Today was the usual dull day of market focused on their own navels, surrounded by the flies of the HFT bots.

Silver was the bigger story with the first report from the March contract, with an impressive claim of over six million ounces of silver being claimed on the Comex.

The Comex silver sees plenty of warehouse action, since CNT is using it as a delivery vehicle into their contracts with the US mint.

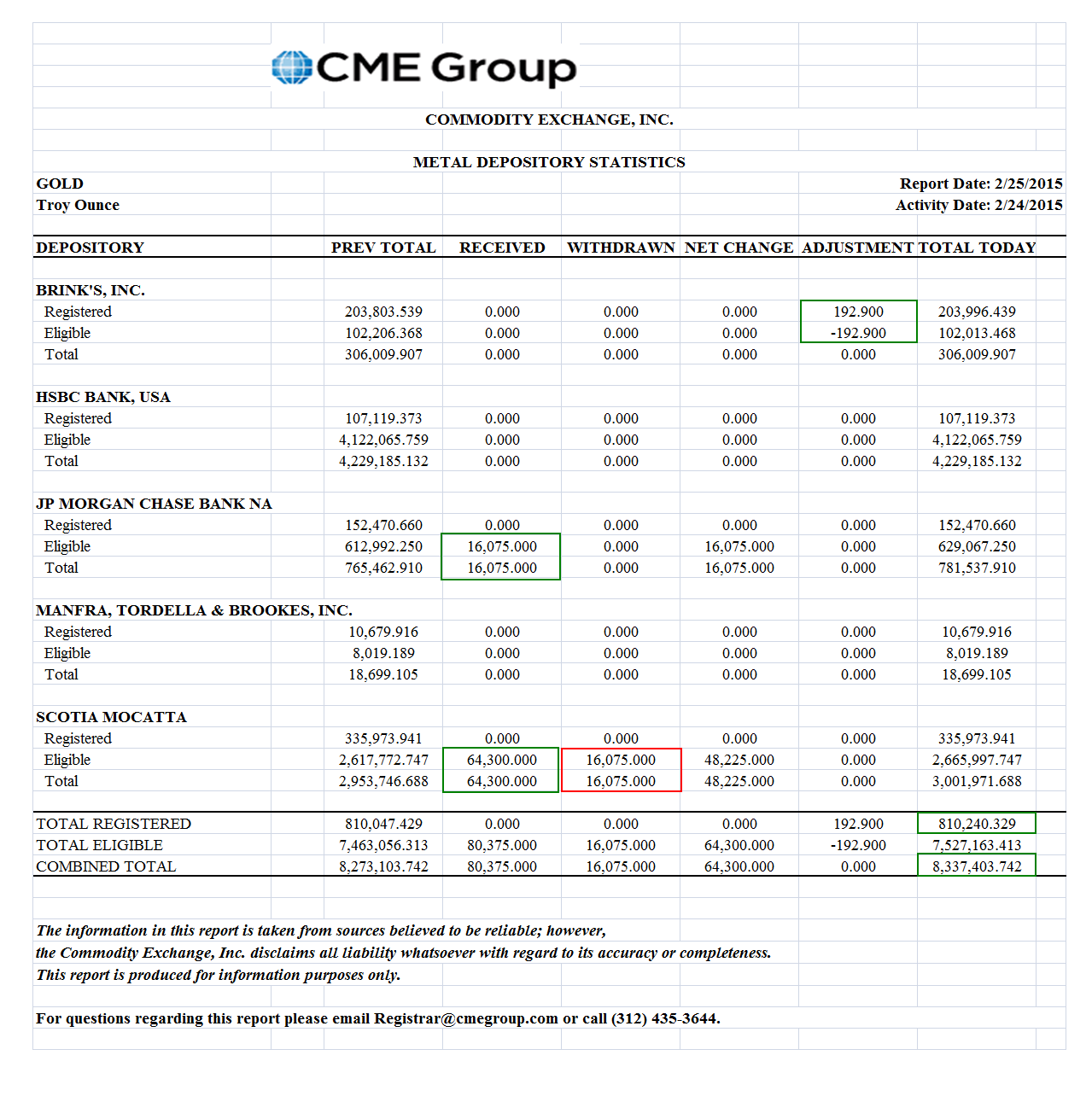

Otherwise the Comex has all the appearances of a bucket shop for gold.

The economic calendar for next week is below, and as you can see, we have another Non-Farm Payrolls report on Friday. Since they have revised the jobs numbers back to whenever already, it will be interesting to see what kind of a number they can scrape up for February.

Stormy weather.

Gold is moving from West to East.

If you don't agree, or don't understand this, that's ok.

You will.

Live long and prosper.

Have a pleasant weekend.