“As observers of totalitarianism such as Victor Klemperer (I Will Bear Witness To the Bitter End 1933-1945) noticed, truth dies in four modes, all of which we have just witnessed.

The first mode is the open hostility to verifiable reality, which takes the form of presenting inventions and lies as if they were facts.

The second mode is shamanistic incantation. The fascist style depends upon 'endless repetition,' designed to make the fictional plausible and the criminal desirable.

The next mode is magical thinking, or the open embrace of contradiction. Accepting untruth of this radical kind requires a blatant abandonment of reason. Klemperer’s descriptions of losing friends in Germany in 1933 over the issue of magical thinking ring eerily true today.

The final mode is misplaced faith. It involves the sort of self-deifying claims. When faith descends from heaven to earth in this way, no room remains for the small truths of our individual discernment and experience. What terrified Klemperer was the way that this transition seemed permanent. Once truth had become oracular rather than factual, evidence was irrelevant. At the end of the war a worker told Klemperer that 'understanding is useless, you have to have faith.'

'What is truth?' Sometimes people ask this question because they wish to do nothing. Generic cynicism makes us feel hip and alternative even as we slip along with our fellow citizens into a morass of indifference. It is your ability to discern facts that makes you an individual, and our collective trust in common knowledge that makes us a society.

Remember professional ethics. When political leaders set a negative example, professional commitments to just practice become more important. It is hard to subvert a rule-of-law state without lawyers, or to hold show trials without judges. Authoritarians need obedient civil servants, and concentration camp directors seek businessmen interested in cheap labor.

To abandon facts is to abandon freedom. If nothing is true, then no one can criticize power, because there is no basis upon which to do so. If nothing is true, then all is spectacle. The biggest wallet pays for the most blinding lights. You submit to tyranny when you renounce the difference between what you want to hear and what is actually the case.”

Timothy Snyder, On Tyranny, 2017

If people feel lost and alone and broken and hopeless today, what will it be like if the world begins to come apart at the hinges? Jesus was a man for simple people. He didn't make his messages incredibly complex. If you were a person that had the eyes to see and the ears to hear, then his message was easily understood.

Many who claim today with their mouths that they follow Jesus will abandon him then with their lives.”

Brandon Andress, And Then the End Will Come

Stocks made another attempt to rally today.

And again the rally failed, and stocks went out near the lows.

This market is a tinderbox, waiting for a trigger event, and that of a diminishing magnitude, which at the end might even seem inconsequential.

I am still sitting in cash, taking it easy.

Gold and silver were lower.

They are having a very difficult time breaking out from here.

With the Golden Week holiday over in China I expect the movement of physical may pick up again there in the East.

The Dollar was higher.

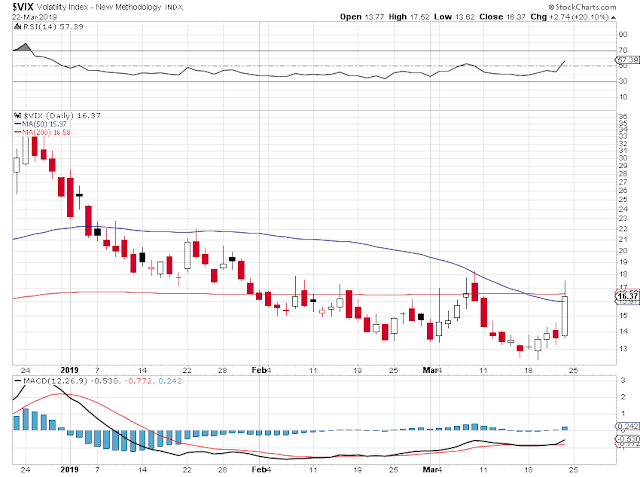

The VIX gained back some of last week's decline.

There will be a stock option expiration on Friday.

Have a pleasant evening.