to the paper and physical gold trade, a forced cash settlement on futures and derivatives, and a price adjustment higher, perhaps in multiples of triple digits. Such price jumps can be unsettling well beyond their immediate circles of interest.

And we could see a TBTF bullion bank or two shaken to their foundations. If the governments overreact in trying to get them out of their own mess again without loss or reform, then I think it is time to keep your heads down and watch for big changes. I doubt they could be that clumsy, but most politicians know less about money than most economists, and that is pretty bad. And they are certainly as craven and pliable, so it is possible.

I have a couple of other forecasts about changing politics in the US, which involves major changes in the current two parties. People forget that the lifeline of the Republicans and the Democrats as they are now is more current than old in terms of human history. And a major party change with some splintering and interesting alliances is becoming more probable.

Although it is just a forecast, it looks like the die will be cast in December. If they try the annual price hit in early December, they might set off a series of unfortunate events as the new year unfolds.

So you might consider this a sort of warning to be watchful, just based on the market mechanics. It does not have to happen. But it has been hard to overestimate the reckless stupidity of unbridled greed.

Again, the most likely outcome is the infamous muddle through and the kick of the can down the road, with a rising price in gold as part of an intermediate trend change. But we are now in a period of high risk, and I don't yet see the right steps being taken to avert it. Some of that rests on the shoulders of the CFTC, and quite a bit on the exchange, the politicians, and the regulators of the banks. They need to take the keys away from the drunks and reckless children in their own organizations and in the ones that they oversee.

I do not want to join the doomsayers, those who troll for clicks with ever more dire headlines of impending doom. It almost gets to be like watching the supermarket tabloids.

All of our problems are soluble, and things are no worse now than they have been many times in the past. Our parents and grandparents faced much worse, and I personally have seen harder times by far. But it is getting pretty bad on a secular level, mostly from self-inflicted wounds and corruption.

I wanted to state this unequivocally now because I can see another financial crisis brewing, and if it does come it undoubtedly will be followed by a bunch of hand-wavers running around saying that 'no one could have seen it coming.' Just like the last two or three financial crises. Maybe this time the powerful will act with caution and good sense. I have the impulse to hedge that though, and certainly not to count on it. In their self-centered blindness they are becoming mere players and pawns in the great tide of history.

"The long memory is the most radical idea in America. That long memory has been taken away from us. You haven't gotten it in your schools. You're not getting it on your television. You're being leapfrogged from one crisis to the next. Mass media contributed to that by taking the great movements that we've been through and trivializing important events.

No, our people's history is like one long river. It flows down from way over there. And everything that those people did and everything they lived flows down to me, and I can reach down and take out what I need, if I have the courage to go out and ask questions."

Utah Phillips

"You will study the wisdom of the past, for in a wilderness of conflicting counsels, a trail has there been blazed. You will study the life of mankind, for this is the life you must order, and, to order with wisdom, must know. You will study the precepts of justice, for these are the truths that through you shall come to their hour of triumph. Here is the high emprise, the fine endeavor, the splendid possibility of achievement, to which I summon you and bid you welcome."

Benjamin N. Cardozo